From the normally somewhat sane voice of Floyd Norris at the New York Times: Credit Crisis? Just Wait for a Replay.

What if it’s not just subprime?

Gee golly gosh, Floyd! I don't know.

Someone might actually have to do some investigative journalism on it. Who knows there may be all this data being analyzed on blogs and shit because there sure as teenage fuckery isn't any analysis in the MSM. And you might have to get off your ass and do some homework or something.

Friday, December 28, 2007

Thursday, December 27, 2007

Spread it!

Commercial paper is short-term (between 30 days and nine months.)

Commercial paper is short-term (between 30 days and nine months.)A2/P2 is lower-rated paper (as opposed to GE/Microsoft/Coke, etc.)

Fed can't do jack-motherfuckin'-shit about the spread unless they want to get into the commercial lending business themselves (and that would just about crash the dollar outright!) Please note the spread is far higher than 9/11!

We're dealing with a solvency crisis (hence, a confidence crisis.) Nobody wants to lend to anybody else because who knows where the bodies are buried?

Once again, for your sanity and mine, this is not a "liquidity crisis". The lack of liquidity is a symptom not a cause.

Tuesday, December 25, 2007

Spirit of the Season

"You're thinking of this bank all wrong. As if they had the money back in a safe. The money's not here. Your money's in a super senior synthetic tranche hedged with a CDS on Joe's house...right next to yours. Supported by the excess spread from the Kennedy house, and Mrs. Macklin's house, and a hundred others. Why, you're lending the Orange County's Firemens' Retirement Fund the money to short builders commercial paper, and then, they're all going to pay it back to you as best they can."

Monday, December 24, 2007

Holiday Cheer

From Reuters: One in Five Expect to Borrow to Heat Homes This Winter.

For perhaps as many as 27 million American adults, keeping warm this winter will mean borrowing money and 20 million will use credit cards to be able to afford their heating bills, according to a CreditCards.com poll.

Nearly 12 percent of Americans say they will need to borrow money to pay winter heating bills; 9 percent will need to use credit cards to be able to afford their heating bills.

Happy Holidays, everyone. Stay warm!

For perhaps as many as 27 million American adults, keeping warm this winter will mean borrowing money and 20 million will use credit cards to be able to afford their heating bills, according to a CreditCards.com poll.

Nearly 12 percent of Americans say they will need to borrow money to pay winter heating bills; 9 percent will need to use credit cards to be able to afford their heating bills.

Happy Holidays, everyone. Stay warm!

Sunday, December 23, 2007

Hooverville, here we come!

From Yahoo! News: Tent city in suburbs is cost of home crisis.

ONTARIO, California (Reuters) - Between railroad tracks and beneath the roar of departing planes sits "tent city," a terminus for homeless people. It is not, as might be expected, in a blighted city center, but in the once-booming suburbia of Southern California.

The noisy, dusty camp sprang up in July with 20 residents and now numbers 200 people, including several children, growing as this region east of Los Angeles has been hit by the U.S. housing crisis.

The unraveling of the region known as the Inland Empire reads like a 21st century version of "The Grapes of Wrath," John Steinbeck's novel about families driven from their lands by the Great Depression.

As more families throw in the towel and head to foreclosure here and across the nation, the social costs of collapse are adding up in the form of higher rates of homelessness, crime and even disease.

Maryanne Hernandez bought her dream house in San Bernardino in 2003 and now risks losing it after falling four months behind on mortgage payments.

"It's not just us. It's all over," said Hernandez, who lives in a neighborhood where most families are struggling to meet payments and many have lost their homes.

She has noticed an increase in crime since the foreclosures started. Her house was robbed, her kids' bikes were stolen and she worries about what type of message empty houses send.

But it is not just homeowners who are hit by the foreclosure wave. People who rent now find themselves in a tighter, more expensive market as demand rises from families who lost homes, said Jean Beil, senior vice president for programs and services at Catholic Charities USA.

"Folks who would have been in a house before are now in an apartment and folks that would have been in an apartment, now can't afford it," said Beil. "It has a trickle-down effect."

It's all good though. Hooray for downward mobility!

ONTARIO, California (Reuters) - Between railroad tracks and beneath the roar of departing planes sits "tent city," a terminus for homeless people. It is not, as might be expected, in a blighted city center, but in the once-booming suburbia of Southern California.

The noisy, dusty camp sprang up in July with 20 residents and now numbers 200 people, including several children, growing as this region east of Los Angeles has been hit by the U.S. housing crisis.

The unraveling of the region known as the Inland Empire reads like a 21st century version of "The Grapes of Wrath," John Steinbeck's novel about families driven from their lands by the Great Depression.

As more families throw in the towel and head to foreclosure here and across the nation, the social costs of collapse are adding up in the form of higher rates of homelessness, crime and even disease.

Maryanne Hernandez bought her dream house in San Bernardino in 2003 and now risks losing it after falling four months behind on mortgage payments.

"It's not just us. It's all over," said Hernandez, who lives in a neighborhood where most families are struggling to meet payments and many have lost their homes.

She has noticed an increase in crime since the foreclosures started. Her house was robbed, her kids' bikes were stolen and she worries about what type of message empty houses send.

But it is not just homeowners who are hit by the foreclosure wave. People who rent now find themselves in a tighter, more expensive market as demand rises from families who lost homes, said Jean Beil, senior vice president for programs and services at Catholic Charities USA.

"Folks who would have been in a house before are now in an apartment and folks that would have been in an apartment, now can't afford it," said Beil. "It has a trickle-down effect."

It's all good though. Hooray for downward mobility!

Friday, December 21, 2007

God Shave the Queen!

From the Times: London house price fall of 6.8% in past month stokes economy fears.

House prices in London have fallen by an average of £28,000 in the past month, as the capital sets the pace of an accelerating property downturn, a leading survey reports today.

Rightmove, the property website that tracks asking prices for homes across the market, says that prices tumbled by £20,000 a week in affluent Kensington and Chelsea – and by more than £10,000 a week in inner-city Hackney.

The company’s data shows that house prices fell by 3.2 per cent across the country, and by 6.8 per cent in London, over the month to the middle of December.

6.8% in a month is a fuckload of a fall, boys and girls.

I thought London was special. Prices never go down in Chelsea, Kensington and Wimbledon. While the Yanks were stupid enough to make sub-prime loans in Cleveland, they were the financially savvy ones, and because of that they were going to be the financial capital of the world (along with Dubai), and New York was in trouble, and the Brits were going to buy up most of Manhattan.

What happened instead, huh?

House prices in London have fallen by an average of £28,000 in the past month, as the capital sets the pace of an accelerating property downturn, a leading survey reports today.

Rightmove, the property website that tracks asking prices for homes across the market, says that prices tumbled by £20,000 a week in affluent Kensington and Chelsea – and by more than £10,000 a week in inner-city Hackney.

The company’s data shows that house prices fell by 3.2 per cent across the country, and by 6.8 per cent in London, over the month to the middle of December.

6.8% in a month is a fuckload of a fall, boys and girls.

I thought London was special. Prices never go down in Chelsea, Kensington and Wimbledon. While the Yanks were stupid enough to make sub-prime loans in Cleveland, they were the financially savvy ones, and because of that they were going to be the financial capital of the world (along with Dubai), and New York was in trouble, and the Brits were going to buy up most of Manhattan.

What happened instead, huh?

Spinning Jenny

The LA Times interviewed the Secretary of the Treasury, a Mr. Paulson: "These are not normal times".

Henry Paulson: The key is to get the balance right and not go so far that you cut off credit and make the situation worse. The Fed has also been looking at disclosure. I think when you look at the mortgage area, it's almost a caricature of what you see in other areas. You've got pages and pages of disclosure, which doesn't mean you're getting the people good information that they can understand. It's sort of, "Everybody cover their rear end," protect themselves legally. But, I've made the case several times, with all the disclosure there should be one simple page signed by the lender and the borrower that says, "Your monthly payment is x and it could be as high as y in a couple of years." The Fed I know has done some real consumer research on this.

Did the Fed do any research as to what happens when the consumer can't even afford the initial x? Or was that not part of the "real consumer research"?

I'm no lawyer but in that situation I don't think it's called "Disclosure". It's referred to as an "Adverse Action Notice".

Of course, that does run into the "cut off credit" part.

Back to the drawing board, Mr. Secretary!

Henry Paulson: The key is to get the balance right and not go so far that you cut off credit and make the situation worse. The Fed has also been looking at disclosure. I think when you look at the mortgage area, it's almost a caricature of what you see in other areas. You've got pages and pages of disclosure, which doesn't mean you're getting the people good information that they can understand. It's sort of, "Everybody cover their rear end," protect themselves legally. But, I've made the case several times, with all the disclosure there should be one simple page signed by the lender and the borrower that says, "Your monthly payment is x and it could be as high as y in a couple of years." The Fed I know has done some real consumer research on this.

Did the Fed do any research as to what happens when the consumer can't even afford the initial x? Or was that not part of the "real consumer research"?

I'm no lawyer but in that situation I don't think it's called "Disclosure". It's referred to as an "Adverse Action Notice".

Of course, that does run into the "cut off credit" part.

Back to the drawing board, Mr. Secretary!

Thursday, December 20, 2007

Jingle Mail, Jingle Mail, Jingle All the Way...

From the Wall Street Journal: Now, Even Borrowers With Good Credit Pose Risks.

Kenneth Lewis acted far ahead of the competition in 2001, when he got Bank of America out of the business of issuing subprime mortgages. While profit margins on these loans to risky borrowers seemed tempting, the bank's chief executive believed the default risks were too hefty to justify.

So what is Mr. Lewis worrying about today? In an interview last week with Wall Street Journal editors, he expressed concern that even borrowers with strong credit scores might turn out to be default risks if housing prices keep tumbling. In other words, what is being portrayed as a credit-quality problem with the riskiest 20% of the mortgage market could spread to a much wider cross-section of home loans.

"There's been a change in social attitudes toward default," Mr. Lewis says. Bankers typically have believed that cash-strapped borrowers would fall behind on their credit cards, car payments and other debts -- but would regard mortgage defaults as calamities to be avoided at all costs. That isn't always so anymore, he says.

"We're seeing people who are current on their credit cards but are defaulting on their mortgages," Mr. Lewis says. "I'm astonished that people would walk away from their homes." The clear implication: At least a few cash-strapped borrowers now believe bailing out on a house is one of the easier ways to get their finances back under control.

Such behavior was highlighted in a page-one Journal article this week about the housing quagmire in Corona, Calif. One couple bought a home for $557,000 in 2004 and then refinanced it for increasing amounts as property prices soared, eventually ending up with an $835,000 mortgage -- and extra cash for personal expenses. The couple then bought a cheaper home in Texas and stopped making payments on the Corona home in June. As the countdown to foreclosure continues, it looks increasingly likely lenders will be stuck with that house.

First off, from a rational economic point of view, mailing back the key is absolutely the "correct" thing to do. It is somebody else's problem; in this case, the MBS holder's. They took on the risk, loaned these people the money. If it didn't work out, so sad, too bad...

Secondly, doesn't Mr. Lewis realize that value is perceived by how much effort it takes to achieve something? How useful is "good credit" when any fool gets two to three credit card offers two weeks out of bankruptcy?

By comparison, a "renter" has to all but subject him/herself to an anal probe. In most places, they have to get a credit check, two letters of reference, put up a deposit in escrow, and pay the first month's rent.

If people have no skin in the game, they will walk away. One doesn't have to be Warren Buffett to figure this one out.

The blunt truth is any mortgage product that didn't involve a hefty downpayment is doomed to fail. Period. It's all about skin in the game. No amount of tap dancing around this subject will work.

Lastly, it is critical to keep in mind the role of psychology in these things. If it becomes socially acceptable to go to a party and say, "I mailed in the keys to the bank. Hah hah hah!", the banks are doomed. Flat out, doomed. There's not a power in the world (including the central banks) that can rescue them. Social acceptibility is the ultimate arbiter of many a behavior, and if everyone's doing it, there's no stigma attached to it.

(And just for the record, I'm willing to bet that this is the scenario that will come to pass. Why? It was socially acceptable in the early-to-mid-90's, and it will be again.)

Incidentally, that story up there was in yesterday's Journal. The couple pulled out the "phantom equity", bought a brand new Lexus and a SUV, and a house in Texas (most probably in cash.)

Why?

You can't go after a house in Texas in bankruptcy, and you certainly can't go after a fully-paid one. You also can't go after a car (because a car is considered the modern equivalent of a "horse" which cannot be repossessed in Texas!) The lender is pretty much screwed. This particular couple has played the system like a Stradivarius.

Welcome to Planet Reality(TM), Mr. Lewis. We hope you will enjoy your stay.

Kenneth Lewis acted far ahead of the competition in 2001, when he got Bank of America out of the business of issuing subprime mortgages. While profit margins on these loans to risky borrowers seemed tempting, the bank's chief executive believed the default risks were too hefty to justify.

So what is Mr. Lewis worrying about today? In an interview last week with Wall Street Journal editors, he expressed concern that even borrowers with strong credit scores might turn out to be default risks if housing prices keep tumbling. In other words, what is being portrayed as a credit-quality problem with the riskiest 20% of the mortgage market could spread to a much wider cross-section of home loans.

"There's been a change in social attitudes toward default," Mr. Lewis says. Bankers typically have believed that cash-strapped borrowers would fall behind on their credit cards, car payments and other debts -- but would regard mortgage defaults as calamities to be avoided at all costs. That isn't always so anymore, he says.

"We're seeing people who are current on their credit cards but are defaulting on their mortgages," Mr. Lewis says. "I'm astonished that people would walk away from their homes." The clear implication: At least a few cash-strapped borrowers now believe bailing out on a house is one of the easier ways to get their finances back under control.

Such behavior was highlighted in a page-one Journal article this week about the housing quagmire in Corona, Calif. One couple bought a home for $557,000 in 2004 and then refinanced it for increasing amounts as property prices soared, eventually ending up with an $835,000 mortgage -- and extra cash for personal expenses. The couple then bought a cheaper home in Texas and stopped making payments on the Corona home in June. As the countdown to foreclosure continues, it looks increasingly likely lenders will be stuck with that house.

First off, from a rational economic point of view, mailing back the key is absolutely the "correct" thing to do. It is somebody else's problem; in this case, the MBS holder's. They took on the risk, loaned these people the money. If it didn't work out, so sad, too bad...

Secondly, doesn't Mr. Lewis realize that value is perceived by how much effort it takes to achieve something? How useful is "good credit" when any fool gets two to three credit card offers two weeks out of bankruptcy?

By comparison, a "renter" has to all but subject him/herself to an anal probe. In most places, they have to get a credit check, two letters of reference, put up a deposit in escrow, and pay the first month's rent.

If people have no skin in the game, they will walk away. One doesn't have to be Warren Buffett to figure this one out.

The blunt truth is any mortgage product that didn't involve a hefty downpayment is doomed to fail. Period. It's all about skin in the game. No amount of tap dancing around this subject will work.

Lastly, it is critical to keep in mind the role of psychology in these things. If it becomes socially acceptable to go to a party and say, "I mailed in the keys to the bank. Hah hah hah!", the banks are doomed. Flat out, doomed. There's not a power in the world (including the central banks) that can rescue them. Social acceptibility is the ultimate arbiter of many a behavior, and if everyone's doing it, there's no stigma attached to it.

(And just for the record, I'm willing to bet that this is the scenario that will come to pass. Why? It was socially acceptable in the early-to-mid-90's, and it will be again.)

Incidentally, that story up there was in yesterday's Journal. The couple pulled out the "phantom equity", bought a brand new Lexus and a SUV, and a house in Texas (most probably in cash.)

Why?

You can't go after a house in Texas in bankruptcy, and you certainly can't go after a fully-paid one. You also can't go after a car (because a car is considered the modern equivalent of a "horse" which cannot be repossessed in Texas!) The lender is pretty much screwed. This particular couple has played the system like a Stradivarius.

Welcome to Planet Reality(TM), Mr. Lewis. We hope you will enjoy your stay.

Wednesday, December 19, 2007

"Build it, they will come"

From the Tampa Tribune: Empty Storefronts Filled With Hope And Promise.

Although Channelside Drive, the Arts District and the Franklin Street corridor have begun to show some retail stirrings after years of stagnation and promises, few would agree that downtown Tampa has yet to show its potential as a vibrant urban center for shopping, dining and entertainment.

Retail expert Lee Nelson, a senior associate at CB Richard Ellis in Tampa, said restaurants and shops will "flock" to the newly built space. But it will take years - not months - for the vacancies to be filled.

"Retailers have to have customers," she said. "Until those condos are full of people, the retail will not come. Then it will be vibrant and exciting."

Yes, "then" it will be vibrant and exciting. Meanwhile, you expect the people to come there on what exactly? Faith?

New York's Fifth Avenue, London's Oxford Street and Chicago's Magnificent Mile have nothing to fear from downtown Tampa.

I would think not! Has this guy ever even walked down either of the three? Places like these don't just arise overnight, and they sure as hell don't arise due to some "marketing plan".

Same goes for all the cities planning "art districts". You can't plan these things!

Enjoy the Section 8 in a few years!

Although Channelside Drive, the Arts District and the Franklin Street corridor have begun to show some retail stirrings after years of stagnation and promises, few would agree that downtown Tampa has yet to show its potential as a vibrant urban center for shopping, dining and entertainment.

Retail expert Lee Nelson, a senior associate at CB Richard Ellis in Tampa, said restaurants and shops will "flock" to the newly built space. But it will take years - not months - for the vacancies to be filled.

"Retailers have to have customers," she said. "Until those condos are full of people, the retail will not come. Then it will be vibrant and exciting."

Yes, "then" it will be vibrant and exciting. Meanwhile, you expect the people to come there on what exactly? Faith?

New York's Fifth Avenue, London's Oxford Street and Chicago's Magnificent Mile have nothing to fear from downtown Tampa.

I would think not! Has this guy ever even walked down either of the three? Places like these don't just arise overnight, and they sure as hell don't arise due to some "marketing plan".

Same goes for all the cities planning "art districts". You can't plan these things!

Enjoy the Section 8 in a few years!

Tuesday, December 18, 2007

Sheer Brilliance

From the Boston Herald: Realtors face tough reality.

“If sales are down, revenue is down,” said Ruth Pino, a Carlson GMAC branch executive in Gloucester.

Quick! Nobel Committee, give this woman the Prize!

“If sales are down, revenue is down,” said Ruth Pino, a Carlson GMAC branch executive in Gloucester.

Quick! Nobel Committee, give this woman the Prize!

Comment puis-je dire?

From the Lower Hudson online: Lots of blame to go around in subprime mortgage crisis.

For months Marie Chantale Joseph and her husband, Daniel, have been unsuccessfully trying to refinance their home before their interest rate spikes in April.

Already, Daniel, a taxi driver, is working 18 hours a day and on weekends to pay the approximately $4,800 a month they owe, and Marie, a babysitter, works as many hours as she can.

"In my country it is different. No one can come and take your home away from you," said Marie Chantale, who must pay about $8,000 a month beginning in April, or lose her home to foreclosure. "Here, if they know you don't know what you are doing, they take advantage of you."

Firstly, the idea that Haiti is more ethical than the US is absurd. We're talking about literally the poorest nation in the Western Hemisphere which also has the dubious distinction of being a failed state.

Secondly, we're talking about a baby-sitter and a cab-driver buying a $500,000 house with monthly payments of $8,000.

Let me repeat that for emphasis: a baby-sitter and a cab-driver with $8,000 monthly payments. (That's $96,000 a year for 30 years, or roughly $3 million!)

Here's the "much esteemed" Federal Reserve's Survey of Consumer Finances, (PDF link) where you can figure out for yourself that even a family in the top 5% of incomes cannot possibly make those payments. They would literally be scraping by, and hope to God and cross their hearts that nothing goes wrong.

Ponder that! No fuckups for 30 straight years -- no medical problems, no unexpected expenses, no recessions, no layoffs, absolute perfection for 30 years.

What is easier to believe?

That they had no clue of what they were doing, or they were gaming the system, and after the shit hits the fan, they fuck off back to Haiti?

You can decide that for yourself!

For months Marie Chantale Joseph and her husband, Daniel, have been unsuccessfully trying to refinance their home before their interest rate spikes in April.

Already, Daniel, a taxi driver, is working 18 hours a day and on weekends to pay the approximately $4,800 a month they owe, and Marie, a babysitter, works as many hours as she can.

"In my country it is different. No one can come and take your home away from you," said Marie Chantale, who must pay about $8,000 a month beginning in April, or lose her home to foreclosure. "Here, if they know you don't know what you are doing, they take advantage of you."

Firstly, the idea that Haiti is more ethical than the US is absurd. We're talking about literally the poorest nation in the Western Hemisphere which also has the dubious distinction of being a failed state.

Secondly, we're talking about a baby-sitter and a cab-driver buying a $500,000 house with monthly payments of $8,000.

Let me repeat that for emphasis: a baby-sitter and a cab-driver with $8,000 monthly payments. (That's $96,000 a year for 30 years, or roughly $3 million!)

Here's the "much esteemed" Federal Reserve's Survey of Consumer Finances, (PDF link) where you can figure out for yourself that even a family in the top 5% of incomes cannot possibly make those payments. They would literally be scraping by, and hope to God and cross their hearts that nothing goes wrong.

Ponder that! No fuckups for 30 straight years -- no medical problems, no unexpected expenses, no recessions, no layoffs, absolute perfection for 30 years.

What is easier to believe?

That they had no clue of what they were doing, or they were gaming the system, and after the shit hits the fan, they fuck off back to Haiti?

You can decide that for yourself!

Monday, December 17, 2007

Liquidity v/s Solvency

We seem to be hearing a lot about the "liquidity crisis". However, this is fundamentally a "solvency crisis".

Here's the situation in a nutshell:

Money was loaned in copious quantities on the basis of highly inflated appraisals of questionable collateral. Then the system leveraged the motherfuckin'-crap (to use a technical term) out of an already highly leveraged position. The money was spent and is not coming back.

Please show me how "printing money" can reverse anything.

Let's review the above in terms that we can all understand:

You sell cars. I buy two with counterfeit cash. Your suppliers balk and refuse to replenish your inventory. Meanwhile, I've sold the cars, and blown the money on booze and hookers.

What are you gonna do? Possibly have me arrested but you're still out the cars and the cash.

Now add the above stated leverage, and you will see the problem.

Here's the situation in a nutshell:

Money was loaned in copious quantities on the basis of highly inflated appraisals of questionable collateral. Then the system leveraged the motherfuckin'-crap (to use a technical term) out of an already highly leveraged position. The money was spent and is not coming back.

Please show me how "printing money" can reverse anything.

Let's review the above in terms that we can all understand:

You sell cars. I buy two with counterfeit cash. Your suppliers balk and refuse to replenish your inventory. Meanwhile, I've sold the cars, and blown the money on booze and hookers.

What are you gonna do? Possibly have me arrested but you're still out the cars and the cash.

Now add the above stated leverage, and you will see the problem.

Thursday, December 13, 2007

Have you heard of ...

... Bankhaus Herstatt?

You will, kids, you will. This is like déjà vu, all over again!

You will, kids, you will. This is like déjà vu, all over again!

Monday, December 10, 2007

Swiss Cheese

Once again, the Wall Street Journal reports: UBS Gains Two New Investors, Writes Down $10 Billion.

UBS AG Monday said that two strategic foreign investors committed to inject capital worth 13 billion Swiss francs ($11.5 billion) as part of a broader move to strengthen capital as the Swiss bank announced a further $10 billion in write-downs on subprime holdings.

The bank said it was now possible that it will record a net loss for the full year.

UBS is issuing mandatory convertible notes worth 13 billion francs for these investments, which will pay a coupon of 9%.

Beyond the investments from these two parties, UBS plans to sell treasury shares and replace its 2007 cash dividend with a stock dividend, boosting capital by 6.4 billion francs.

9% while 3-month Treasuries are barely yielding 3%!

That's like going down the pawn-shop to borrow from Fat Tony.

And a stock dividend is less than worthless.

Before the stock dividend, each investor owns a certain fraction of the company. After the dividend, ta-daa, they own the same fraction.

It's like your mom cutting a cake into two pieces, and saying, "Now you have double the cake."

Watch out,suckers er, UBS investors!

UBS AG Monday said that two strategic foreign investors committed to inject capital worth 13 billion Swiss francs ($11.5 billion) as part of a broader move to strengthen capital as the Swiss bank announced a further $10 billion in write-downs on subprime holdings.

The bank said it was now possible that it will record a net loss for the full year.

UBS is issuing mandatory convertible notes worth 13 billion francs for these investments, which will pay a coupon of 9%.

Beyond the investments from these two parties, UBS plans to sell treasury shares and replace its 2007 cash dividend with a stock dividend, boosting capital by 6.4 billion francs.

9% while 3-month Treasuries are barely yielding 3%!

That's like going down the pawn-shop to borrow from Fat Tony.

And a stock dividend is less than worthless.

Before the stock dividend, each investor owns a certain fraction of the company. After the dividend, ta-daa, they own the same fraction.

It's like your mom cutting a cake into two pieces, and saying, "Now you have double the cake."

Watch out,

Saturday, December 08, 2007

Dow (Corning) Deflation

Well, the Wall Street Journal has done it again: Evidence Grows That Consumers Are Pulling Back.

The latest sign that growth in consumer spending, the mainstay of the U.S. economy, is slowing? A nip and tuck in spending on cosmetic surgery.

The slowdown was a hot topic at the meeting of the American Society of Plastic Surgeons in Baltimore this fall. One breast-implant maker sees hints of a slowdown in demand.

Well, looks like Bubbles and Jiggles are going to go down after all (and not that way either, you perverts!)

And who needs AAA-rated bonds when you have double-D's?

Russ Meyer, come back. America needs you!

The latest sign that growth in consumer spending, the mainstay of the U.S. economy, is slowing? A nip and tuck in spending on cosmetic surgery.

The slowdown was a hot topic at the meeting of the American Society of Plastic Surgeons in Baltimore this fall. One breast-implant maker sees hints of a slowdown in demand.

Well, looks like Bubbles and Jiggles are going to go down after all (and not that way either, you perverts!)

And who needs AAA-rated bonds when you have double-D's?

Russ Meyer, come back. America needs you!

Tuesday, December 04, 2007

House Prices and Foreclosures

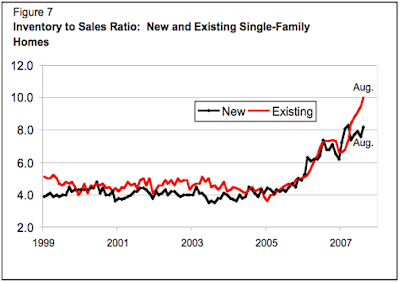

(Source: Boston Fed.)

This is data just for Massachussetts.

There are two ways to interpret this graph:

The rise in prices predicts foreclosures. It suggests that people bought houses they couldn't really afford on their incomes.

The second is that if you look at prices, they didn't hit the 0% growth mark until after foreclosures had taken off. That suggests that people were buying houses with the implicit assumption of rising prices.

Both, of course, are familiar to people who have been following this mania.

Saturday, December 01, 2007

Beer Bingo

Truly a venerable tradition if ever there was one!

Truly a venerable tradition if ever there was one!The rules are simple.

You have to swill one gulp of beer each time one of the words in the above Alphabet Soup is mentioned in the press. If you don't know what the word means, and you admit it, you have to take three gulps. If challenged to explain, and you fail, you must down what's left in the glass.

Of course, this will mean that you will frequently be liquored up before breakfast but that's probably the only reasonable way to deal with the bollix-ed cock-up clusterfuck that is the US Economy.

Friday, November 30, 2007

Dude, Where's My Goldilocks?

I miss Goldilocks. I really really do. I miss the fact that they no longer talk about her on CNBC.

Where's my Goldilocks Economy?

Did Goldie get sodomized by the three bears? Is she now flashing "six-inch hooker heels, and a `tramp stamp'"? Is there some deep dark shameful secret that nobody wants to talk about?

Where is she?

Bring her back, says I!

Where's my Goldilocks Economy?

Did Goldie get sodomized by the three bears? Is she now flashing "six-inch hooker heels, and a `tramp stamp'"? Is there some deep dark shameful secret that nobody wants to talk about?

Where is she?

Bring her back, says I!

Tuesday, November 27, 2007

Brain Meltdown

From Bloomberg: U.S. Stocks Rebound, Led by Banks; Citigroup, Intel Shares Rise.

Altria Group Inc., the world's largest tobacco maker, increased after Goldman Sachs Group Inc. advised buying shares whose profits aren't tied to the economy.

Huh?!? (insert head-scratching)

Altria Group Inc., the world's largest tobacco maker, increased after Goldman Sachs Group Inc. advised buying shares whose profits aren't tied to the economy.

Huh?!? (insert head-scratching)

Monday, November 26, 2007

The Smell Test

CBS Marketwatch reports: HSBC to provide $35 billion in funding to SIVs.

HSBC Holdings on Monday said it would move two of its structured investment vehicles onto its balance sheet and provide up to $35 billion in funding, saying it doesn't expect a near-term resolution of the funding problems faced by the vehicles that it and other banks operate.

The bank said it is providing up to $35 billion in funding, and its balance sheet will expand by $45 billion.

But the banking giant insists earnings won't be materially impacted, because existing investors will continue to bear all economic risk from actual losses. It added that the move won't impact capital requirements much, either.

"We believe that HSBC's actions will set a benchmark and restore a degree of confidence to the SIV sector, while providing a specific solution to address the challenges faced by investors in Cullinan and Asscher, the two SIVs managed by HSBC," the bank said in a statement.

Here's my interpretation:

HSBC blinked first. Citibank, Bank of America, and J.P.Morgan are currentily in the process of beshitting themselves.

From Bloomberg: Bank of America Takes Lead in Backing `SuperSIV' Fund.

Loomis Sayles & Co. declined to invest after receiving one of 16 invitations for a personal meeting last week with current Fed Chairman Ben Bernanke, said Daniel Fuss, who oversees $22 billion as chief investment officer at the Boston-based firm.

``It's so nice to get a personal invitation to go to Washington and have a one-hour visit with Ben Bernanke,'' said Fuss, who decided participating wasn't worth the risk to his firm. ``Oh, boy, did I feel important for about 27 seconds, and then you smell a rat.''

Bravo!!!

HSBC Holdings on Monday said it would move two of its structured investment vehicles onto its balance sheet and provide up to $35 billion in funding, saying it doesn't expect a near-term resolution of the funding problems faced by the vehicles that it and other banks operate.

The bank said it is providing up to $35 billion in funding, and its balance sheet will expand by $45 billion.

But the banking giant insists earnings won't be materially impacted, because existing investors will continue to bear all economic risk from actual losses. It added that the move won't impact capital requirements much, either.

"We believe that HSBC's actions will set a benchmark and restore a degree of confidence to the SIV sector, while providing a specific solution to address the challenges faced by investors in Cullinan and Asscher, the two SIVs managed by HSBC," the bank said in a statement.

Here's my interpretation:

HSBC blinked first. Citibank, Bank of America, and J.P.Morgan are currentily in the process of beshitting themselves.

From Bloomberg: Bank of America Takes Lead in Backing `SuperSIV' Fund.

Loomis Sayles & Co. declined to invest after receiving one of 16 invitations for a personal meeting last week with current Fed Chairman Ben Bernanke, said Daniel Fuss, who oversees $22 billion as chief investment officer at the Boston-based firm.

``It's so nice to get a personal invitation to go to Washington and have a one-hour visit with Ben Bernanke,'' said Fuss, who decided participating wasn't worth the risk to his firm. ``Oh, boy, did I feel important for about 27 seconds, and then you smell a rat.''

Bravo!!!

Saturday, November 24, 2007

You really stuck it to the Man, man!

From the Richmond Times, we have: Dream in distress.

Scott and Dawn Loving were able to stop the foreclosure on their house -- at least temporarily.

The Lovings got into trouble when the subprime adjustable-rate mortgage on their Chesterfield County home reset after two years.

Their monthly payment jumped from $1,250 to $1,400, resetting six months later at $1,600, then again at $1,650. Their new payment consumed more than half their net income.

They got the subprime loan because their credit was damaged years ago when they went on a debt-management plan to pay off $30,000 in credit-card debt.

They were locked into their original mortgage because it carried a hefty prepayment penalty.

As soon as the penalty phase passed, they looked into refinancing. "At least a dozen lenders turned us down," Scott said.

They found one taker. The payoff on the old loan -- a combo ARM and fixed-rate mortgage -- was $137,000.

They walked away with another ARM. This one was for $161,000, which increased their debt. It included $4,000 in cash. Fees and closing costs totaled $20,000.

"We didn't feel we had any choice," Scott said.

The new payment is $1,623, not much better than the $1,650 payment on the old loan. "But we had a fresh start," he said.

The initial interest rate on the new loan is 9.8 percent, 0.1 percent better than the old loan. It, too, has a prepayment penalty -- 5 percent of the loan amount. It resets next June.

Let's see:

You were bothered because you were paying half your salary on $137K.

Now, you owe $161K.

Some jack-off ran away with $20K that you now have to repay.

You also got $4K "back". You do realize that the $4K was a loan that you have to pay back, dontcha?

The loan resets in 6 months. Guess what's it gonna reset to, and guess what happens to a payment on a larger loan. You should sit down and check whether it will take up more than half your salary or not.

You're a regular Cheese-Whiz, d00d! You should run for Congress.

Scott and Dawn Loving were able to stop the foreclosure on their house -- at least temporarily.

The Lovings got into trouble when the subprime adjustable-rate mortgage on their Chesterfield County home reset after two years.

Their monthly payment jumped from $1,250 to $1,400, resetting six months later at $1,600, then again at $1,650. Their new payment consumed more than half their net income.

They got the subprime loan because their credit was damaged years ago when they went on a debt-management plan to pay off $30,000 in credit-card debt.

They were locked into their original mortgage because it carried a hefty prepayment penalty.

As soon as the penalty phase passed, they looked into refinancing. "At least a dozen lenders turned us down," Scott said.

They found one taker. The payoff on the old loan -- a combo ARM and fixed-rate mortgage -- was $137,000.

They walked away with another ARM. This one was for $161,000, which increased their debt. It included $4,000 in cash. Fees and closing costs totaled $20,000.

"We didn't feel we had any choice," Scott said.

The new payment is $1,623, not much better than the $1,650 payment on the old loan. "But we had a fresh start," he said.

The initial interest rate on the new loan is 9.8 percent, 0.1 percent better than the old loan. It, too, has a prepayment penalty -- 5 percent of the loan amount. It resets next June.

Let's see:

You were bothered because you were paying half your salary on $137K.

Now, you owe $161K.

Some jack-off ran away with $20K that you now have to repay.

You also got $4K "back". You do realize that the $4K was a loan that you have to pay back, dontcha?

The loan resets in 6 months. Guess what's it gonna reset to, and guess what happens to a payment on a larger loan. You should sit down and check whether it will take up more than half your salary or not.

You're a regular Cheese-Whiz, d00d! You should run for Congress.

Wednesday, November 21, 2007

Knock, knock, knocking on Norwegian Wood?

All the way from icy Norway, we have Townships caught up in international credit crisis.

Several small townships in northern Norway went along with a securities firm's advice and invested as much as NOK 4 billion in complicated American commercial paper sold by Citibank. They now risk losing it all.

The township politicians are both embarrassed and angry at the financial advisers who they now claim led them astray. "They think we're a bunch of small-town fools," one local mayor told newspaper Dagens Næringsliv.

Excuse me, you are a bunch of small-town fools.

Like yokels everywhere, you were probably wined and dined by Citibank, and you fell for the bait.

Terra officials say they're sorry about the losses, but claim the townships are viewed as "professional players" in the financial markets and must also take responsibility "for the investments they choose to make."

The politicians claim they "asked all the questions we could" about risk levels, not least those tied to currency valuation. The US dollar is also extremely weak at present against the Norwegian kroner, reducing relative values of US holdings.

While the finger-pointing continues, the townships are obligated to put what some fear is good money after bad. Norwegian townships that are suddenly relatively wealthy on energy revenues are also learning to be more cautious, as they face constant, complicated investment offers from foreign institutions.

Experience keeps a dear school but fools will learn in no other.

Several small townships in northern Norway went along with a securities firm's advice and invested as much as NOK 4 billion in complicated American commercial paper sold by Citibank. They now risk losing it all.

The township politicians are both embarrassed and angry at the financial advisers who they now claim led them astray. "They think we're a bunch of small-town fools," one local mayor told newspaper Dagens Næringsliv.

Excuse me, you are a bunch of small-town fools.

Like yokels everywhere, you were probably wined and dined by Citibank, and you fell for the bait.

Terra officials say they're sorry about the losses, but claim the townships are viewed as "professional players" in the financial markets and must also take responsibility "for the investments they choose to make."

The politicians claim they "asked all the questions we could" about risk levels, not least those tied to currency valuation. The US dollar is also extremely weak at present against the Norwegian kroner, reducing relative values of US holdings.

While the finger-pointing continues, the townships are obligated to put what some fear is good money after bad. Norwegian townships that are suddenly relatively wealthy on energy revenues are also learning to be more cautious, as they face constant, complicated investment offers from foreign institutions.

Experience keeps a dear school but fools will learn in no other.

Jawboning

From the esteemed Wall Street Journal, we have: Paulson Shifts on Mortgages.

U.S. Treasury Secretary Henry Paulson, concerned that millions of homeowners aren't being helped quickly enough, is pressing the mortgage-service industry to help broad swaths of borrowers qualify for better loans instead of dealing with mortgage problems on a case-by-case basis.

In an interview, Mr. Paulson said the number of potential home-loan defaults "will be significantly bigger" in 2008 than in 2007. He said he is "aggressively encouraging" the mortgage-service industry -- which collects loan payments from borrowers -- to develop criteria that would enable large groups of borrowers who might default on their payments to qualify for loans with better terms.

Let us first take a detour:

We first had this from CNN on April 20th.

"All the signs I look at" show "the housing market is at or near the bottom," Paulson said. The U.S. economy is "very healthy" and "robust," he said.

Then, we had this on July 2nd.

"In terms of looking at housing, most of us believe that it's at or near the bottom," he told Reuters in an interview.

Mr. Paulson, you seem to be coming around to Planet Reality(TM). You know the one that Warren Buffett lives on?

Also, "aggressively encouraging" is not a plan. Agreed?

Flapping your gums doesn't seem to be having much of an effect as you may have noticed. Of course, you and I both know that that was never the plan but perception matters particularly at the level at which you are operating. Agreed?

You may want to consult this graph again. Time's kinda running out.

There's just one teensy-weensy niggling little problem with the "broad swaths" solution. The vast majority people wouldn't be able to pay back the principal even if you gave them loans at 0% interest. So I would advise a Plan B.

And if they hand back the house, then their paying neighbors might also refuse to pay inordinate sums, and may also hand back the house. In that case, I would advise a Plan C as well.

Incidentally, how's that Super-SIV plan of yours working out?

U.S. Treasury Secretary Henry Paulson, concerned that millions of homeowners aren't being helped quickly enough, is pressing the mortgage-service industry to help broad swaths of borrowers qualify for better loans instead of dealing with mortgage problems on a case-by-case basis.

In an interview, Mr. Paulson said the number of potential home-loan defaults "will be significantly bigger" in 2008 than in 2007. He said he is "aggressively encouraging" the mortgage-service industry -- which collects loan payments from borrowers -- to develop criteria that would enable large groups of borrowers who might default on their payments to qualify for loans with better terms.

Let us first take a detour:

We first had this from CNN on April 20th.

"All the signs I look at" show "the housing market is at or near the bottom," Paulson said. The U.S. economy is "very healthy" and "robust," he said.

Then, we had this on July 2nd.

"In terms of looking at housing, most of us believe that it's at or near the bottom," he told Reuters in an interview.

Mr. Paulson, you seem to be coming around to Planet Reality(TM). You know the one that Warren Buffett lives on?

Also, "aggressively encouraging" is not a plan. Agreed?

Flapping your gums doesn't seem to be having much of an effect as you may have noticed. Of course, you and I both know that that was never the plan but perception matters particularly at the level at which you are operating. Agreed?

You may want to consult this graph again. Time's kinda running out.

There's just one teensy-weensy niggling little problem with the "broad swaths" solution. The vast majority people wouldn't be able to pay back the principal even if you gave them loans at 0% interest. So I would advise a Plan B.

And if they hand back the house, then their paying neighbors might also refuse to pay inordinate sums, and may also hand back the house. In that case, I would advise a Plan C as well.

Incidentally, how's that Super-SIV plan of yours working out?

Tuesday, November 20, 2007

2 Good 2 B 4got10

From Newsday, we have: Loan was too good to be true.

Robin and William Fitzgerald always wanted to buy a home, but with no savings, mediocre credit and jobs as a legal secretary and truck driver, they thought it was beyond their reach.

Then, in 2005, the Fitzgeralds believed their luck had turned.

Through a friend, they met Aaron Wider, a Garden City mortgage banker who also owned several homes in the Massapequa area. They settled on a two-family high ranch in North Massapequa at a sales price of $805,000.

Because Wider also was a mortgage banker, he said he could approve a loan that other banks wouldn't, the Fitzgeralds recalled. "It was like he was giving us an opportunity for us to fulfill our dream," Robin Fitzgerald said.

After a year of struggling with mortgage payments that -- minus rent from tenants -- were $3,400 a month, the Fitzgeralds fell behind. Last March, Pennsylvania-based GMAC Bank, which had bought their loans from Wider's bank, began foreclosure proceedings.

Only then, after hiring their own appraiser, did the Fitzgeralds learn that their home was valued at $545,000 when they bought it.

No savings, mediocre credit, barely job-worthy, didn't do any homework, borrowed $800K to buy a house which may or may not have been "worth" $545K.

What a bunch of fuckin' ding-dongs!

George Cornielle was living in Elmhurst with his wife and grown daughter in 2005, when a friend who did construction work for Wider asked Cornielle if he was interested in buying a home.

"I wasn't even thinking about a house," Cornielle said. "I said 'I don't think I qualify.' " But the friend assured Cornielle that Wider could arrange a loan and soon Cornielle was in contract to buy a high ranch in East Massapequa for $812,500.

Cornielle, who is a $52,000-a-year catering supervisor at Kennedy Airport, said he paid a down payment of $17,000 and didn't ask questions when lawyers placed dozens of documents before him to sign. Cornielle said he used a lawyer Wider provided him; Wider did not comment on Cornielle's case.

Cornielle said he did not notice that personal information in his loan application was incorrect. The papers say he has two children, ages 13 and 14, and that he earns $14,500 a month -- more than triple what he said he actually makes.

Although Cornielle is not in foreclosure, he said he is one month behind on his mortgage payments and has borrowed up to $60,000 from family and friends in order to avoid defaulting.

Cornielle eventually obtained copies of the appraisals, which showed the house was worth $830,000 and $825,000 in 2005. Cornielle paid for a new appraisal in July, which showed the house was valued last summer at $484,000.

Wider said he considers the Fitzgeralds personal friends. Robin Fitzgerald tells a different story.

"I said Aaron, 'You're like a walking angel.' That's how I felt about him," Fitzgerald said. "We felt like he was the answer to our prayers."

Now, she said, she often cries herself to sleep.

Didn't notice the phantom income; didn't notice two fake young children; didn't notice the fake appraisal of $825K from $484K; borrowed more than 15X his income to buy a house which was "worth" slightly more than half that; currently continuing to borrow $60K from family which will obviously never get paid back.

Now his wife cries herself to sleep.

Lady, you're gonna learn a lesson as old as time : debt never sleeps!

Is this a great fuckin' country or what?

Robin and William Fitzgerald always wanted to buy a home, but with no savings, mediocre credit and jobs as a legal secretary and truck driver, they thought it was beyond their reach.

Then, in 2005, the Fitzgeralds believed their luck had turned.

Through a friend, they met Aaron Wider, a Garden City mortgage banker who also owned several homes in the Massapequa area. They settled on a two-family high ranch in North Massapequa at a sales price of $805,000.

Because Wider also was a mortgage banker, he said he could approve a loan that other banks wouldn't, the Fitzgeralds recalled. "It was like he was giving us an opportunity for us to fulfill our dream," Robin Fitzgerald said.

After a year of struggling with mortgage payments that -- minus rent from tenants -- were $3,400 a month, the Fitzgeralds fell behind. Last March, Pennsylvania-based GMAC Bank, which had bought their loans from Wider's bank, began foreclosure proceedings.

Only then, after hiring their own appraiser, did the Fitzgeralds learn that their home was valued at $545,000 when they bought it.

No savings, mediocre credit, barely job-worthy, didn't do any homework, borrowed $800K to buy a house which may or may not have been "worth" $545K.

What a bunch of fuckin' ding-dongs!

George Cornielle was living in Elmhurst with his wife and grown daughter in 2005, when a friend who did construction work for Wider asked Cornielle if he was interested in buying a home.

"I wasn't even thinking about a house," Cornielle said. "I said 'I don't think I qualify.' " But the friend assured Cornielle that Wider could arrange a loan and soon Cornielle was in contract to buy a high ranch in East Massapequa for $812,500.

Cornielle, who is a $52,000-a-year catering supervisor at Kennedy Airport, said he paid a down payment of $17,000 and didn't ask questions when lawyers placed dozens of documents before him to sign. Cornielle said he used a lawyer Wider provided him; Wider did not comment on Cornielle's case.

Cornielle said he did not notice that personal information in his loan application was incorrect. The papers say he has two children, ages 13 and 14, and that he earns $14,500 a month -- more than triple what he said he actually makes.

Although Cornielle is not in foreclosure, he said he is one month behind on his mortgage payments and has borrowed up to $60,000 from family and friends in order to avoid defaulting.

Cornielle eventually obtained copies of the appraisals, which showed the house was worth $830,000 and $825,000 in 2005. Cornielle paid for a new appraisal in July, which showed the house was valued last summer at $484,000.

Wider said he considers the Fitzgeralds personal friends. Robin Fitzgerald tells a different story.

"I said Aaron, 'You're like a walking angel.' That's how I felt about him," Fitzgerald said. "We felt like he was the answer to our prayers."

Now, she said, she often cries herself to sleep.

Didn't notice the phantom income; didn't notice two fake young children; didn't notice the fake appraisal of $825K from $484K; borrowed more than 15X his income to buy a house which was "worth" slightly more than half that; currently continuing to borrow $60K from family which will obviously never get paid back.

Now his wife cries herself to sleep.

Lady, you're gonna learn a lesson as old as time : debt never sleeps!

Is this a great fuckin' country or what?

Thursday, November 15, 2007

The Gentleman's Index

The Herengracht (Gentleman's Canal) is one of the most desirable places in Amsterdam, and thanks to the finicky particular capitalists that the Dutch traditionally were, we have an uninterrupted view of house prices for more than 350 years.

Here's what it looks like (the graph is adjusted for inflation.) Even if you don't speak Dutch you should be able to guess easily.

Here's what it looks like (the graph is adjusted for inflation.) Even if you don't speak Dutch you should be able to guess easily.

How to cope if you're a senior?

Wednesday, November 14, 2007

Cleaving Cleveland

From the BBC: Foreclosure wave sweeps America.

Of course, the BBC is spinning the story as, "Look at those stupid people across the Pond" while ignoring the fact that Britain's situation is an order of magnitude worse.

Now, CNN seems to have picked up that story: Where Cleveland went wrong.

What made Cleveland the nation's foreclosure epicenter?

Like most rust-belt cities, it's suffered serious economic setbacks. The city lost jobs at more than three times the national rate during 2001 through 2003 and has not had a meaningful recovery since, according to Richard DeKaser, chief economist at Cleveland-based mortgage lender National City Corp. The state of Ohio recorded a quarter of all U.S. manufacturing job losses since 2001.

Add considerable population shrinkage: With 450,000 people, Cleveland has fewer than half the residents it boasted in 1950, when only six cities in the nation were larger.

As the Treasurer of Cuyahoga County in Ohio, Jim Rokakis spends a lot of his time trying to deal with Cleveland's foreclosure crisis.

According to Rokakis, Cleveland got hammered because lax governmental oversight from the state allowed Wild-West lending. "No one was watching," he said. "There was no sheriff in town. The state legislature was dominated by banking interests."

Cleveland tried to enact local anti-predatory lending ordinances in 2002, but national lenders then abandoned the market, according to Mark Wiseman, who heads the Cuyahoga County Foreclosure Prevention Program, which is part of the county treasurer's office.

One bank representative, speaking under condition of anonymity, said the ordinances would have put local lending criteria well above and beyond the national standards. The lenders wanted no part of that.

For Rokakis, this long-term lack of accountability enabled lenders to continue to make bad loans virtually unchecked. These included many subprime, hybrid ARMs, also called "toxic ARMs," products he considers predatory.

But even the staunchly pro-consumer Rokakis admitted that predatory lending victims are not entirely blameless for their own problems.

With times hard, "People were looking for a way to make a living," he said. "There were all these 'Buy real estate with no credit and no down payment deals.' The way to wealth was real estate."

Rokakis told of a 78-year-old Cleveland woman recently saddled with an unaffordable, 30-year ARM arranged by her minister, a mortgage broker. "I asked him why," said Rokakis, "you would give an elderly woman an ARM. He said, 'She wanted the house.'"

Roakakis shook his head. "I want a date with Uma Thurman," he said, "but you have to be realistic."

Of course, the BBC is spinning the story as, "Look at those stupid people across the Pond" while ignoring the fact that Britain's situation is an order of magnitude worse.

Now, CNN seems to have picked up that story: Where Cleveland went wrong.

What made Cleveland the nation's foreclosure epicenter?

Like most rust-belt cities, it's suffered serious economic setbacks. The city lost jobs at more than three times the national rate during 2001 through 2003 and has not had a meaningful recovery since, according to Richard DeKaser, chief economist at Cleveland-based mortgage lender National City Corp. The state of Ohio recorded a quarter of all U.S. manufacturing job losses since 2001.

Add considerable population shrinkage: With 450,000 people, Cleveland has fewer than half the residents it boasted in 1950, when only six cities in the nation were larger.

As the Treasurer of Cuyahoga County in Ohio, Jim Rokakis spends a lot of his time trying to deal with Cleveland's foreclosure crisis.

According to Rokakis, Cleveland got hammered because lax governmental oversight from the state allowed Wild-West lending. "No one was watching," he said. "There was no sheriff in town. The state legislature was dominated by banking interests."

Cleveland tried to enact local anti-predatory lending ordinances in 2002, but national lenders then abandoned the market, according to Mark Wiseman, who heads the Cuyahoga County Foreclosure Prevention Program, which is part of the county treasurer's office.

One bank representative, speaking under condition of anonymity, said the ordinances would have put local lending criteria well above and beyond the national standards. The lenders wanted no part of that.

For Rokakis, this long-term lack of accountability enabled lenders to continue to make bad loans virtually unchecked. These included many subprime, hybrid ARMs, also called "toxic ARMs," products he considers predatory.

But even the staunchly pro-consumer Rokakis admitted that predatory lending victims are not entirely blameless for their own problems.

With times hard, "People were looking for a way to make a living," he said. "There were all these 'Buy real estate with no credit and no down payment deals.' The way to wealth was real estate."

Rokakis told of a 78-year-old Cleveland woman recently saddled with an unaffordable, 30-year ARM arranged by her minister, a mortgage broker. "I asked him why," said Rokakis, "you would give an elderly woman an ARM. He said, 'She wanted the house.'"

Roakakis shook his head. "I want a date with Uma Thurman," he said, "but you have to be realistic."

Giambattista Vico and the Cyclicity of History

From a Florida ad.

From within your architecturally distinctive residence or upon its gracious terrace, you feel the caress of a bay breeze as you gaze across the urban landscape and emerald waters. And yet, you remain one cool remove from the sea and city sites at your feet. Privacy and luxury envelop you. Rooftop gardens and terraces create an enchanting oasis in the heart of the city.

Here's a similar ad.

Where you sit and watch at twilight the fronds of the graceful palm, latticed against the fading gold of the sun-kissed sky–

Where sun, moon and stars, at eventide, stage a welcome constituting the glorious galaxy of the firmament–Where the whispering breeze springs fresh from the lap of Caribbean and woos with elusive cadence like unto a mother’s lullaby–Where the silver cycle is heaven’s lavalier, and the full orbit its glorious pendant.

Except the second ad is from 1925 right before the Great Florida Bust of 1926. Prices didn't recover in nominal terms until 1986.

Plus ça change, plus ...

From within your architecturally distinctive residence or upon its gracious terrace, you feel the caress of a bay breeze as you gaze across the urban landscape and emerald waters. And yet, you remain one cool remove from the sea and city sites at your feet. Privacy and luxury envelop you. Rooftop gardens and terraces create an enchanting oasis in the heart of the city.

Here's a similar ad.

Where you sit and watch at twilight the fronds of the graceful palm, latticed against the fading gold of the sun-kissed sky–

Where sun, moon and stars, at eventide, stage a welcome constituting the glorious galaxy of the firmament–Where the whispering breeze springs fresh from the lap of Caribbean and woos with elusive cadence like unto a mother’s lullaby–Where the silver cycle is heaven’s lavalier, and the full orbit its glorious pendant.

Except the second ad is from 1925 right before the Great Florida Bust of 1926. Prices didn't recover in nominal terms until 1986.

Plus ça change, plus ...

Banker-ese

From Bloomberg: JPMorgan Says SIVs Will `Go the Way of the Dinosaur'.

JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon said structured investment vehicles, whose assets have dwindled by at least $75 billion since July, will ``go the way of the dinosaur.''

``SIVs don't have a business purpose,'' Dimon told a conference hosted by Merrill Lynch & Co. in New York today.

Sure they do.

They're a mechanism for evading capital requirements hence allowing much larger leverage than is legal.

And what's so radical about SIV's anyway? All they do is borrow short, and lend long taken to an absurd extreme. That's like Banking 101 -- the stuff they teach undergraduates on the first day of class.

What are you, retarded?

JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon said structured investment vehicles, whose assets have dwindled by at least $75 billion since July, will ``go the way of the dinosaur.''

``SIVs don't have a business purpose,'' Dimon told a conference hosted by Merrill Lynch & Co. in New York today.

Sure they do.

They're a mechanism for evading capital requirements hence allowing much larger leverage than is legal.

And what's so radical about SIV's anyway? All they do is borrow short, and lend long taken to an absurd extreme. That's like Banking 101 -- the stuff they teach undergraduates on the first day of class.

What are you, retarded?

Monday, November 12, 2007

Is Switzerland really Turkmenistan?

From the LA Times: S & P slashes State Street CDO rating.

The ratings on the most senior class of Carina CDO Ltd. were lowered to BB, two levels below investment grade, from AAA, while another AAA class was slashed 18 steps to CCC-minus. The chance of material losses to note holders is high, New York-based S&P said.

Eighteen notches, count 'em, eighteen.

It's as if you thought you were loaning money to the Swiss, and instead found that you'd bought bonds from Uruguay or Turkmenistan!

Hurray for the lawyers!

The ratings on the most senior class of Carina CDO Ltd. were lowered to BB, two levels below investment grade, from AAA, while another AAA class was slashed 18 steps to CCC-minus. The chance of material losses to note holders is high, New York-based S&P said.

Eighteen notches, count 'em, eighteen.

It's as if you thought you were loaning money to the Swiss, and instead found that you'd bought bonds from Uruguay or Turkmenistan!

Hurray for the lawyers!

Saturday, November 10, 2007

New York is "Special"

From the New York Sun: Condo Fee Defaults Surge in Manhattan.

A precipitous rise in the number of condominium owners who are defaulting on their common payments, an important indicator of future foreclosures, is being reported.

Much has been said about Manhattan's perceived real estate invincibility in the aftermath of the subprime meltdown, but lawyers representing dozens of condominium boards in some of the city's wealthiest neighborhoods say they are seeing these default cases increase as much as 25% this year.

Let's review the situation one more time.

While the desire to live in Manhattan/San Francisco/Paris/Rome is infinite, the means to do so are decidedly not.

Are we clear on this concept?

And just for those who think everyone in Manhattan is "rich", the median income is $50K. Just Manhattan, not the five boroughs; just the frakkin' island; and that's familial income, not individual income.

There seems to be one more argument made. The Europeans/Arabs/Chinese will buy the property now that the dollar is sinking.

It doesn't matter.

What matters is whether or not the local incomes support the rent. If they don't, it doesn't matter what you paid for the condo. You won't be able to rent it out for anywhere near the carrying costs, and if you can't rent it out for the carrying costs, you overpaid. The END.

This actually brings us to an old joke of how "economists know the price of everything but the value of nothing".

This is an argument about valuation not price, and the valuation depends on rent, and rents depend on local incomes. The price may appear cheap denominated in euros/dinar/remnimbi but the value, alas, is quite decidedly not.

Then there's the "they'll just raise the rent" or the "rents just go up" argument.

The landlords can "demand" any rent they like but the question is how are they going to get it if the local economy doesn't support it? It's like the scene in Austin Powers where she states her name as "Ivana Hump-a-lot", and he replies, "and I wanna toilet made out of solid gold, babeee, but it's just not in the cards, now is it?"

Are we really clear about this concept as well?

At this point in time, usually, there is a final fallback argument. It's a hedge against inflation. Fine, but why would you buy a depreciating asset as a hedge? Just buy gold/oil/non-agricultural commodities if you're so worried.

Why is this absurdly simple argument so hard for people to understand?

A precipitous rise in the number of condominium owners who are defaulting on their common payments, an important indicator of future foreclosures, is being reported.

Much has been said about Manhattan's perceived real estate invincibility in the aftermath of the subprime meltdown, but lawyers representing dozens of condominium boards in some of the city's wealthiest neighborhoods say they are seeing these default cases increase as much as 25% this year.

Let's review the situation one more time.

While the desire to live in Manhattan/San Francisco/Paris/Rome is infinite, the means to do so are decidedly not.

Are we clear on this concept?

And just for those who think everyone in Manhattan is "rich", the median income is $50K. Just Manhattan, not the five boroughs; just the frakkin' island; and that's familial income, not individual income.

There seems to be one more argument made. The Europeans/Arabs/Chinese will buy the property now that the dollar is sinking.

It doesn't matter.

What matters is whether or not the local incomes support the rent. If they don't, it doesn't matter what you paid for the condo. You won't be able to rent it out for anywhere near the carrying costs, and if you can't rent it out for the carrying costs, you overpaid. The END.

This actually brings us to an old joke of how "economists know the price of everything but the value of nothing".

This is an argument about valuation not price, and the valuation depends on rent, and rents depend on local incomes. The price may appear cheap denominated in euros/dinar/remnimbi but the value, alas, is quite decidedly not.

Then there's the "they'll just raise the rent" or the "rents just go up" argument.

The landlords can "demand" any rent they like but the question is how are they going to get it if the local economy doesn't support it? It's like the scene in Austin Powers where she states her name as "Ivana Hump-a-lot", and he replies, "and I wanna toilet made out of solid gold, babeee, but it's just not in the cards, now is it?"

Are we really clear about this concept as well?

At this point in time, usually, there is a final fallback argument. It's a hedge against inflation. Fine, but why would you buy a depreciating asset as a hedge? Just buy gold/oil/non-agricultural commodities if you're so worried.

Why is this absurdly simple argument so hard for people to understand?

Thursday, November 01, 2007

Rolling a Fatty!

From the Wall Street Journal: Bear CEO's Handling

Of Crisis Raises Issues.

A crisis at Bear Stearns Cos. this summer came to a head in July. Two Bear hedge funds were hemorrhaging value. Investors were clamoring to get their money back. Lenders to the funds were demanding more collateral. Eventually, both funds collapsed.

During 10 critical days of this crisis -- one of the worst in the securities firm's 84-year history -- Bear's chief executive wasn't near his Wall Street office. James Cayne was playing in a bridge tournament in Nashville, Tenn., without a cellphone or an email device.

Eh? This is not really a problem. That's what deputies are for. Would they have made the same fuss if he was having his appendix out?

After a day of bridge at a Doubletree hotel in Memphis, in 2004, Mr. Cayne invited a fellow player and a woman to smoke pot with him, according to someone who was there, and led the two to a lobby men's room where he intended to light up. The other player declined, says the person who was there, but the woman followed Mr. Cayne inside and shared a joint, to the amusement of a passerby.

Oooh! When times are troubling, you gotta "unwind" somehow.

Most of Wall St. does alcohol. Jimmy Cayne prefers Humboldt County's finest!

"Asked more generally whether he smoked pot during bridge tournaments or on other occasions, Mr. Cayne said he would respond only "to a specific allegation," not to general questions.

Now that's being "blunt" about it!

Of Crisis Raises Issues.

A crisis at Bear Stearns Cos. this summer came to a head in July. Two Bear hedge funds were hemorrhaging value. Investors were clamoring to get their money back. Lenders to the funds were demanding more collateral. Eventually, both funds collapsed.

During 10 critical days of this crisis -- one of the worst in the securities firm's 84-year history -- Bear's chief executive wasn't near his Wall Street office. James Cayne was playing in a bridge tournament in Nashville, Tenn., without a cellphone or an email device.

Eh? This is not really a problem. That's what deputies are for. Would they have made the same fuss if he was having his appendix out?

After a day of bridge at a Doubletree hotel in Memphis, in 2004, Mr. Cayne invited a fellow player and a woman to smoke pot with him, according to someone who was there, and led the two to a lobby men's room where he intended to light up. The other player declined, says the person who was there, but the woman followed Mr. Cayne inside and shared a joint, to the amusement of a passerby.

Oooh! When times are troubling, you gotta "unwind" somehow.

Most of Wall St. does alcohol. Jimmy Cayne prefers Humboldt County's finest!

"Asked more generally whether he smoked pot during bridge tournaments or on other occasions, Mr. Cayne said he would respond only "to a specific allegation," not to general questions.

Now that's being "blunt" about it!

Monday, October 29, 2007

The Human Toll

From the Houston Chronicle: Lengthy standoff ends in Spring with man's suicide.

A 12-hour standoff ended this morning with a north Houston man lobbing Molotov cocktails at Houston Police before taking his own life rather than vacate a home he'd lost to foreclosure.

James Hahn, a chemist, had told police he would not be taken from the home alive, said Capt. Bruce Williams, an HPD spokesman.

A 12-hour standoff ended this morning with a north Houston man lobbing Molotov cocktails at Houston Police before taking his own life rather than vacate a home he'd lost to foreclosure.

James Hahn, a chemist, had told police he would not be taken from the home alive, said Capt. Bruce Williams, an HPD spokesman.

Friday, October 26, 2007

Jingle Mail

Fear Factor

Modern Fairy Tale

From the Financial Times: Buffett cautious on $75bn 'Superfund'.

Warren Buffett said on Thursday, “One of the lessons that investors seem to have to learn over and over again, and will again in the future, is that not only can you not turn a toad into a prince by kissing it, but you cannot turn a toad into a prince by repackaging it."

Oh. Mr. Buffett! I could just kiss you for that delightful metaphor.

Warren Buffett said on Thursday, “One of the lessons that investors seem to have to learn over and over again, and will again in the future, is that not only can you not turn a toad into a prince by kissing it, but you cannot turn a toad into a prince by repackaging it."

Oh. Mr. Buffett! I could just kiss you for that delightful metaphor.

Thursday, October 25, 2007

The Non-Subprime Situation

Asinine Administration

From CBS Marketwatch, we have Merrill Lynch write-down 'positive:' White House economist.

The announcement by Merrill Lynch that it is taking a $8 billion write-down of mortgage assets is a "positive sign," said Edward Lazear, the White House chief economist on Wednesday. "I actually view the announcement by companies like Merrill Lynch as positive signs because you want this stuff to be recognized," Lazear said in an interview on CNBC. Lazear said the announcement might speed the return of normalcy to credit markets.

Well, it "might" do anything. It might make the administration do a turnaround in the Iraq war too but I wouldn't hold my breath.

Just let's write out that loss again just in case we were unclear on the concept:

-8,000,000,000

Losses for everyone, says I!

The announcement by Merrill Lynch that it is taking a $8 billion write-down of mortgage assets is a "positive sign," said Edward Lazear, the White House chief economist on Wednesday. "I actually view the announcement by companies like Merrill Lynch as positive signs because you want this stuff to be recognized," Lazear said in an interview on CNBC. Lazear said the announcement might speed the return of normalcy to credit markets.

Well, it "might" do anything. It might make the administration do a turnaround in the Iraq war too but I wouldn't hold my breath.

Just let's write out that loss again just in case we were unclear on the concept:

Losses for everyone, says I!

Wednesday, October 24, 2007

The Oldest Fallacy in Economics

From CBS Marketwatch, we have Could Calif. fires draw a line under housing crash?

Economists have noted the perverse reality that in the wake of disasters, re-construction spending helps the economy, even as people are still struggling to recover from their personal losses.