From the Times Online in Pennsylvania, we have Kristen Garrett writing about Home sales in county sputter.

When Lisa Kusko put her house up for sale last year, she never dreamed she would still own it more than a year later.

"I had no idea at all it would take this long to sell. I knew it wouldn't be instant. ... I just didn't think I would own it at this time, this year," Kusko said.

The decline in sales is something Sally Heimbrook, a real estate agent with Prudential in Beaver, knows all too well.

"We're pretty much seeing a pretty down market, and it's difficult to keep saying it because we don't want to discourage people," Heimbrook said. "But there are many, many, many more houses out there than there are buyers."

Denial, right before anger, bargaining, depression, and capitulance.

O, Great Pumpkin, where are you?

Tuesday, October 31, 2006

Monday, October 30, 2006

Wake up and smell the coffins!

From the St. Petersburg Times in Florida, we have: Some temptations for wavering buyers.

Here are the latest attempts by builders, in these slow times on the housing front, to persuade nervous buyers to sign a contract now.

If you sell at a loss, we'll make up the difference.

Hannah Bartoletta Homes makes this offer to buyers who resell their homes: If the final selling price is less than the original home price, Hannah Bartoletta will pay the sellers the difference between the two: up to 10 percent of the original price or $100,000, whichever is lower.

The offer is good only for owner-occupants who have lived in the house at least 18 months, and there are some other time limits and restrictions.

I think we can make three safe conclusions from this absurd offer:

Prices are definitely going down, otherwise the builder would not have made this ridiculous offer. Why not just cut the price by 10%? (Because they know that that's not going to make the inventory move.)

The builders think that prices are going down more than 10% in 18 months. That's why you have the 10% guarantee, and 18 month clause. Trying to get the last suckers in.

If Hannah Homes goes bankrupt in less than 18 months, you won't be getting a single fucking penny. It's called counterparty risk, sweethearts!

Go on, suckers! You can be an FB too!

Here are the latest attempts by builders, in these slow times on the housing front, to persuade nervous buyers to sign a contract now.

If you sell at a loss, we'll make up the difference.

Hannah Bartoletta Homes makes this offer to buyers who resell their homes: If the final selling price is less than the original home price, Hannah Bartoletta will pay the sellers the difference between the two: up to 10 percent of the original price or $100,000, whichever is lower.

The offer is good only for owner-occupants who have lived in the house at least 18 months, and there are some other time limits and restrictions.

I think we can make three safe conclusions from this absurd offer:

Go on, suckers! You can be an FB too!

Friday, October 27, 2006

Economists say the darndest things!

From the Wellesley Townsman, we have Anne-Marie Smolski talking about Sales of Mass. homes continue to drop.

According to Wellesley resident Karl Case, a nationally known real estate expert who teaches economics at Wellesley College, the decline in demand is being matched by seller resistance, and the sellers are holding out for what they think the property is worth. Furthermore, he said, the market is close to becoming illiquid, that is, properties are just not trading hands like they were.

I have news for you, bubba!

Housing (along with art, collectibles, etc.) is the ultimate illiquid market. Always has been, always will be.

An asset is said to be liquid based on how fast it can be converted into cash (or cash equivalents.) This is the "textbook" definition.

By this measure, stocks, bonds, futures, etc. are quite liquid because you can easily sell them on the market.

Let us understand why they can be sold quickly, and the rest of the argument will be utterly obvious.

The first and most important point is that they are fungible. One common share of Microsoft is the same as any other common share of Microsoft. Secondly, there's an actively traded market so you can easily determine the current price of Microsoft. Lastly, if you want to sell your shares of Microsoft, since there's no God-given right that a buyer must exist, you need a mechanism to trade it. Enter the "market-maker" who will be happy to take the shares off your hand (for a premium, of course!)

It is these market-makers that provide liquidity to the market. (And let me state that even in these so-called liquid markets, liquidity can dry up quickly if no market-maker is willing to take something off your hand. In short, liquidity is a dynamic thing not some static thing that exists independent of the object.)

Compare that to housing : totally non-fungible (each house is unique,) no mark-to-market mechanism, and definitely no market-makers. (Same goes for a Van Gogh painting, or the first edition of James Joyce's "Ulysses" -- although there are market-makers for the latter.)

Also, it should be noted that providing liquidity is a function of the price level. At a low enough price, everything becomes liquid. I will happily take any Van Gogh painting anywhere in the world, sight unseen, and pay for shipping and insurance for under $10,000.

Economists have a long history of saying stupid things, or blaming bad events on the lack of liquidity. "If only liquidity existed, things would not be thus", etc. etc.

I have news for these economists.

Market-makers exist to make money. They will not take on positions that they are likely to lose money on. Boom! That's why the liquidity spigot can be shut off at a moment's notice.

As a trader in the real world, this abrupt shutting off of liquidity is something that we definitely take into account in our models.

Mr. Case is a famous economist but ignorant of the real world to the point of spewing garbage.

According to Wellesley resident Karl Case, a nationally known real estate expert who teaches economics at Wellesley College, the decline in demand is being matched by seller resistance, and the sellers are holding out for what they think the property is worth. Furthermore, he said, the market is close to becoming illiquid, that is, properties are just not trading hands like they were.

I have news for you, bubba!

Housing (along with art, collectibles, etc.) is the ultimate illiquid market. Always has been, always will be.

An asset is said to be liquid based on how fast it can be converted into cash (or cash equivalents.) This is the "textbook" definition.

By this measure, stocks, bonds, futures, etc. are quite liquid because you can easily sell them on the market.

Let us understand why they can be sold quickly, and the rest of the argument will be utterly obvious.

The first and most important point is that they are fungible. One common share of Microsoft is the same as any other common share of Microsoft. Secondly, there's an actively traded market so you can easily determine the current price of Microsoft. Lastly, if you want to sell your shares of Microsoft, since there's no God-given right that a buyer must exist, you need a mechanism to trade it. Enter the "market-maker" who will be happy to take the shares off your hand (for a premium, of course!)

It is these market-makers that provide liquidity to the market. (And let me state that even in these so-called liquid markets, liquidity can dry up quickly if no market-maker is willing to take something off your hand. In short, liquidity is a dynamic thing not some static thing that exists independent of the object.)

Compare that to housing : totally non-fungible (each house is unique,) no mark-to-market mechanism, and definitely no market-makers. (Same goes for a Van Gogh painting, or the first edition of James Joyce's "Ulysses" -- although there are market-makers for the latter.)

Also, it should be noted that providing liquidity is a function of the price level. At a low enough price, everything becomes liquid. I will happily take any Van Gogh painting anywhere in the world, sight unseen, and pay for shipping and insurance for under $10,000.

Economists have a long history of saying stupid things, or blaming bad events on the lack of liquidity. "If only liquidity existed, things would not be thus", etc. etc.

I have news for these economists.

Market-makers exist to make money. They will not take on positions that they are likely to lose money on. Boom! That's why the liquidity spigot can be shut off at a moment's notice.

As a trader in the real world, this abrupt shutting off of liquidity is something that we definitely take into account in our models.

Mr. Case is a famous economist but ignorant of the real world to the point of spewing garbage.

Thursday, October 26, 2006

Smorgasbord of Stupidity

From America's daily paper, USA Today, we have Noelle Knox giving examples of lessons learnt in the School of Hard Knocks: Sellers sing the blues as price drop sets record.

In 2004, Derderian bought a house in Las Vegas as an investment for $281,000. He found tenants, but he kicked them out after 10 months because their rent was always late.

He listed the house in the summer for $305,000. Having owned real estate only during boom years, he assumed it would sell in about a week. After a month, he cut the price to $289,900. Another week went by. He offered to pay nearly $9,000 toward a buyer's closing costs.

Then along came Johnson, a 38-year-old truck driver, who snapped up the house and boasts, "I got a great deal."

Derderian, meantime, lost about $25,000 from paying the mortgage on an empty home.

Oopsie! It's called carrying costs, sweetheart!

That's what's hurting Bryan Rauch. In January, he bought a home in Anthem, Ariz., where Pulte Homes is offering a slew of incentives, including advice from re-sale experts to help buyers fix up and sell their current homes.

"The plan was to renovate it and flip it," says Rauch, 37, a nurse-turned-real estate-investor.

Nurse turned real-estate investor. How can it not end badly?

He put the home back on the market in February, at $284,000, then lowered the price repeatedly until he hit $270,000. Still no buyers. After six months, he rented it out at a $500-a-month loss.

"The problem is the builder is giving away homes," Rauch says. "Properties like this are now selling for the low $200s."

Ummm, no, douchebag.

The builder is not "giving away" homes. He's fucking you over. He can cut prices deeply, and still make a profit. And if you think he gives a crap about you, you're gonna learn a serious lesson.

But Rauch needs to cut his losses. So he's putting the home back on the market at $260,000 and crossing his fingers like a lot of other sellers around the country.

Yep, "faith-based" initiatives. That's definitely what makes this country so great.

Wow, it's raining idiots out there. I'm having trouble keeping up!

In 2004, Derderian bought a house in Las Vegas as an investment for $281,000. He found tenants, but he kicked them out after 10 months because their rent was always late.

He listed the house in the summer for $305,000. Having owned real estate only during boom years, he assumed it would sell in about a week. After a month, he cut the price to $289,900. Another week went by. He offered to pay nearly $9,000 toward a buyer's closing costs.

Then along came Johnson, a 38-year-old truck driver, who snapped up the house and boasts, "I got a great deal."

Derderian, meantime, lost about $25,000 from paying the mortgage on an empty home.

Oopsie! It's called carrying costs, sweetheart!

That's what's hurting Bryan Rauch. In January, he bought a home in Anthem, Ariz., where Pulte Homes is offering a slew of incentives, including advice from re-sale experts to help buyers fix up and sell their current homes.

"The plan was to renovate it and flip it," says Rauch, 37, a nurse-turned-real estate-investor.

Nurse turned real-estate investor. How can it not end badly?

He put the home back on the market in February, at $284,000, then lowered the price repeatedly until he hit $270,000. Still no buyers. After six months, he rented it out at a $500-a-month loss.

"The problem is the builder is giving away homes," Rauch says. "Properties like this are now selling for the low $200s."

Ummm, no, douchebag.

The builder is not "giving away" homes. He's fucking you over. He can cut prices deeply, and still make a profit. And if you think he gives a crap about you, you're gonna learn a serious lesson.

But Rauch needs to cut his losses. So he's putting the home back on the market at $260,000 and crossing his fingers like a lot of other sellers around the country.

Yep, "faith-based" initiatives. That's definitely what makes this country so great.

Wow, it's raining idiots out there. I'm having trouble keeping up!

I know a genius when I see one

We've met Kirsten Downey before. She's the unsung financial luminary writing for the Washington Post.

She has decided to give us some more of her pearls of wisdom in A Record Drop In Home Prices.

One reason prices are dropping is that sellers are having a harder time finding buyers.

What did I tell you? She's a fucking financial genius!

I mean look at the sheer uncanny brilliance in that comment. What insight into finance! Why, oh why is the Economics community neglecting to laud her with laurels?

Mine eyes have seen the glory!

She has decided to give us some more of her pearls of wisdom in A Record Drop In Home Prices.

One reason prices are dropping is that sellers are having a harder time finding buyers.

What did I tell you? She's a fucking financial genius!

I mean look at the sheer uncanny brilliance in that comment. What insight into finance! Why, oh why is the Economics community neglecting to laud her with laurels?

Mine eyes have seen the glory!

Always Watch the Inventory

More news from Florida from the Palm Beach Post: Prices, sales continue downward spiral.

The slowdown has caused an astounding 49-month supply of existing homes for sale in Palm Beach County, Regional Multiple Listing Service records show.

"The market is not in balance, and as long as that is the case, you will continue to see reductions in price," said Homekeys.net President Manuel Iraola. "Have we reached the bottom? Probably not, but we are getting closer. And most importantly, the descent has been relatively soft."

49 months of inventory? That's not a slowdown, that's a fucking disaster!

And "we are getting closer" to the bottom? Hahahahahaahahah. When you have roughly 3-6 months of inventory, that's when you'll be at the bottom, Bumblejack!

I hope my readers haven't forgetten what Motoko Rich, the dumb bimbo from the New York Times had to say: "South Florida is working off of a totally new economic model than any of us have ever experienced in the past.".

I really really love that quote!

The slowdown has caused an astounding 49-month supply of existing homes for sale in Palm Beach County, Regional Multiple Listing Service records show.

"The market is not in balance, and as long as that is the case, you will continue to see reductions in price," said Homekeys.net President Manuel Iraola. "Have we reached the bottom? Probably not, but we are getting closer. And most importantly, the descent has been relatively soft."

49 months of inventory? That's not a slowdown, that's a fucking disaster!

And "we are getting closer" to the bottom? Hahahahahaahahah. When you have roughly 3-6 months of inventory, that's when you'll be at the bottom, Bumblejack!

I hope my readers haven't forgetten what Motoko Rich, the dumb bimbo from the New York Times had to say: "South Florida is working off of a totally new economic model than any of us have ever experienced in the past.".

I really really love that quote!

Tarte Tatin : The Principle of Inversion

Jeff Collins from the OC Register writes about Auctions help sellers move on.

The Norris Group, founded by Riverside real estate investor and forecaster Bruce Norris, is launching a home auction business Nov. 19 at a Cal Poly Pomona auditorium, hawking 19 vacant, investor-owned homes.

"These are investors who are in strong positions, and they think things are getting worse, and they'd rather come to an end sooner rather than later," explained Norris' son, Greg, a project manager for the group. "People are getting to the point where they cannot afford to hold on to properties anymore."

If they "cannot afford to hold on", then they're not in a "strong position", are they now?

Weak is strong, and down is up, and round and round and round we go...

The Norris Group, founded by Riverside real estate investor and forecaster Bruce Norris, is launching a home auction business Nov. 19 at a Cal Poly Pomona auditorium, hawking 19 vacant, investor-owned homes.

"These are investors who are in strong positions, and they think things are getting worse, and they'd rather come to an end sooner rather than later," explained Norris' son, Greg, a project manager for the group. "People are getting to the point where they cannot afford to hold on to properties anymore."

If they "cannot afford to hold on", then they're not in a "strong position", are they now?

Weak is strong, and down is up, and round and round and round we go...

Wednesday, October 25, 2006

The Law of Unintended Consequences

From the Miami Herald, we have Beatrice A. Garcia reporting on Citizens insurance to drop some properties.

The state-run insurance pool is getting ready to move second homes, vacation homes and most investment properties off its books.

If owners of non-homestead properties can't find coverage from another insurer, they can stay with Citizens. However, they will be charged a 25 percent surcharge.

Let's see if we can analyze what the consequences of this policy are likely to be.

Firstly, let's talk about whether the government should act as an insurer of last resort. By law, Citizen's must charge above the market rate. (This means that every insurer will dump their "crap" onto the government. Wouldn't you?)

Also, that means that everyone who gets dumped will see massive increases in the rates for coverage.

The government has decided that second homes which can't get coverage will be charged a 25% surcharge over the going rate. If they can't afford it, they will sell their property.

Now let's ask the important question : who is likely to own a second home?

The answer : either rich people, or speculators.

The former didn't get rich by pissing money away, and the latter are notoriously skittish. Both are likely to cut their losses, and run. Effectively, this policy puts a cap on the price of houses in Florida, and even worse, causes people to want to sell their houses (putting severe downward pressure on what is already the most over-inflated bubble in history.)

We've been here before.

Florida had a massive bubble in 1926. Prices didn't recover in inflation-adjusted terms till the mid-80's. (Yep! you read that right.)

Lastly, if you don't get insurance coverage in hurricane-prone Florida, you're not very likely to buy a vacation home there. This is going to fuck up Florida's "business model" completely.

Do you believe that the politicians thought through these "unintended consequences"?

If so, I have a bridge in New York I want to sell to you!

The state-run insurance pool is getting ready to move second homes, vacation homes and most investment properties off its books.

If owners of non-homestead properties can't find coverage from another insurer, they can stay with Citizens. However, they will be charged a 25 percent surcharge.

Let's see if we can analyze what the consequences of this policy are likely to be.

Firstly, let's talk about whether the government should act as an insurer of last resort. By law, Citizen's must charge above the market rate. (This means that every insurer will dump their "crap" onto the government. Wouldn't you?)

Also, that means that everyone who gets dumped will see massive increases in the rates for coverage.

The government has decided that second homes which can't get coverage will be charged a 25% surcharge over the going rate. If they can't afford it, they will sell their property.

Now let's ask the important question : who is likely to own a second home?

The answer : either rich people, or speculators.

The former didn't get rich by pissing money away, and the latter are notoriously skittish. Both are likely to cut their losses, and run. Effectively, this policy puts a cap on the price of houses in Florida, and even worse, causes people to want to sell their houses (putting severe downward pressure on what is already the most over-inflated bubble in history.)

We've been here before.

Florida had a massive bubble in 1926. Prices didn't recover in inflation-adjusted terms till the mid-80's. (Yep! you read that right.)

Lastly, if you don't get insurance coverage in hurricane-prone Florida, you're not very likely to buy a vacation home there. This is going to fuck up Florida's "business model" completely.

Do you believe that the politicians thought through these "unintended consequences"?

If so, I have a bridge in New York I want to sell to you!

Fauq-uieah

From the Fauquier Times Democrat, we have Centex Abandons Arrington.

In a two-page letter dated Oct. 10, Centex Homes Division president Robert K. Davis notified Mayor George Fitch that the Dallas-based company "will not move forward and complete the purchase" of about 385 acres for a gated subdivision on U.S. 29 at the town's southwestern edge.

Centex wanted to build 298 single-family homes, which would have started at $900,000 apiece, according to the company.

The senior citizens-only project would have protected 200 or so acres from further development and put $23.2 million in Centex cash in government coffers.

298 houses in the middle of Virginia starting at $900K for senior citizens?

How many retired people who can afford $900K are willing to live in a place with no redeeming features?

Which dumbass originally conceived this project?

In a two-page letter dated Oct. 10, Centex Homes Division president Robert K. Davis notified Mayor George Fitch that the Dallas-based company "will not move forward and complete the purchase" of about 385 acres for a gated subdivision on U.S. 29 at the town's southwestern edge.

Centex wanted to build 298 single-family homes, which would have started at $900,000 apiece, according to the company.

The senior citizens-only project would have protected 200 or so acres from further development and put $23.2 million in Centex cash in government coffers.

298 houses in the middle of Virginia starting at $900K for senior citizens?

How many retired people who can afford $900K are willing to live in a place with no redeeming features?

Which dumbass originally conceived this project?

Caveat emptor

From CNN's "Business 2.0" section, we have Top 10 cities: Where to Buy Now.

The interstate highway system bypasses it, and the runway at the local airport isn't long enough to support anything beyond regional jets.

"Panama City is an economy waiting to break out," says Steven Cochrane, chief regional economist for Moody's Economy.com. Other factors increasing demand: Property prices are still low by Florida standards, and the local market has already absorbed a price correction after peaking last year.

Janet Roan, a Century 21 agent in Panama City, notes that two-bedroom beachfront condos are going for as little as $330,000 - down by more than $100,000 from 2005.

CAUTION: Local politicians, notoriously cozy with builders, have green-lighted several master-plan communities for future development. If supply gets out of hand, prices will stall.

Wow! Prices have already dropped by roughly 25% (how's that for a stall?), politicians are "cozy" with builders, there's no connectivity by road or air, the per-capita income will barely rise from $31K to $40K by 2011, but the economy is "waiting to break out"?

I think it's going to be "waiting" a long time!

The interstate highway system bypasses it, and the runway at the local airport isn't long enough to support anything beyond regional jets.

"Panama City is an economy waiting to break out," says Steven Cochrane, chief regional economist for Moody's Economy.com. Other factors increasing demand: Property prices are still low by Florida standards, and the local market has already absorbed a price correction after peaking last year.

Janet Roan, a Century 21 agent in Panama City, notes that two-bedroom beachfront condos are going for as little as $330,000 - down by more than $100,000 from 2005.

CAUTION: Local politicians, notoriously cozy with builders, have green-lighted several master-plan communities for future development. If supply gets out of hand, prices will stall.

Wow! Prices have already dropped by roughly 25% (how's that for a stall?), politicians are "cozy" with builders, there's no connectivity by road or air, the per-capita income will barely rise from $31K to $40K by 2011, but the economy is "waiting to break out"?

I think it's going to be "waiting" a long time!

Tuesday, October 24, 2006

Of traitors and turncoats

From the Southwest Florida News Press, we have Pedro Morales writing about Classes can help workers buy new home.

A banker is offering financial literacy classes to a work force it hopes will take advantage of a new affordable housing community in Naples.

"Nobody has the patience to educate workerbees on how they can be financed," said Kelly Capolino, a Realtor with Coldwell Banker Real Estate. "We want to teach them, don't go and buy the new truck now, buy the home first."

A banker is offering lessons in financial responsibility? A banker?!?

Hahahahahhahah! He's a traitor to the profession.

Bankers make their money by loaning money to people not by having them be "financially responsible".

What's next? Hookers in Las Vegas offering classes on celibacy?

A banker is offering financial literacy classes to a work force it hopes will take advantage of a new affordable housing community in Naples.

"Nobody has the patience to educate workerbees on how they can be financed," said Kelly Capolino, a Realtor with Coldwell Banker Real Estate. "We want to teach them, don't go and buy the new truck now, buy the home first."

A banker is offering lessons in financial responsibility? A banker?!?

Hahahahahhahah! He's a traitor to the profession.

Bankers make their money by loaning money to people not by having them be "financially responsible".

What's next? Hookers in Las Vegas offering classes on celibacy?

Saturday, October 21, 2006

Bad statistics meets worse journalism

From the OC Register, we have Jonathan Lansner talking about Novel mortgages blamed.

Cagan tracked everything including purchase prices, kinds of loans used and fresh valuations of homes. Then he estimated how many owners will get into deep trouble as their monthly payments increase when they have little or no equity left in their home.

Yes, Cagan sees 18,601 O.C. mortgages going bad through 2011.

18,601 exactly? Not 18,602, or 18,603? Heaven forbid, it should be 18,599. Oh, the horror!

And a forecast out to 2011, eh? That's pretty gutsy. Cagan is a wondrous beacon of light boldly looking out into the mists of time.

Since I do stuff like this for a living, I should explain. Economic analysis (when done well) generally reveals a range of possibilities (a distribution, formally.) While, I can talk about the most likely outcome (mean or median, whatever is most appropriate), the chances of hitting that mean exactly are about as likely as a politician telling the truth. Which is to say, not a fucking chance in hell!

However, newspaper reporting can't deal with such subtleties as a range of outcomes. They want to know crude things like, "will it go up, or will it go down?", and I would probably answer, "That depends on whether you're taking Viagra or not!" (but that's why they don't interview me.)

Secondly, most models have an error associated with them. The error compounds geometrically as you iterate the model (which is to say the model becomes pretty darn useless after a few iterations.) Our amateur statistician has fallen into the above trap by projecting out the model for 5 years. I've even seen professors of statistics from famous schools (which shall remain unnamed) fall into the above trap so it seems to be an endemic arrogance of the profession.

Lastly, all models (particularly economic) are conceived with certain assumptions in mind (either overtly or implicitly.) However, events that are outside these assumptions can radically alter the distribution, and the outcome (the "fat tail" phenomenon.) How many airline profit-projection models took into account the possibility of two planes crashing into two tall towers?

You can never account for all possibilities, but good traders make sure they are protected against these, as yet unknown, "fat tails".

I would like to add that in the light of the above paragraph, the following quote of Donald Rumsfeld (which he took a lot of flak for) makes perfect sense:

"Reports that say that something hasn't happened are always interesting to me, because as we know, there are known knowns; there are things we know we know. We also know there are known unknowns; that is to say we know there are some things we do not know. But there are also unknown unknowns -- the ones we don't know we don't know."

The "fat tails" are the unknown unknowns, and thinking about them is absolutely crucial to developing trading models (which is what I do for a living.)

I'm sure the journalist doesn't understand "standard errors", "geometric compounding of errors", or "fat tails". He's just a parrot repeating stuff without any clear understanding of the concepts.

As for the unknown unknowns, fuggedaboutit!

Cagan tracked everything including purchase prices, kinds of loans used and fresh valuations of homes. Then he estimated how many owners will get into deep trouble as their monthly payments increase when they have little or no equity left in their home.

Yes, Cagan sees 18,601 O.C. mortgages going bad through 2011.

18,601 exactly? Not 18,602, or 18,603? Heaven forbid, it should be 18,599. Oh, the horror!

And a forecast out to 2011, eh? That's pretty gutsy. Cagan is a wondrous beacon of light boldly looking out into the mists of time.

Since I do stuff like this for a living, I should explain. Economic analysis (when done well) generally reveals a range of possibilities (a distribution, formally.) While, I can talk about the most likely outcome (mean or median, whatever is most appropriate), the chances of hitting that mean exactly are about as likely as a politician telling the truth. Which is to say, not a fucking chance in hell!

However, newspaper reporting can't deal with such subtleties as a range of outcomes. They want to know crude things like, "will it go up, or will it go down?", and I would probably answer, "That depends on whether you're taking Viagra or not!" (but that's why they don't interview me.)

Secondly, most models have an error associated with them. The error compounds geometrically as you iterate the model (which is to say the model becomes pretty darn useless after a few iterations.) Our amateur statistician has fallen into the above trap by projecting out the model for 5 years. I've even seen professors of statistics from famous schools (which shall remain unnamed) fall into the above trap so it seems to be an endemic arrogance of the profession.

Lastly, all models (particularly economic) are conceived with certain assumptions in mind (either overtly or implicitly.) However, events that are outside these assumptions can radically alter the distribution, and the outcome (the "fat tail" phenomenon.) How many airline profit-projection models took into account the possibility of two planes crashing into two tall towers?

You can never account for all possibilities, but good traders make sure they are protected against these, as yet unknown, "fat tails".

I would like to add that in the light of the above paragraph, the following quote of Donald Rumsfeld (which he took a lot of flak for) makes perfect sense:

"Reports that say that something hasn't happened are always interesting to me, because as we know, there are known knowns; there are things we know we know. We also know there are known unknowns; that is to say we know there are some things we do not know. But there are also unknown unknowns -- the ones we don't know we don't know."

The "fat tails" are the unknown unknowns, and thinking about them is absolutely crucial to developing trading models (which is what I do for a living.)

I'm sure the journalist doesn't understand "standard errors", "geometric compounding of errors", or "fat tails". He's just a parrot repeating stuff without any clear understanding of the concepts.

As for the unknown unknowns, fuggedaboutit!

Friday, October 20, 2006

Bread and Circuses

From Bloomberg, we have World Series Fever Grips Detroit as Tigers Help Trump Job Woes.

Witness Michael Weiss, a 12-year assembly line worker at a Ford Motor Co. truck plant. While Ford's troubles deepened this year and Weiss, 37, contemplated a buyout offer, he and his wife stopped taking vacations and switched to smaller vehicles.

Yet this week the Livonia, Michigan, couple paid $137 for Detroit Tigers souvenirs as their baseball team prepared for its first World Series since 1984.

"The Tigers give us something to watch," says Kendra Weiss, 37. "They give us something to do."

The hard part will come after the Series, says Boyle.

"This year's ride has been wonderful, but it won't reverse the decline of the U.S. auto industry."

Let's not forget that 21% of Detroit is unemployed. Yep, 21% (you read that right!)

Give them bread & circuses, who needs an economy?

Witness Michael Weiss, a 12-year assembly line worker at a Ford Motor Co. truck plant. While Ford's troubles deepened this year and Weiss, 37, contemplated a buyout offer, he and his wife stopped taking vacations and switched to smaller vehicles.

Yet this week the Livonia, Michigan, couple paid $137 for Detroit Tigers souvenirs as their baseball team prepared for its first World Series since 1984.

"The Tigers give us something to watch," says Kendra Weiss, 37. "They give us something to do."

The hard part will come after the Series, says Boyle.

"This year's ride has been wonderful, but it won't reverse the decline of the U.S. auto industry."

Let's not forget that 21% of Detroit is unemployed. Yep, 21% (you read that right!)

Give them bread & circuses, who needs an economy?

Risky Business

From the AP in San Diego, we have Troops' debt a growing security concern.

Thousands of U.S. troops are being barred from overseas duty because they are so deep in debt they are considered security risks, according to an Associated Press review of military records.

Data supplied to the AP by the Navy, Marines and Air Force show that the number of clearances revoked for financial reasons rose every year between 2002 and 2005, climbing ninefold from 284 at the start of the period to 2,654 last year. Partial numbers from this year suggest the trend continues.

Do you see the problem?

Thousands of U.S. troops are being barred from overseas duty because they are so deep in debt they are considered security risks, according to an Associated Press review of military records.

Data supplied to the AP by the Navy, Marines and Air Force show that the number of clearances revoked for financial reasons rose every year between 2002 and 2005, climbing ninefold from 284 at the start of the period to 2,654 last year. Partial numbers from this year suggest the trend continues.

Do you see the problem?

Humpty Dumpty

From the Andover Townsman, we have Judy "Sleepy" Wakefield writing about: Housing: What a difference a year makes.

"It's stabilization," local realtor J.B. Doherty said of the current local real estate scene, with which he has been involved for the past 33 years.

"There's not much appreciation if you just got into the housing market," he said. "It's more like depreciation."

It's stabilization!

There's not much appreciation!

It's more like depreciation!

All within a few sentences.

"When I use a word," Humpty Dumpty said, in rather a scornful tone, "it means just what I choose it to mean -- neither more nor less."

"The question is," said Alice, "whether you can make words mean so many different things."

"The question is," said Humpty Dumpty, "which is to be master -- that's all."

"It's stabilization," local realtor J.B. Doherty said of the current local real estate scene, with which he has been involved for the past 33 years.

"There's not much appreciation if you just got into the housing market," he said. "It's more like depreciation."

It's stabilization!

There's not much appreciation!

It's more like depreciation!

All within a few sentences.

"When I use a word," Humpty Dumpty said, in rather a scornful tone, "it means just what I choose it to mean -- neither more nor less."

"The question is," said Alice, "whether you can make words mean so many different things."

"The question is," said Humpty Dumpty, "which is to be master -- that's all."

Tuesday, October 17, 2006

Rambling Realtors

From the LA Daily News, we have Alex Dobuzinskis setting new records of journalistic lows in Sales hit 8-year low for condos.

Young potential first-time buyers are waiting, perhaps expecting prices to plummet, said RE/MAX Realtor Mike Lebecki.

"They're very cautious, and I don't think they're thinking their caution through necessarily," he said. "If all their friends are being cautious and not thinking it through, then they're all doing the same thing, and they're going to continue to ... buy BMWs and pay rent."

Can somebody explain what this above rambling actually means?

I think it means that Mike Lebecki isn't making any money selling houses, and has resorted to smoking Meth.

And what's the problem with being a "Beemer owning loser renter"? Sounds good to me if you can afford it.

As for the journalist reporting this, well...

Young potential first-time buyers are waiting, perhaps expecting prices to plummet, said RE/MAX Realtor Mike Lebecki.

"They're very cautious, and I don't think they're thinking their caution through necessarily," he said. "If all their friends are being cautious and not thinking it through, then they're all doing the same thing, and they're going to continue to ... buy BMWs and pay rent."

Can somebody explain what this above rambling actually means?

I think it means that Mike Lebecki isn't making any money selling houses, and has resorted to smoking Meth.

And what's the problem with being a "Beemer owning loser renter"? Sounds good to me if you can afford it.

As for the journalist reporting this, well...

Monday, October 16, 2006

Quack, quack!

From the San Diego Union Tribune, we have Diane "Bimbo" Bell writing about Duck duds draw honks but no sale.

Why was Angel McCormick standing at a busy intersection dressed in a duck costume the other day?

If sign-spinning youngsters can get the attention of motorists for housing development sales, McCormick figured she could do the same for her four-bedroom house in Murrieta.

She held her “For Sale” sign while wearing the bright yellow duck outfit for nearly 11 hours over four days on various well-traveled streets near her home. It brought her lots of smiles and waves, one unappreciated hand gesture, three requests for fliers, three phone queries and one house tour by a couple who followed her home. Despite McCormick's ingenuity and a few low-ball offers, however, her house remains on the market.

She has dropped her price range to $535,000-$547,000, even though a slightly smaller home nearby sold early last month for $595,000.

Are Americans so stupid that a lame-ass duck costume will induce you to buy a half a million+ dollar house?

Don't answer that question. Thanks!

Why was Angel McCormick standing at a busy intersection dressed in a duck costume the other day?

If sign-spinning youngsters can get the attention of motorists for housing development sales, McCormick figured she could do the same for her four-bedroom house in Murrieta.

She held her “For Sale” sign while wearing the bright yellow duck outfit for nearly 11 hours over four days on various well-traveled streets near her home. It brought her lots of smiles and waves, one unappreciated hand gesture, three requests for fliers, three phone queries and one house tour by a couple who followed her home. Despite McCormick's ingenuity and a few low-ball offers, however, her house remains on the market.

She has dropped her price range to $535,000-$547,000, even though a slightly smaller home nearby sold early last month for $595,000.

Are Americans so stupid that a lame-ass duck costume will induce you to buy a half a million+ dollar house?

Don't answer that question. Thanks!

Friday, October 06, 2006

Read the fine print...

From the Asbury Park Press in New Jersey, we have Housing Bust.

Kara Homes Inc., one of the biggest home builders in Monmouth and Ocean counties, has filed for protection from creditors under the bankruptcy laws.

Middletown resident Gina Haspilaire and her husband, Richard, have been waiting to move into their home at Cottage Gate at Navesink in Middletown since March 2005. The home's delivery date kept being delayed, Gina Haspilaire said.

Now the couple want Kara to return their deposit, which is about $125,000, she said. The couple used money saved for their son's college education to pay for the downpayment, figuring they would replace it with money from the sale of their existing home.

"When we did this, my son had two more years to finish high school," Haspilaire said. "Now we can't sell our house, and they won't give us back the money."

They don't want the house, which is completed but without a certificate of occupancy. She said she believes the contract was voided because the home wasn't delivered on time.

Wow, so much stupidity, so little time...

You gambled with your son's college fund two years before he starts?

Secondly, you can "believe" that the contract is voided but chances are it's not. Any smart builder will have builtin contingency clauses (and remember! the "crooked" builders are always smart.)

Also, that's precisely the risk in pre-construction. You takes your chances, and you pays the price.

Yep, this may be a housing bust but it's a full-blown bull market in stupidity!

Kara Homes Inc., one of the biggest home builders in Monmouth and Ocean counties, has filed for protection from creditors under the bankruptcy laws.

Middletown resident Gina Haspilaire and her husband, Richard, have been waiting to move into their home at Cottage Gate at Navesink in Middletown since March 2005. The home's delivery date kept being delayed, Gina Haspilaire said.

Now the couple want Kara to return their deposit, which is about $125,000, she said. The couple used money saved for their son's college education to pay for the downpayment, figuring they would replace it with money from the sale of their existing home.

"When we did this, my son had two more years to finish high school," Haspilaire said. "Now we can't sell our house, and they won't give us back the money."

They don't want the house, which is completed but without a certificate of occupancy. She said she believes the contract was voided because the home wasn't delivered on time.

Wow, so much stupidity, so little time...

You gambled with your son's college fund two years before he starts?

Secondly, you can "believe" that the contract is voided but chances are it's not. Any smart builder will have builtin contingency clauses (and remember! the "crooked" builders are always smart.)

Also, that's precisely the risk in pre-construction. You takes your chances, and you pays the price.

Yep, this may be a housing bust but it's a full-blown bull market in stupidity!

My Mommy made me do it!

From The Capital Times in Madison, WI, we have Mike Ivey reporting on: The big chill for home sellers.

In 1996, Marc Loy and Ron Becker bought a four-bedroom, two-bath brick home near Tenney Park for $160,000 and over the past 10 years have watched its assessed value more than double.

Loy and Becker are moving to Cincinnati in January for a job commitment and have already purchased another home there. They aren't sure what to do if they can't sell their Madison home soon.

"We can't afford to pay two mortgages," said Loy.

Then, why did you get two mortgages, O Great Fucktard?

In 1996, Marc Loy and Ron Becker bought a four-bedroom, two-bath brick home near Tenney Park for $160,000 and over the past 10 years have watched its assessed value more than double.

Loy and Becker are moving to Cincinnati in January for a job commitment and have already purchased another home there. They aren't sure what to do if they can't sell their Madison home soon.

"We can't afford to pay two mortgages," said Loy.

Then, why did you get two mortgages, O Great Fucktard?

Thursday, October 05, 2006

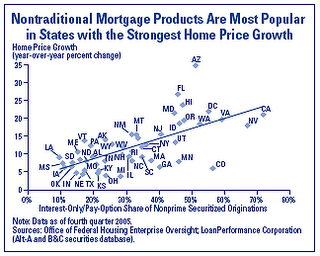

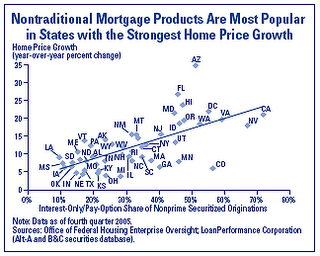

The Rise of "Non-Traditional" Loans

From the FDIC, we have a detailed report on housing.

For those not familiar with interest-only (I/O) loans, basically you're only paying the interest on the loan, not paying back part of the principal (as you would with just about any loan.)

How, you ask, is this possible?

The answer is that it's not. There is always a reset clause (say 3 years) when you have to pay back the principal in full. Needless to say, most people will not be able to so they will need to refinance into a different loan.

I/O loans make sense in very specific contexts (say you need financing because you plan to get a large payment a year from now, etc.) It makes ZERO sense for the "average" person. Basically, you're just renting from the bank except that you're on the hook if the value of the asset actually falls.

Do you see the fucking problem?

For those not familiar with interest-only (I/O) loans, basically you're only paying the interest on the loan, not paying back part of the principal (as you would with just about any loan.)

How, you ask, is this possible?

The answer is that it's not. There is always a reset clause (say 3 years) when you have to pay back the principal in full. Needless to say, most people will not be able to so they will need to refinance into a different loan.

I/O loans make sense in very specific contexts (say you need financing because you plan to get a large payment a year from now, etc.) It makes ZERO sense for the "average" person. Basically, you're just renting from the bank except that you're on the hook if the value of the asset actually falls.

Do you see the fucking problem?

Tuesday, October 03, 2006

Why did the chicken cross the road?

From the Sun Sentinel in Palm Beach, FL, we have a pair of dueling banjos, Tal Abbady and Robin Benedick singing a song about: Palm Beach County housing expenses pummel paychecks.

"I've had to tighten my belt. We don't go out much. We don't live extravagantly," said retiree Ed Fuller, 65, who bought his house west of West Palm Beach three years ago.

"At least we've got the ocean down here to look at," he added of his outings to the beach.

The retired Anheuser-Busch dispatcher has a $2,200 monthly mortgage payment, about $100 more than his monthly income. He draws from his 401(k) account to make ends meet, but knows that money will dry up before his mortgage is paid off.

Why would a retiree on a fixed income buy a house that costs more than his income?

All together now: speculation!

I have news for you, Ed.

You're an FB!

The B stands for "borrower", and you can work out the effin' F for yourself!

"I've had to tighten my belt. We don't go out much. We don't live extravagantly," said retiree Ed Fuller, 65, who bought his house west of West Palm Beach three years ago.

"At least we've got the ocean down here to look at," he added of his outings to the beach.

The retired Anheuser-Busch dispatcher has a $2,200 monthly mortgage payment, about $100 more than his monthly income. He draws from his 401(k) account to make ends meet, but knows that money will dry up before his mortgage is paid off.

Why would a retiree on a fixed income buy a house that costs more than his income?

All together now: speculation!

I have news for you, Ed.

You're an FB!

The B stands for "borrower", and you can work out the effin' F for yourself!

Can you hear yourself speaking?

From the Virginia Daily Press, we have Novelda Summers writing about: Report cites economic decline.

The slowdown in the region's economy -and particularly in the Defense Department's efforts to help military members buy homes off base - will drive push deceleration in the region's housing market. That market currently sees homes overvalued by about 20 percent - twice as overvalued as last year at this time.

That doesn't mean prices are due to fall, Koch said. It means sellers won't make as much of a profit as they might have expected, and homes will stay on the market longer. A house listed at $400,000 might fetch $350,000, or sellers might find themselves offering incentives such as closing costs.

Prices are "not due to fall", but a "house listed at $400,000 might fetch $350,000."

Illegal drugs, or stupidity? You decide.

The slowdown in the region's economy -and particularly in the Defense Department's efforts to help military members buy homes off base - will drive push deceleration in the region's housing market. That market currently sees homes overvalued by about 20 percent - twice as overvalued as last year at this time.

That doesn't mean prices are due to fall, Koch said. It means sellers won't make as much of a profit as they might have expected, and homes will stay on the market longer. A house listed at $400,000 might fetch $350,000, or sellers might find themselves offering incentives such as closing costs.

Prices are "not due to fall", but a "house listed at $400,000 might fetch $350,000."

Illegal drugs, or stupidity? You decide.

How to Fail Economics

From the "general economics reporter" of the Boston Herald, Jay Fitzgerald, we have: Gas price drop balm to housing bite.

Pump prices for a regular gallon of gas have taken a big fall in recent days and weeks, hitting an average of $2.30 this past weekend in Massachusetts, far below even the most optimistic recent projections of possible price declines, according to new AAA Southern New England data.

In August, gas prices were hovering in the $3.05 range.

Sara Johnson, an economist at Lexington’s Global Insight, a research firm, said falling fuel prices could “strengthen households’ purchasing power,” as well as encourage people to drive more to restaurants and shops.

The extra spending will help offset housing woes - but not completely, she said.

Let's say this "average family" drives a lot, and spends $200 on gas a month. How much money are they saving?

(1 - 2.30/3.05) * 200 = $49.18

A whole whoppin' $50 a month. That's $600 a year.

Yessirree, bob! That's definitely going to save the housing market.

Pump prices for a regular gallon of gas have taken a big fall in recent days and weeks, hitting an average of $2.30 this past weekend in Massachusetts, far below even the most optimistic recent projections of possible price declines, according to new AAA Southern New England data.

In August, gas prices were hovering in the $3.05 range.

Sara Johnson, an economist at Lexington’s Global Insight, a research firm, said falling fuel prices could “strengthen households’ purchasing power,” as well as encourage people to drive more to restaurants and shops.

The extra spending will help offset housing woes - but not completely, she said.

Let's say this "average family" drives a lot, and spends $200 on gas a month. How much money are they saving?

A whole whoppin' $50 a month. That's $600 a year.

Yessirree, bob! That's definitely going to save the housing market.

The Shearing of the Sheep

From the OC Register, we have Jeff Collins writing about: Housing's Hail Mary.

But after two months without a buyer, Toranto hoped to enlist a higher authority in her sales campaign, entreating St. Joseph – patron saint of home seekers – to help sell her tidy two-bedroom unit at the back of a quiet complex.

On a recent weekday morning, she dug a 6-inch hole in the brick planter next to her front door, then buried a 3-inch plastic statue of St. Joseph head-first into the dirt.

"Usually, I'm skeptical about these things," said Toranto, 71, an interior designer. "But the times we're in, the market being as slow as it is ... I figured I'd give it a try."

Doesn't the lord help those who help themselves, and lower the price, or some such?

"I believe he's the patron for all us Realtors," said Century 21 agent Lourdes Carroll of La Palma. "When I go and sell a house, I take the statue and I ask the seller to ask St. Joseph for his help. … It's great to have heavenly friends."

Isn't it ever?!?

Kathy Lopez, a Washington Mutual loan consultant, said St. Joseph helped her sell her home at the height of the housing slowdown in the mid- 1990s although she did end up taking less than she paid.

And sometimes the lord giveth less than what she paid...

Way to go, St. Joe! MISSION ACCOMPLISHED!

But after two months without a buyer, Toranto hoped to enlist a higher authority in her sales campaign, entreating St. Joseph – patron saint of home seekers – to help sell her tidy two-bedroom unit at the back of a quiet complex.

On a recent weekday morning, she dug a 6-inch hole in the brick planter next to her front door, then buried a 3-inch plastic statue of St. Joseph head-first into the dirt.

"Usually, I'm skeptical about these things," said Toranto, 71, an interior designer. "But the times we're in, the market being as slow as it is ... I figured I'd give it a try."

Doesn't the lord help those who help themselves, and lower the price, or some such?

"I believe he's the patron for all us Realtors," said Century 21 agent Lourdes Carroll of La Palma. "When I go and sell a house, I take the statue and I ask the seller to ask St. Joseph for his help. … It's great to have heavenly friends."

Isn't it ever?!?

Kathy Lopez, a Washington Mutual loan consultant, said St. Joseph helped her sell her home at the height of the housing slowdown in the mid- 1990s although she did end up taking less than she paid.

And sometimes the lord giveth less than what she paid...

Way to go, St. Joe! MISSION ACCOMPLISHED!

Sunday, October 01, 2006

The Chickens Rebel Against the Guards

From CBS Marketwatch, we have: Lenders gone wild.

Countrywide Financial, the nation's largest residential mortgage lender, argued against new rules. "Interest-only and payment option adjustable mortgages have been tested in previous economic cycles and are fundamentally sound loan products," Countrywide wrote in its official comment on the proposed guidelines. Requiring lenders to qualify borrowers on the true cost of a loan, the company said, "would tend to defeat the intended function of the loan and would significantly reduce the number of borrowers that could qualify."

See if you can read through this thoroughly Orwellian argument!

The Fed regulators have taken the proverbial punchbowl away. The tide has receded, and only now can one see who's been swimming naked (Thanks, Mr. Buffett, for that wondrous metaphor!)

After all, why should lenders worry about the "true cost of a loan"?

Need additional evidence?

Mr. Mozilo and his cronies have been dumping the shares of CFC like pimps dumping a syphilitic whore from their roster.

Countrywide Financial, the nation's largest residential mortgage lender, argued against new rules. "Interest-only and payment option adjustable mortgages have been tested in previous economic cycles and are fundamentally sound loan products," Countrywide wrote in its official comment on the proposed guidelines. Requiring lenders to qualify borrowers on the true cost of a loan, the company said, "would tend to defeat the intended function of the loan and would significantly reduce the number of borrowers that could qualify."

See if you can read through this thoroughly Orwellian argument!

The Fed regulators have taken the proverbial punchbowl away. The tide has receded, and only now can one see who's been swimming naked (Thanks, Mr. Buffett, for that wondrous metaphor!)

After all, why should lenders worry about the "true cost of a loan"?

Need additional evidence?

Mr. Mozilo and his cronies have been dumping the shares of CFC like pimps dumping a syphilitic whore from their roster.

Subscribe to:

Posts (Atom)