From the equally self-laudatory Washington Post, we have Kirstin Downey writing about: Keeping Tabs on the Joneses.

And many have noticed that the house with the lowest price often moves first.

Quick, Kirstin! You're a fucking financial genius. You need to publish this absolutely amazing insight in the Journal of Finance.

There's a Nobel just waiting for such totally novel ideas, and possibly a Pulitzer for your journalistic insight!

How do the fucking editors let such tripe get published?

Saturday, September 30, 2006

Friday, September 29, 2006

Who's guarding the chicken-house?

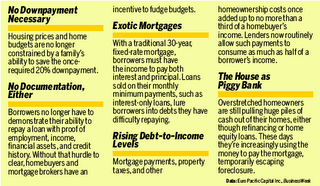

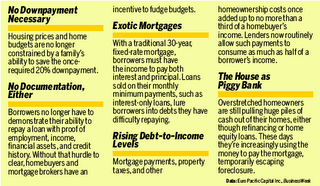

From CBS Marketwatch, we have Regulators crack down on "exotic" mortgages.

Cracking down on exotic mortgages that have exploded in popularity in recent years, U.S. regulators told banks Friday that they've got to make sure that borrowers can actually pay back the full amount of the mortgage.

Let us see : the regulators are asking the banks that they should make sure that "borrowers can actually pay back" the loan? The regulators are asking the bank?

Shouldn't the bank care? (The answer is "no".)

This is like the warnings on plastic shopping bags : "Do not put over your head. May cause suffocation".

However, the truth is that the banks no longer care, and given the rules, nor should they.

Thanks to the "miracle" of securitization, the banks no longer care whether the loan will get paid back or not. They make the vigorish, and pass the loan on to a greater fool, typically a pension fund, or better yet a foreign central bank.

If the loan defaults, the bank doesn't care. The greater fools will get hurt.

In the rare case that the bank is actually holding on to the loan, the taxpayers will bail the bank out.

So what exactly are the regulators "regulating"?

Cracking down on exotic mortgages that have exploded in popularity in recent years, U.S. regulators told banks Friday that they've got to make sure that borrowers can actually pay back the full amount of the mortgage.

Let us see : the regulators are asking the banks that they should make sure that "borrowers can actually pay back" the loan? The regulators are asking the bank?

Shouldn't the bank care? (The answer is "no".)

This is like the warnings on plastic shopping bags : "Do not put over your head. May cause suffocation".

However, the truth is that the banks no longer care, and given the rules, nor should they.

Thanks to the "miracle" of securitization, the banks no longer care whether the loan will get paid back or not. They make the vigorish, and pass the loan on to a greater fool, typically a pension fund, or better yet a foreign central bank.

If the loan defaults, the bank doesn't care. The greater fools will get hurt.

In the rare case that the bank is actually holding on to the loan, the taxpayers will bail the bank out.

So what exactly are the regulators "regulating"?

Wednesday, September 27, 2006

Let them eat, cupcakes!

From ABC News, we have Home Prices Fall, Sellers Suffer.

Just outside Los Angeles, Cindy Schwanke's family is waging an all-out battle to sell its three-bedroom home.

"We never really thought we'd have a problem selling," she said.

After seven months and three real estate agents, there was still no sale.

So Schwanke quit her job as a pastry chef to focus all her efforts on selling her house.

To make her home more appealing, she spent $25,000 improving it, and she dropped her asking price by a whopping $100,000.

"I try to bring people in. I bake cupcakes for them. I … offer them water, and I do whatever I can to make it a pleasant experience for them," she said.

So far, her cupcakes haven't done the trick.

Maybe, you're not doing "whatever you can". You need to try harder!

Three suggestions, sunshine: let them "cup" your "cake", give out "massages", or bake "pot brownies". Hubba, hubba!

Alternately, you could just lower the fucking price!

Just outside Los Angeles, Cindy Schwanke's family is waging an all-out battle to sell its three-bedroom home.

"We never really thought we'd have a problem selling," she said.

After seven months and three real estate agents, there was still no sale.

So Schwanke quit her job as a pastry chef to focus all her efforts on selling her house.

To make her home more appealing, she spent $25,000 improving it, and she dropped her asking price by a whopping $100,000.

"I try to bring people in. I bake cupcakes for them. I … offer them water, and I do whatever I can to make it a pleasant experience for them," she said.

So far, her cupcakes haven't done the trick.

Maybe, you're not doing "whatever you can". You need to try harder!

Three suggestions, sunshine: let them "cup" your "cake", give out "massages", or bake "pot brownies". Hubba, hubba!

Alternately, you could just lower the fucking price!

Tuesday, September 26, 2006

Sloppy Seconds

And one more time from the most esteemed paper in the known universe, the much-heralded, Pulitzer prize-winning, self-congratulatory New York Times, we have Jeremy Peters on a repeat of what he said yesterday: Homes Post Price Drop for August.

Home prices fell in August compared with a year earlier, the first such decline in more than a decade.

David A. Lereah, chief economist for the Realtors association, said the price drop was a taste of what the market should expect in the coming months. But he predicted that prices would probably improve next year.

“We’re in for a ride right now,” Mr. Lereah said. “This is the first of many price corrections for the remaining months of the year — for at least the next three or four months.”

Firstly, I like the use of "a decade". Lying through statistics, a true art, if ever there was one!

If they had used two decades, they would've had to reach a different conclusion that price falls do occur, and reasonably regularly at that.

Secondly, why didn't the journalist ask the "Chief Economist" of the NAR why he thought things would improve next year? I mean, if he really believes that shouldn't he be out buying these things before everyone, and sell out at a huge profit later?

But, we all know his crystal ball is lying.

How do we know?

Here's a report Mr. Liarreah made to the NAR internally : link. (Scroll down, it's the third PDF.)

(Warning: I expect the link to disappear!)

I guess when you gotta earn revenue, even the "newspaper of record" has to whore itself out!

Home prices fell in August compared with a year earlier, the first such decline in more than a decade.

David A. Lereah, chief economist for the Realtors association, said the price drop was a taste of what the market should expect in the coming months. But he predicted that prices would probably improve next year.

“We’re in for a ride right now,” Mr. Lereah said. “This is the first of many price corrections for the remaining months of the year — for at least the next three or four months.”

Firstly, I like the use of "a decade". Lying through statistics, a true art, if ever there was one!

If they had used two decades, they would've had to reach a different conclusion that price falls do occur, and reasonably regularly at that.

Secondly, why didn't the journalist ask the "Chief Economist" of the NAR why he thought things would improve next year? I mean, if he really believes that shouldn't he be out buying these things before everyone, and sell out at a huge profit later?

But, we all know his crystal ball is lying.

How do we know?

Here's a report Mr. Liarreah made to the NAR internally : link. (Scroll down, it's the third PDF.)

(Warning: I expect the link to disappear!)

I guess when you gotta earn revenue, even the "newspaper of record" has to whore itself out!

Monday, September 25, 2006

All the News That Generates Ad Revenue

From the leading newspaper of the world, the New York Times, we have Jeremy Peters reporting on: Home Prices Drop After 11-Year Ascent.

David Lereah, chief economist of the association, said he expects prices to continue to fall. “We do expect an adjustment in home prices to last several months, as we work through a buildup in the inventory of homes on the market,” he said in a written statement. “This is the price correction we’ve been expecting — with sales stabilizing, we should go back to positive price growth early next year.”

We've met this liar before. He claims that they've been expecting this "price correction"!

So why exactly did he write a book published in Feb 2006 titled Why the Real Estate Boom Will Not Bust?

Why don't these fucking journalists do their homework, and ask some tough questions to the "Chief Economist" of the NAR?

"Newspaper of record"? More like record incompetence!

David Lereah, chief economist of the association, said he expects prices to continue to fall. “We do expect an adjustment in home prices to last several months, as we work through a buildup in the inventory of homes on the market,” he said in a written statement. “This is the price correction we’ve been expecting — with sales stabilizing, we should go back to positive price growth early next year.”

We've met this liar before. He claims that they've been expecting this "price correction"!

So why exactly did he write a book published in Feb 2006 titled Why the Real Estate Boom Will Not Bust?

Why don't these fucking journalists do their homework, and ask some tough questions to the "Chief Economist" of the NAR?

"Newspaper of record"? More like record incompetence!

Sunday, September 24, 2006

The Rules of the Game

From the Chicago Tribune, we have Susan Diesenhouse reporting on Condo prices near a cliff.

Earlier this month a Chicago developer sold 150 condominiums in a two-hour lottery by discounting prices about 20 percent from what he would have asked last spring, an indication that industry observers say could signal widespread price reductions here and around the country.

For the first time in his 37 years as a developer, Nicholas S. Gouletas, chairman of Chicago-based American Invsco Corp., held a lottery to sell his condos, in this case 150 moderately priced residences in a 292-unit vintage high-rise at 182 W. Lake St. in the Loop.

Gouletas figures he still could make a 10 percent profit by cutting future carrying costs. He will avoid the expense of 2 1/2 years of mortgage interest payments, marketing, maintenance, insurance and taxes by not struggling to sell condos against the headwinds of a slowing housing market.

Now, Susan cannot be faulted for reporting the truth. But, this staff reporter has no perspective.

For the more economically challenged readers, here's how it works: the developer doesn't give a flying fuck about what price he has sold the product in the past. Only the future matters!

If he has to move inventory, he will ruthlessly slash the price (initially cutting into profits, and even taking a loss if carrying costs are involved.)

Mr. Gouletas has analyzed the situation perfectly. As for the first 142 buyers, they've just lost 20% of their value. In short, they're fucked!

(The units are fungible so we can indeed be sure that they have lost 20%.)

Wish some newspapers had the guts to tell it like it is!

Earlier this month a Chicago developer sold 150 condominiums in a two-hour lottery by discounting prices about 20 percent from what he would have asked last spring, an indication that industry observers say could signal widespread price reductions here and around the country.

For the first time in his 37 years as a developer, Nicholas S. Gouletas, chairman of Chicago-based American Invsco Corp., held a lottery to sell his condos, in this case 150 moderately priced residences in a 292-unit vintage high-rise at 182 W. Lake St. in the Loop.

Gouletas figures he still could make a 10 percent profit by cutting future carrying costs. He will avoid the expense of 2 1/2 years of mortgage interest payments, marketing, maintenance, insurance and taxes by not struggling to sell condos against the headwinds of a slowing housing market.

Now, Susan cannot be faulted for reporting the truth. But, this staff reporter has no perspective.

For the more economically challenged readers, here's how it works: the developer doesn't give a flying fuck about what price he has sold the product in the past. Only the future matters!

If he has to move inventory, he will ruthlessly slash the price (initially cutting into profits, and even taking a loss if carrying costs are involved.)

Mr. Gouletas has analyzed the situation perfectly. As for the first 142 buyers, they've just lost 20% of their value. In short, they're fucked!

(The units are fungible so we can indeed be sure that they have lost 20%.)

Wish some newspapers had the guts to tell it like it is!

The Outer Limits of Stupidity

From the much esteemed New York Times, we have Bob Tedeschi writing about It Seemed Like a Good Bet at the Time...

FOR Inga Rogers, the party ends in 38 days.

On Nov. 1, the adjustable-rate mortgage, or ARM, she took out three years ago at the spectacular rate of 3.875 percent will get considerably more expensive. Ms. Rogers, a single mother of two living in a three-bedroom ranch in suburban Boston, faces a rate increase of three percentage points, raising her monthly house payment by $300, to $1,419, and putting her at a financial crossroads.

Her choices: keep the loan and run the risk of future increases, or ditch her adjustable mortgage in favor of a more stable loan with a higher monthly payment.

Ms. Rogers, a hairstylist working 32 hours a week, will have to work more in either case. The 6.85 percent 30-year fixed-rate loan she is considering would cost $100 a month more than her higher ARM payment, but it would at least protect her from future increases that could go far higher.

“I still might not be able to make the extra money, because with my job I don’t have a set income,” she said. “So I have an adjustable salary, too. My whole life is a roller coaster.”

Firstly, why the fuck is someone with an "adjustable salary", as she so euphemistically puts it, buying a house?

Secondly, how close to the financial precipice do you have to dance where the difference of $100 a month can make or break your life? What happens if you fall ill for a month or so?

Here's the real answer: she was speculating, she probably put no money down, and has no "skin in the game", and the reporter is too stupid to ask the hard questions.

FOR Inga Rogers, the party ends in 38 days.

On Nov. 1, the adjustable-rate mortgage, or ARM, she took out three years ago at the spectacular rate of 3.875 percent will get considerably more expensive. Ms. Rogers, a single mother of two living in a three-bedroom ranch in suburban Boston, faces a rate increase of three percentage points, raising her monthly house payment by $300, to $1,419, and putting her at a financial crossroads.

Her choices: keep the loan and run the risk of future increases, or ditch her adjustable mortgage in favor of a more stable loan with a higher monthly payment.

Ms. Rogers, a hairstylist working 32 hours a week, will have to work more in either case. The 6.85 percent 30-year fixed-rate loan she is considering would cost $100 a month more than her higher ARM payment, but it would at least protect her from future increases that could go far higher.

“I still might not be able to make the extra money, because with my job I don’t have a set income,” she said. “So I have an adjustable salary, too. My whole life is a roller coaster.”

Firstly, why the fuck is someone with an "adjustable salary", as she so euphemistically puts it, buying a house?

Secondly, how close to the financial precipice do you have to dance where the difference of $100 a month can make or break your life? What happens if you fall ill for a month or so?

Here's the real answer: she was speculating, she probably put no money down, and has no "skin in the game", and the reporter is too stupid to ask the hard questions.

Friday, September 08, 2006

Scooping Yourself

I hate when I "scoop" myself.

From the Senate's website: Committee Meetings/Hearings Scheduled.

Wednesday, Sep. 13, 2006

10 a.m.

Banking, Housing, and Urban Affairs

Housing and Transportation Subcommittee

Economic Policy Subcommittee

To hold joint hearings to examine the housing bubble and its implications for the economy.

SD-538

But, but, but, I thought there was no housing bubble. Comrade Bernanke told me so...

From the Senate's website: Committee Meetings/Hearings Scheduled.

Wednesday, Sep. 13, 2006

10 a.m.

Banking, Housing, and Urban Affairs

Housing and Transportation Subcommittee

Economic Policy Subcommittee

To hold joint hearings to examine the housing bubble and its implications for the economy.

SD-538

But, but, but, I thought there was no housing bubble. Comrade Bernanke told me so...

Damning Documentation

Roughly a year ago (Oct 2005), Helicopter Ben testified in front of the Senate. Here's a link to the Washington Post reporting on that: Bernanke: There's No Housing Bubble to Go Bust.

Ben S. Bernanke does not think the national housing boom is a bubble that is about to burst, he indicated to Congress last week, just a few days before President Bush nominated him to become the next chairman of the Federal Reserve.

U.S. house prices have risen by nearly 25 percent over the past two years, noted Bernanke, currently chairman of the president's Council of Economic Advisers, in testimony to Congress's Joint Economic Committee. But these increases, he said, "largely reflect strong economic fundamentals," such as strong growth in jobs, incomes and the number of new households.

I am documenting it here because I am going to relish watching Pinocchio squirm in front of the Senate next week.

Ben S. Bernanke does not think the national housing boom is a bubble that is about to burst, he indicated to Congress last week, just a few days before President Bush nominated him to become the next chairman of the Federal Reserve.

U.S. house prices have risen by nearly 25 percent over the past two years, noted Bernanke, currently chairman of the president's Council of Economic Advisers, in testimony to Congress's Joint Economic Committee. But these increases, he said, "largely reflect strong economic fundamentals," such as strong growth in jobs, incomes and the number of new households.

I am documenting it here because I am going to relish watching Pinocchio squirm in front of the Senate next week.

Thursday, September 07, 2006

A Day Late, and a Dollar Short

From the Boston Globe, we have Kimberly Blanton reporting on: `Priced below assessment'.

In the $1 million-plus housing market in Greater Boston, sales plunged 62 percent this year, according to the listing database MLS Property Information Network. The drop is making it ``routine" for assessments to exceed asking prices in that market, said Landvest agent Terry Mailtland, causing problems for sellers whose assessments are so high that buyers perceive a big tax bill as ``an impediment to a sale."

But clients Diane and Richard Schmalensee view a slightly higher assessment on their home overlooking Chestnut Hill reservoir as a selling point. The house was put on the market in October for $2.95 million. In May, they dropped the price to $2.75 million, below the $2.84 million assessment on the 1-acre property with a three-car garage and tennis court.

"Right after we bought this, the prices began to shoot up, and we said, `Aren't we lucky,'" said Diane Schmalensee, a business consultant; her husband, Richard Schmalensee is dean of the Sloan School at Massachusetts Institute of Technology. With the market in decline, she realized perhaps "we waited a little too long" to sell.

Three points, sweetheart:

Firstly, you waited too long to try to sell it. You haven't sold it yet! And hence, your estimate of what it's worth is what we like to call a "wishing price".

What you sell it for will be the "true price", assuming you are able to sell it at all.

Secondly, prices shot up, and "Aren't we lucky?". Yep, all multi-million dollar transactions should be made on "luck" not on the basis of fundamentals. Now, all you have to do is sit back, and hope that your prospective purchaser also believes in "luck". If they start believing in fundamentals, you're fucking screwed!

Lastly, how can the Dean of the Sloan School not understand the basics of economics? This isn't Joe Six-Pack or Jane Soccer-Mom, this is the fucking dean of the Business School at MIT!

Guess, the good professor is going to have to take a lesson in the School of Hard Knocks!

In the $1 million-plus housing market in Greater Boston, sales plunged 62 percent this year, according to the listing database MLS Property Information Network. The drop is making it ``routine" for assessments to exceed asking prices in that market, said Landvest agent Terry Mailtland, causing problems for sellers whose assessments are so high that buyers perceive a big tax bill as ``an impediment to a sale."

But clients Diane and Richard Schmalensee view a slightly higher assessment on their home overlooking Chestnut Hill reservoir as a selling point. The house was put on the market in October for $2.95 million. In May, they dropped the price to $2.75 million, below the $2.84 million assessment on the 1-acre property with a three-car garage and tennis court.

"Right after we bought this, the prices began to shoot up, and we said, `Aren't we lucky,'" said Diane Schmalensee, a business consultant; her husband, Richard Schmalensee is dean of the Sloan School at Massachusetts Institute of Technology. With the market in decline, she realized perhaps "we waited a little too long" to sell.

Three points, sweetheart:

Firstly, you waited too long to try to sell it. You haven't sold it yet! And hence, your estimate of what it's worth is what we like to call a "wishing price".

What you sell it for will be the "true price", assuming you are able to sell it at all.

Secondly, prices shot up, and "Aren't we lucky?". Yep, all multi-million dollar transactions should be made on "luck" not on the basis of fundamentals. Now, all you have to do is sit back, and hope that your prospective purchaser also believes in "luck". If they start believing in fundamentals, you're fucking screwed!

Lastly, how can the Dean of the Sloan School not understand the basics of economics? This isn't Joe Six-Pack or Jane Soccer-Mom, this is the fucking dean of the Business School at MIT!

Guess, the good professor is going to have to take a lesson in the School of Hard Knocks!

Wednesday, September 06, 2006

Clap if you believe in fairies!

From the Hartford Courant, we have Rich Green reporting on: Gold Coast Not So Golden.

Beside those handcrafted stonewalls and putting green-perfect lawns that stretch for acres across lower Fairfield County, for sale signs are as common as a new Lexus.

The experts tell us not to worry about a 1980s-style real estate crash. But here at the busy intersection of Wall Street wealth and spacious stainless steel kitchens, the story is different from the rest of the state.

Home sales are slowing all over, but on the Gold Coast the market has plummeted, with sales down by nearly 20 percent through the end of June, compared with last year. There's no panic, but a lot of people are wondering.

I asked John Clapp, a business professor at the University of Connecticut, whether a collapse in Fairfield County could trigger the rest of the state.

"There certainly are some danger signs. It is possible that things will go down a lot," said Clapp, who is affiliated with the Center for Real Estate and Urban Economic Studies. "But it's hard to see a dramatic decline in prices like in the 1980s."

Shouldn't the reporter be asking, "Why is it hard?"

And don't you think that the professor who's "associated" wih the Center for Real Estate (read: shill for the NAR.) could be a just a little bit biased?

A teensy? A weensy? A soupçon?

Besides, the good professor even gets his dates wrong! In the mid-to-latish 80's, real estate had a big boom, and the big crash occurred in the very late 80's, and the pain was felt well into the mid-90's.

I guess being an academic means never having to say you're sorry!

Beside those handcrafted stonewalls and putting green-perfect lawns that stretch for acres across lower Fairfield County, for sale signs are as common as a new Lexus.

The experts tell us not to worry about a 1980s-style real estate crash. But here at the busy intersection of Wall Street wealth and spacious stainless steel kitchens, the story is different from the rest of the state.

Home sales are slowing all over, but on the Gold Coast the market has plummeted, with sales down by nearly 20 percent through the end of June, compared with last year. There's no panic, but a lot of people are wondering.

I asked John Clapp, a business professor at the University of Connecticut, whether a collapse in Fairfield County could trigger the rest of the state.

"There certainly are some danger signs. It is possible that things will go down a lot," said Clapp, who is affiliated with the Center for Real Estate and Urban Economic Studies. "But it's hard to see a dramatic decline in prices like in the 1980s."

Shouldn't the reporter be asking, "Why is it hard?"

And don't you think that the professor who's "associated" wih the Center for Real Estate (read: shill for the NAR.) could be a just a little bit biased?

A teensy? A weensy? A soupçon?

Besides, the good professor even gets his dates wrong! In the mid-to-latish 80's, real estate had a big boom, and the big crash occurred in the very late 80's, and the pain was felt well into the mid-90's.

I guess being an academic means never having to say you're sorry!

Hurricane Housepoor

From the Herald Tribune in Sarasota, we have: Buyers in a bind.

After struggling home builder Jade Homes suddenly closed its doors last month, buyers of about 75 homes found themselves in difficult straits.

Ali Alshalkmi is a Tampa businessman who bought 10 homes at a total cost of about $3 million for himself and members of his extended family. He deposited $200,000 with Jade last year.

Three of the homes were never begun and seven others are in varying stages of partial construction.

"I must have left 200 messages," said Alshalkmi, before retaining Mike Mardis, a Tampa litigator with the firm of Siver, Barlow & Watson.

"They never returned the call."

Shawn Stumpf, his wife, Kristy, and their two small children expected to soon move into their new Jade home in North Port. They sold their former house last year to make the $50,000 deposit on a $326,000 Jade house at 1733 Kadashow Drive.

The Stumpfs are now living with Shawn Stumpf's mother.

The day after the story broke, the plumbing contractor returned to the house and "cut out all the fixtures he could" from the nearly complete installation, said Stumpf, a Verizon repairman.

Odeimist Torres, who is 61/2 months pregnant with her second child, has been living in a rented home because her North Port home is unfinished. Materials, including dry wall, have been removed, she said.

Her parents and her brother, Jose Navarro, also bought nearby homes that are basically complete but need a certificate of occupancy for the owners to move in.

Let's see...

We have: a speculator buying 10 houses (with eye-popping 15:1 leverage,) 7 of which are incomplete (and rotting in the rain); the company has decamped with the money; the contractors are stealing fixtures and dry walls; a pregnant lady is speculating, and so are her siblings, and parents!

I want to remind readers that, as reported by Motoko Rich, the dumb bitch from the New York Times, "South Florida is working off of a totally new economic model than any of us have ever experienced in the past."

For the record, the last time Florida "worked off a totally new economic model" was in 1926. Prices did not recover (in inflation-adjusted terms) till the mid-80's!

After struggling home builder Jade Homes suddenly closed its doors last month, buyers of about 75 homes found themselves in difficult straits.

Ali Alshalkmi is a Tampa businessman who bought 10 homes at a total cost of about $3 million for himself and members of his extended family. He deposited $200,000 with Jade last year.

Three of the homes were never begun and seven others are in varying stages of partial construction.

"I must have left 200 messages," said Alshalkmi, before retaining Mike Mardis, a Tampa litigator with the firm of Siver, Barlow & Watson.

"They never returned the call."

Shawn Stumpf, his wife, Kristy, and their two small children expected to soon move into their new Jade home in North Port. They sold their former house last year to make the $50,000 deposit on a $326,000 Jade house at 1733 Kadashow Drive.

The Stumpfs are now living with Shawn Stumpf's mother.

The day after the story broke, the plumbing contractor returned to the house and "cut out all the fixtures he could" from the nearly complete installation, said Stumpf, a Verizon repairman.

Odeimist Torres, who is 61/2 months pregnant with her second child, has been living in a rented home because her North Port home is unfinished. Materials, including dry wall, have been removed, she said.

Her parents and her brother, Jose Navarro, also bought nearby homes that are basically complete but need a certificate of occupancy for the owners to move in.

Let's see...

We have: a speculator buying 10 houses (with eye-popping 15:1 leverage,) 7 of which are incomplete (and rotting in the rain); the company has decamped with the money; the contractors are stealing fixtures and dry walls; a pregnant lady is speculating, and so are her siblings, and parents!

I want to remind readers that, as reported by Motoko Rich, the dumb bitch from the New York Times, "South Florida is working off of a totally new economic model than any of us have ever experienced in the past."

For the record, the last time Florida "worked off a totally new economic model" was in 1926. Prices did not recover (in inflation-adjusted terms) till the mid-80's!

Tuesday, September 05, 2006

Momo fuku

The Momo part refers to "mortgage moms" as reported in the Washington Post: Mortgage Moms' May Star in Midterm Vote.

The meaning of the second should be self-evident after reading the following:

Life is cramped at the Condit household. Dale and Sharon Condit and their two young sons need more room but can't seem to sell their current home -- on the market now for three months.

In a year when politics is being roiled by angry debates over the Iraq war and immigration, it might seem odd to imagine the midterm elections being waged over square footage and closet space. But these are parts of a lifestyle that Sharon Condit, a deputy clerk of court, describes as dogged by a sense of limits: "We have dreams of this future, but we can't get it right now."

A less obvious but powerful variable is the interest paid by people carrying credit card debt or mortgages whose monthly payments vary with interest rates. People buffeted by these trends have given rise to a new and volatile voting block.

This year could mark the emergence of what might be called mortgage moms -- voters whose sense of well-being is freighted with anxiety about their families' financial squeeze.

I too have a dream of a future, a future where retards like you can't get loans for mortgages they can't afford.

Did the politicians hold a gun to your head to make you get the mortgage? Did they make you max out your credit cards? Can the politicians buy your house at your absurdly inflated price?

You speculated, you lost, and now you must pay the price for your foolishness.

And, why in fuck's name are journalists bandying about this bullshit?

The meaning of the second should be self-evident after reading the following:

Life is cramped at the Condit household. Dale and Sharon Condit and their two young sons need more room but can't seem to sell their current home -- on the market now for three months.

In a year when politics is being roiled by angry debates over the Iraq war and immigration, it might seem odd to imagine the midterm elections being waged over square footage and closet space. But these are parts of a lifestyle that Sharon Condit, a deputy clerk of court, describes as dogged by a sense of limits: "We have dreams of this future, but we can't get it right now."

A less obvious but powerful variable is the interest paid by people carrying credit card debt or mortgages whose monthly payments vary with interest rates. People buffeted by these trends have given rise to a new and volatile voting block.

This year could mark the emergence of what might be called mortgage moms -- voters whose sense of well-being is freighted with anxiety about their families' financial squeeze.

I too have a dream of a future, a future where retards like you can't get loans for mortgages they can't afford.

Did the politicians hold a gun to your head to make you get the mortgage? Did they make you max out your credit cards? Can the politicians buy your house at your absurdly inflated price?

You speculated, you lost, and now you must pay the price for your foolishness.

And, why in fuck's name are journalists bandying about this bullshit?

Monday, September 04, 2006

Happy Days

Firstly, a graph that was reported in the Detroit Times.

Now, for the stupidity reported in the Boston Herald by Jessica Fargen: Wages slump in Bay State, Dems lambaste Mitt

The median hourly wage in Massachusetts, adjusted for inflation, dropped nearly 5 percent between 2003 and 2005 - $17.19 per hour to $16.35 per hour - the steepest drop in the nation during that time, according the State of Working Massachusetts report by the Massachusetts Budget and Policy Center.

Democrats blasted Romney yesterday for failing to deliver jobs and higher wages in Massachusetts as he eyes a White House run.

But Eric Fehrnstrom, Romney’s spokesman, pointed out that Massachusetts residents have an average household income of $57,184, which is 19 percent higher than the national average.

Let's ask a few questions:

Sunday, Monday, Happy Days!

Now, for the stupidity reported in the Boston Herald by Jessica Fargen: Wages slump in Bay State, Dems lambaste Mitt

The median hourly wage in Massachusetts, adjusted for inflation, dropped nearly 5 percent between 2003 and 2005 - $17.19 per hour to $16.35 per hour - the steepest drop in the nation during that time, according the State of Working Massachusetts report by the Massachusetts Budget and Policy Center.

Democrats blasted Romney yesterday for failing to deliver jobs and higher wages in Massachusetts as he eyes a White House run.

But Eric Fehrnstrom, Romney’s spokesman, pointed out that Massachusetts residents have an average household income of $57,184, which is 19 percent higher than the national average.

Let's ask a few questions:

- Did Jessica do her homework?

- Can a governor "deliver" jobs, or does the market have that privilege?

- Is being "better than the national average" a sign of success?

- Is Jessica intelligent enough to understand these concepts?

Sunday, Monday, Happy Days!

I'm on the Rollercoaster, and I wanna get off...

The Eccentric Economist is running out of blogging time faster than the world is running out of stupidity.

From, TBO.com, we have Christian Wade reporting on Waterfront Homes Flood the Market.

NEW PORT RICHEY - The full-page advertisement in the Gulf Harbors Civic Association's newsletter was a desperate plea to homeowners.

"WHY IS EVERYONE SELLING?

MORE HOMES FOR SALE MEAN LOWER PRICES!

STOP SELLING!"

The appeal was not as surprising as the woman who submitted it: one of the affluent subdivision's most successful real estate brokers.

"The signs are going up faster than they're coming down," said JoAnn Milano of Century 21. "The market is suffering."

Her advice to Gulf Harbors homeowners: Unless you need to sell, don't.

Yeah, why is everyone selling? Please don't sell that pets.com stock. It's worth millions 'cause my mamy said so. Please don't sell it. Please, pretty please, pretty pretty please!

If you don't stop selling, I'm going to take my dolls, and go home.

Eat shit, and die, bitch!

From, TBO.com, we have Christian Wade reporting on Waterfront Homes Flood the Market.

NEW PORT RICHEY - The full-page advertisement in the Gulf Harbors Civic Association's newsletter was a desperate plea to homeowners.

"WHY IS EVERYONE SELLING?

MORE HOMES FOR SALE MEAN LOWER PRICES!

STOP SELLING!"

The appeal was not as surprising as the woman who submitted it: one of the affluent subdivision's most successful real estate brokers.

"The signs are going up faster than they're coming down," said JoAnn Milano of Century 21. "The market is suffering."

Her advice to Gulf Harbors homeowners: Unless you need to sell, don't.

Yeah, why is everyone selling? Please don't sell that pets.com stock. It's worth millions 'cause my mamy said so. Please don't sell it. Please, pretty please, pretty pretty please!

If you don't stop selling, I'm going to take my dolls, and go home.

Eat shit, and die, bitch!

Run, sweetheart, run, run like the wind!

Business Week talks about the stupid things that people are doing.

Let's focus on the last part. They're pulling out money from their home equity to pay the mortgage.

For the unenlightened, let me explain in detail.

Equity = Theoretical Home Worth - Current Debt Owed

The important part is the "theoretical" part because you don't know what your home is worth until you actually sell it. Unlike fungible assets in liquid markets (stocks, bonds, commodities, liquid derivatives on the former) there is no mechanism to "mark to market".

Equity is based on what someone thinks your home is worth, and what these "someones" (read: banks) are willing to loan you against this highly theoretical number.

These loans have to be at a higher interest rate than your mortgage because they are secondary loans, and they are "theoretical", as we have noted above (and hence, more "risky".)

So these folks are using money obtained at a higher interest rate to pay off loans at a lower interest rate!

Do you see the problem?

Let's focus on the last part. They're pulling out money from their home equity to pay the mortgage.

For the unenlightened, let me explain in detail.

The important part is the "theoretical" part because you don't know what your home is worth until you actually sell it. Unlike fungible assets in liquid markets (stocks, bonds, commodities, liquid derivatives on the former) there is no mechanism to "mark to market".

Equity is based on what someone thinks your home is worth, and what these "someones" (read: banks) are willing to loan you against this highly theoretical number.

These loans have to be at a higher interest rate than your mortgage because they are secondary loans, and they are "theoretical", as we have noted above (and hence, more "risky".)

So these folks are using money obtained at a higher interest rate to pay off loans at a lower interest rate!

Do you see the problem?

Pimp My Newspaper

From the "venerated" New York Times, a blast from the past : Fear of Committing?.

ON the diving board of dashed hopes and denial paces an unhappy figure: the would-be buyer who shops for years but resists taking the plunge.

Like timid bathers, some just need time to acclimate to the chilly reality of what their money can't buy. That process can take some time. Eventually, though, after long and careful looking, they do take the leap.

But others never do. They focus on flaws and high prices as a way of rationalizing an underlying inability to commit to real estate.

"The head ruled every decision and didn't give way to the heart, so they never fell in love with anything," Mr. Prince said. "It was always too much of a cold decision to make."

A fear of unsound investments, when it gums up the gears of decision-making, can obscure unmet needs.

Such thinking, if prolonged and paired with the inability to make a decision one way or the other, can signal what's known as an obsessional personality. Obsessives, Dr. Maloney explained, adeptly bury their feelings beneath an avalanche of thoughts.

Yep, you shouldn't "think" before making a deal worth $500,000 or more. You should go with your "feelings" particularly if thinking "obscures unmet needs."

Pimp it, bitch, pimp it! The internet is going to put a stake in the heart of your last remaining revenue source.

ON the diving board of dashed hopes and denial paces an unhappy figure: the would-be buyer who shops for years but resists taking the plunge.

Like timid bathers, some just need time to acclimate to the chilly reality of what their money can't buy. That process can take some time. Eventually, though, after long and careful looking, they do take the leap.

But others never do. They focus on flaws and high prices as a way of rationalizing an underlying inability to commit to real estate.

"The head ruled every decision and didn't give way to the heart, so they never fell in love with anything," Mr. Prince said. "It was always too much of a cold decision to make."

A fear of unsound investments, when it gums up the gears of decision-making, can obscure unmet needs.

Such thinking, if prolonged and paired with the inability to make a decision one way or the other, can signal what's known as an obsessional personality. Obsessives, Dr. Maloney explained, adeptly bury their feelings beneath an avalanche of thoughts.

Yep, you shouldn't "think" before making a deal worth $500,000 or more. You should go with your "feelings" particularly if thinking "obscures unmet needs."

Pimp it, bitch, pimp it! The internet is going to put a stake in the heart of your last remaining revenue source.

Saturday, September 02, 2006

New York, New York

From SeattlePi.com, we have Aubrey Cohen reporting on: 296 square feet -- but it's home.

But a local developer is betting Seattle urbanites are primed to carve out their own two-truck chunks of Belltown. The moda condos, set to break ground in October, promise "New York-style living," with units as small as 296 square feet that start at $149,950.

A quick review of real-estate listings shows "New York-style living" is, indeed, available in New York, with condos as small as 250 square feet on the market in Manhattan.

Wake up, honey!

It's not the tiny apartments that make people want to live in New York. We put up with tiny apartments because it's New York.

"A quick review..."?!?

Oy! This is just too fucking retarded for words!

But a local developer is betting Seattle urbanites are primed to carve out their own two-truck chunks of Belltown. The moda condos, set to break ground in October, promise "New York-style living," with units as small as 296 square feet that start at $149,950.

A quick review of real-estate listings shows "New York-style living" is, indeed, available in New York, with condos as small as 250 square feet on the market in Manhattan.

Wake up, honey!

It's not the tiny apartments that make people want to live in New York. We put up with tiny apartments because it's New York.

"A quick review..."?!?

Oy! This is just too fucking retarded for words!

Friday, September 01, 2006

Econ 001.1 : The Concept of Interest Rate

Before I talk about fancy concepts, I figured I should talk about a topic that lies at the heart of economics.

Why is there an interest rate in the first place?

If you don't understand the question, if I borrow money from you, why should I pay you more tomorrow than today? In fact, why should I pay you at all?

Ah, ha!

Lending money comes with risk. The risk that the counterparty may never pay it back at all.

So money tomorrow is worth a little more than money today, and that's why lenders charge interest!

We're going on to build on this modest concept so hang with me.

Why is there an interest rate in the first place?

If you don't understand the question, if I borrow money from you, why should I pay you more tomorrow than today? In fact, why should I pay you at all?

Ah, ha!

Lending money comes with risk. The risk that the counterparty may never pay it back at all.

So money tomorrow is worth a little more than money today, and that's why lenders charge interest!

We're going on to build on this modest concept so hang with me.

Pirates of the Caribbean

From CBS Marketwatch, we have Ciena cuts loss, plans reverse split.

Ciena Corp. on Thursday reported a sharply lower loss in its third quarter and announced a 1-for-7 reverse stock split.

The split is expected to take effect after the close of trading on Sept. 22. The move would reduce the number of Ciena shares outstanding to 84.4 million from the current level of 591 million.

Sounds pretty innocuous, doesn't it?

Here's how it works : they declare that 7 "old" shares equals 1 "new" share. Currently, the stock trades roughly around $4. So the new shares will be worth roughly around $28.

But this seems like a cosmetic change. So why do it?

"I think we're making good progress, but we still have a ways to go," Smith said. He reiterated that the company's next goal is to achieve a net profit, which Smith predicted would happen in the "near future."

Whoa, those waves look a little more ominous now!

No profits, you say?

You may rest assured that even though the stock has a reverse split, the options given to the insiders will NOT be re-evaluated. A quick look on Yahoo! shows that the insiders are furiously selling shares, and the CEO Smith has options exercisable at roughly $2.36 a share. (To spell it out, he would only have made roughly $1.64 per stock option. Now, he will walk away with roughly $26.64 per stock option.)

Ain't that just peachy?

The executives will cash out their options leaving the shareholders holding the empty shell of a company that will "achieve a net profit" in the "near future".

ARRRRR, Avast ye landlubbers!

Ciena Corp. on Thursday reported a sharply lower loss in its third quarter and announced a 1-for-7 reverse stock split.

The split is expected to take effect after the close of trading on Sept. 22. The move would reduce the number of Ciena shares outstanding to 84.4 million from the current level of 591 million.

Sounds pretty innocuous, doesn't it?

Here's how it works : they declare that 7 "old" shares equals 1 "new" share. Currently, the stock trades roughly around $4. So the new shares will be worth roughly around $28.

But this seems like a cosmetic change. So why do it?

"I think we're making good progress, but we still have a ways to go," Smith said. He reiterated that the company's next goal is to achieve a net profit, which Smith predicted would happen in the "near future."

Whoa, those waves look a little more ominous now!

No profits, you say?

You may rest assured that even though the stock has a reverse split, the options given to the insiders will NOT be re-evaluated. A quick look on Yahoo! shows that the insiders are furiously selling shares, and the CEO Smith has options exercisable at roughly $2.36 a share. (To spell it out, he would only have made roughly $1.64 per stock option. Now, he will walk away with roughly $26.64 per stock option.)

Ain't that just peachy?

The executives will cash out their options leaving the shareholders holding the empty shell of a company that will "achieve a net profit" in the "near future".

ARRRRR, Avast ye landlubbers!

Paging George Orwell

From TheStreet.com we have Dupont Slashing Pensions.

Starting in 2008, DuPont's pension calculation will be reduced to one-third of its current level.

The Wilmington, Del., chemicals giant will also put new hires starting in 2007 into its savings plan rather than the pension and retirement plan. New workers will not receive a company subsidy for retiree health care or retiree life insurance.

"These steps are consistent with market trends in employee benefits and will enhance the company's business competitiveness," said James C. Borel, senior vice president, DuPont Human Resources. "The planned changes reinforce our commitment to help employees provide for a secure retirement."

(Ed: emphasis mine.)

Yep, you're definitely committed to providing for a "secure" retirement!

Sign o' the times!

Starting in 2008, DuPont's pension calculation will be reduced to one-third of its current level.

The Wilmington, Del., chemicals giant will also put new hires starting in 2007 into its savings plan rather than the pension and retirement plan. New workers will not receive a company subsidy for retiree health care or retiree life insurance.

"These steps are consistent with market trends in employee benefits and will enhance the company's business competitiveness," said James C. Borel, senior vice president, DuPont Human Resources. "The planned changes reinforce our commitment to help employees provide for a secure retirement."

(Ed: emphasis mine.)

Yep, you're definitely committed to providing for a "secure" retirement!

Sign o' the times!

The World's Largest Ponzi Scheme

From BusinessWeek, we have an article on Nightmare Mortgages.

Click on the side link labeled Worst Practices.

Consider Greg, a single father earning about $45,000 a year as a baker in San Diego who asked BusinessWeek not to use his last name. A decade ago a bank might have given him a mortgage for about $100,000, or 2.5 times his income, the rule of thumb. Yet he's on the hook for about $940,000, or nearly 21 times his pay, with two loans on two houses from Countrywide and Accredited Home Services.

Do you see the problem?

Click on the side link labeled Worst Practices.

Consider Greg, a single father earning about $45,000 a year as a baker in San Diego who asked BusinessWeek not to use his last name. A decade ago a bank might have given him a mortgage for about $100,000, or 2.5 times his income, the rule of thumb. Yet he's on the hook for about $940,000, or nearly 21 times his pay, with two loans on two houses from Countrywide and Accredited Home Services.

Do you see the problem?

Subscribe to:

Posts (Atom)