From the Houston Chronicle: Lengthy standoff ends in Spring with man's suicide.

A 12-hour standoff ended this morning with a north Houston man lobbing Molotov cocktails at Houston Police before taking his own life rather than vacate a home he'd lost to foreclosure.

James Hahn, a chemist, had told police he would not be taken from the home alive, said Capt. Bruce Williams, an HPD spokesman.

Monday, October 29, 2007

Friday, October 26, 2007

Jingle Mail

Fear Factor

Modern Fairy Tale

From the Financial Times: Buffett cautious on $75bn 'Superfund'.

Warren Buffett said on Thursday, “One of the lessons that investors seem to have to learn over and over again, and will again in the future, is that not only can you not turn a toad into a prince by kissing it, but you cannot turn a toad into a prince by repackaging it."

Oh. Mr. Buffett! I could just kiss you for that delightful metaphor.

Warren Buffett said on Thursday, “One of the lessons that investors seem to have to learn over and over again, and will again in the future, is that not only can you not turn a toad into a prince by kissing it, but you cannot turn a toad into a prince by repackaging it."

Oh. Mr. Buffett! I could just kiss you for that delightful metaphor.

Thursday, October 25, 2007

The Non-Subprime Situation

Asinine Administration

From CBS Marketwatch, we have Merrill Lynch write-down 'positive:' White House economist.

The announcement by Merrill Lynch that it is taking a $8 billion write-down of mortgage assets is a "positive sign," said Edward Lazear, the White House chief economist on Wednesday. "I actually view the announcement by companies like Merrill Lynch as positive signs because you want this stuff to be recognized," Lazear said in an interview on CNBC. Lazear said the announcement might speed the return of normalcy to credit markets.

Well, it "might" do anything. It might make the administration do a turnaround in the Iraq war too but I wouldn't hold my breath.

Just let's write out that loss again just in case we were unclear on the concept:

-8,000,000,000

Losses for everyone, says I!

The announcement by Merrill Lynch that it is taking a $8 billion write-down of mortgage assets is a "positive sign," said Edward Lazear, the White House chief economist on Wednesday. "I actually view the announcement by companies like Merrill Lynch as positive signs because you want this stuff to be recognized," Lazear said in an interview on CNBC. Lazear said the announcement might speed the return of normalcy to credit markets.

Well, it "might" do anything. It might make the administration do a turnaround in the Iraq war too but I wouldn't hold my breath.

Just let's write out that loss again just in case we were unclear on the concept:

Losses for everyone, says I!

Wednesday, October 24, 2007

The Oldest Fallacy in Economics

From CBS Marketwatch, we have Could Calif. fires draw a line under housing crash?

Economists have noted the perverse reality that in the wake of disasters, re-construction spending helps the economy, even as people are still struggling to recover from their personal losses.

For once, I have no interest in the bubble but I wish to address the above fallacy, namely, that disasters help the economy.

Disasters do NOT help the economy!

Why?

If it were true, then we should logically go around creating disasters so that it would help the economy.

Put like that, it sounds absurd, doesn't it? That's because it is absurd.

Why?

It ignores the hidden in favor of what can be observed.

After this disaster, tragic as it is, the insurance companies will fork out to rebuild the houses. That means that cash is not doing something else productive somewhere else (this would be the unobservable part.)

Instead of the economy getting both the house and the investment, it only gets a replacement house.

Let's review this again just to be clear.

Suppose I throw a party, and in the course of the party, my guests break two wine glasses. Now, the next week I need to go out and buy two wine glasses from my budget which was originally allocated to say buying a book.

Instead of two wine glasses and a book, I have ended up with just two wine glasses. Obviously, I have lost.

Of course, the wine merchant is happy but the (unobservable) book merchant is unhappy.

This is the oldest fallacy in Economics, and the above explanation dates back to Frédéric Bastiat. It is so common that investment managers, politicians, and CEO's make it daily.

However, I've never seen Buffett make this mistake.

Economists have noted the perverse reality that in the wake of disasters, re-construction spending helps the economy, even as people are still struggling to recover from their personal losses.

For once, I have no interest in the bubble but I wish to address the above fallacy, namely, that disasters help the economy.

Disasters do NOT help the economy!

Why?

If it were true, then we should logically go around creating disasters so that it would help the economy.

Put like that, it sounds absurd, doesn't it? That's because it is absurd.

Why?

It ignores the hidden in favor of what can be observed.

After this disaster, tragic as it is, the insurance companies will fork out to rebuild the houses. That means that cash is not doing something else productive somewhere else (this would be the unobservable part.)

Instead of the economy getting both the house and the investment, it only gets a replacement house.

Let's review this again just to be clear.

Suppose I throw a party, and in the course of the party, my guests break two wine glasses. Now, the next week I need to go out and buy two wine glasses from my budget which was originally allocated to say buying a book.

Instead of two wine glasses and a book, I have ended up with just two wine glasses. Obviously, I have lost.

Of course, the wine merchant is happy but the (unobservable) book merchant is unhappy.

This is the oldest fallacy in Economics, and the above explanation dates back to Frédéric Bastiat. It is so common that investment managers, politicians, and CEO's make it daily.

However, I've never seen Buffett make this mistake.

Tuesday, October 23, 2007

Twirlissimo Inc. goes global!

We first talked about the Twirlissimo Phenomenon here.

The China Post reports: China bid to tame economy starts real estate market bust.

Sweating in the bright afternoon sun, the men and women stand on the sides of the roads like homeless people clutching wrinkled cardboard signs. Waving the boards, the real estate agents call out to cars zooming by.

Surrounding the agents in this upscale neighborhood are vast swaths of empty apartments that just a few months ago were selling at record high prices.

Looks like Twirlissimo is being outsourced to China!

The China Post reports: China bid to tame economy starts real estate market bust.

Sweating in the bright afternoon sun, the men and women stand on the sides of the roads like homeless people clutching wrinkled cardboard signs. Waving the boards, the real estate agents call out to cars zooming by.

Surrounding the agents in this upscale neighborhood are vast swaths of empty apartments that just a few months ago were selling at record high prices.

Looks like Twirlissimo is being outsourced to China!

Bovine Excrement

From the AP, we have Target cuts October same-store sales view.

Target Corp (NYSE:TGT - News) cut its outlook for October sales at stores open at least a year on Monday, the second month in a row the discount retailer has lowered its same-store sales forecast, as investors begin to focus on how the holiday sales season will measure up.

Target now expects same-store sales to rise between 2 percent to 4 percent, down from a forecast earlier this month of an increase of between 3 percent and 5 percent.

In a recorded message, the retailer said its reduced forecast was partly based on "greater-than-normal daily volatility and continued disappointing sales results for the first two weeks of October."

"greater-than-normal volatility"?

What the fuck does that mean? Stocks can be more volatile, bonds can be more volatile, hell, my temper is almost always volatile. But what does it mean for store sales to be more volatile?

Either you make sales or you don't. Seems to me they want to say sales are fewer and far between. That's not volatility. That's just fewer sales except they don't want to outright say it.

Moo!

Target Corp (NYSE:TGT - News) cut its outlook for October sales at stores open at least a year on Monday, the second month in a row the discount retailer has lowered its same-store sales forecast, as investors begin to focus on how the holiday sales season will measure up.

Target now expects same-store sales to rise between 2 percent to 4 percent, down from a forecast earlier this month of an increase of between 3 percent and 5 percent.

In a recorded message, the retailer said its reduced forecast was partly based on "greater-than-normal daily volatility and continued disappointing sales results for the first two weeks of October."

"greater-than-normal volatility"?

What the fuck does that mean? Stocks can be more volatile, bonds can be more volatile, hell, my temper is almost always volatile. But what does it mean for store sales to be more volatile?

Either you make sales or you don't. Seems to me they want to say sales are fewer and far between. That's not volatility. That's just fewer sales except they don't want to outright say it.

Moo!

Sunday, October 21, 2007

Mmmmm.... donuts!

From the Palm Beach Post, we have Who's to Blame?

Michael Sichenzia has a problem. The former mortgage whiz who spent time in New York state's prison for mortgage fraud knows that bad home loans claimed some victims and fattened bank accounts for others.

But telling them apart isn't easy. "The thing we have the most difficulty doing nowadays is figuring out who has legitimately been taken advantage of, as opposed to who went into the transaction with their eyes open," says Mr. Sichenzia, now lead investigator for the Deerfield Beach law firm of Glinn Somera & Silva, which handles foreclosure cases.

Not every borrower, though, was seeking shelter. And not everyone was duped into an onerous deal.

"I had a guy who called me who owns 70 homes," says Stuart broker Michael Morgan. "I know a lady who owns 16. It's the room of 1,000 doughnuts. How many can you eat? Two? Three? Well, how many houses can you live in?"

Mmmmm ... glazed houses, double-glazed houses, houses with sprinkles, chocolate-covered houses!

Michael Sichenzia has a problem. The former mortgage whiz who spent time in New York state's prison for mortgage fraud knows that bad home loans claimed some victims and fattened bank accounts for others.

But telling them apart isn't easy. "The thing we have the most difficulty doing nowadays is figuring out who has legitimately been taken advantage of, as opposed to who went into the transaction with their eyes open," says Mr. Sichenzia, now lead investigator for the Deerfield Beach law firm of Glinn Somera & Silva, which handles foreclosure cases.

Not every borrower, though, was seeking shelter. And not everyone was duped into an onerous deal.

"I had a guy who called me who owns 70 homes," says Stuart broker Michael Morgan. "I know a lady who owns 16. It's the room of 1,000 doughnuts. How many can you eat? Two? Three? Well, how many houses can you live in?"

Mmmmm ... glazed houses, double-glazed houses, houses with sprinkles, chocolate-covered houses!

Friday, October 19, 2007

The Unanswerable Question

From the Wall Street Journal, we have Burned by Real Estate, Some Just Walk Away.

During the height of Las Vegas's real-estate boom two years ago, property investor Rob Rozzen bought 16 homes, hoping that skyrocketing prices would pump up his retirement nest egg.

Now, Mr. Rozzen says he is considering filing for bankruptcy protection. As the housing market slowed, the 40-year-old was unable to sell the homes, and his full-time job as a real-estate agent was no longer able to support mortgage payments totaling $45,000 a month. So one by one, over the past 14 months, Mr. Rozzen has stopped making payments on his investment properties, for which he paid between $226,000 and $390,000, and lenders have foreclosed.

As a result, Mr. Rozzen's credit score plunged from 730 to the high 400s, he says.

The Prada clothes, luxurious vacations, and full-time housekeeper and pool cleaner he once enjoyed are things of the past. Still, he says, walking away from his investment properties was his only option. "You get to a point where your hands are tied," he says.

But walking away from a mortgage is almost always a bad idea.

What about walking away from 16 mortgages, all underwater?

Is that a bad idea?

Answer that, bee-yatch!

During the height of Las Vegas's real-estate boom two years ago, property investor Rob Rozzen bought 16 homes, hoping that skyrocketing prices would pump up his retirement nest egg.

Now, Mr. Rozzen says he is considering filing for bankruptcy protection. As the housing market slowed, the 40-year-old was unable to sell the homes, and his full-time job as a real-estate agent was no longer able to support mortgage payments totaling $45,000 a month. So one by one, over the past 14 months, Mr. Rozzen has stopped making payments on his investment properties, for which he paid between $226,000 and $390,000, and lenders have foreclosed.

As a result, Mr. Rozzen's credit score plunged from 730 to the high 400s, he says.

The Prada clothes, luxurious vacations, and full-time housekeeper and pool cleaner he once enjoyed are things of the past. Still, he says, walking away from his investment properties was his only option. "You get to a point where your hands are tied," he says.

But walking away from a mortgage is almost always a bad idea.

What about walking away from 16 mortgages, all underwater?

Is that a bad idea?

Answer that, bee-yatch!

Friday, October 12, 2007

When The Saints Come Marching In

From AZCentral.com: Some homes hold steady while Valley housing overall slows down.

Kathy and Dennis Rowedder are trying to sell their north Phoenix home in the 85050 ZIP code. The couple recently closed on a new house in Peoria and got a $30,000 concession on it because they haven't yet sold their existing home.

So far, the couple have lowered their price $40,000 to $360,000.

"I thought when we listed it at the beginning of August it was priced really well. I buried a statue of St. Joseph in our front yard for luck," Kathy Rowedder said. "But after we lowered our price, I went out and dug it up, cleaned it off and brought it back in the house."

St. Joe may have left the courtyard, but what would baby Jebus do?

Kathy and Dennis Rowedder are trying to sell their north Phoenix home in the 85050 ZIP code. The couple recently closed on a new house in Peoria and got a $30,000 concession on it because they haven't yet sold their existing home.

So far, the couple have lowered their price $40,000 to $360,000.

"I thought when we listed it at the beginning of August it was priced really well. I buried a statue of St. Joseph in our front yard for luck," Kathy Rowedder said. "But after we lowered our price, I went out and dug it up, cleaned it off and brought it back in the house."

St. Joe may have left the courtyard, but what would baby Jebus do?

Thursday, October 11, 2007

Fear Factor

Whenever you read an article, you need to check what's the incentive of the person writing the article.

Here's one from Yahoo!: Commentary: Worth $4 Million -- and Unable to Retire.

I got a call from a newly "rich" executive. Having worked 60-hour weeks for years and now ready to retire at 55, he sold his business for $4 million. He was ready to live out his dream life and live off that tidy nest egg. The problem is, to do so--on $4 million--he must cut his standard of living.

It's the plight of the "mMillionaire" -- the middle-class Millionaire.

Mansions and yachts are out. The mMillionaires who want to retire before age 65 or 72, find they must live in three- and four-bedroom homes and drive mid-priced four-door sedans and mini-vans.

This is bullshit!

With $4M, you can clear roughly $150K each year in income alone tax-free without touching the principal. If you have trouble with that, give it to me. I'll be able to afford both mansion and yacht, and even the occasional week in Tahiti with that.

However, let's see who "sponsored" the article.

It's sponsored by Fidelity.

How does Fidelity make money? By the fees they get on managing money.

How do they make more fees? By managing larger sums of money.

Hookay! This belongs in the "never ask the barber whether you need a haircut" section.

Here's one from Yahoo!: Commentary: Worth $4 Million -- and Unable to Retire.

I got a call from a newly "rich" executive. Having worked 60-hour weeks for years and now ready to retire at 55, he sold his business for $4 million. He was ready to live out his dream life and live off that tidy nest egg. The problem is, to do so--on $4 million--he must cut his standard of living.

It's the plight of the "mMillionaire" -- the middle-class Millionaire.

Mansions and yachts are out. The mMillionaires who want to retire before age 65 or 72, find they must live in three- and four-bedroom homes and drive mid-priced four-door sedans and mini-vans.

This is bullshit!

With $4M, you can clear roughly $150K each year in income alone tax-free without touching the principal. If you have trouble with that, give it to me. I'll be able to afford both mansion and yacht, and even the occasional week in Tahiti with that.

However, let's see who "sponsored" the article.

It's sponsored by Fidelity.

How does Fidelity make money? By the fees they get on managing money.

How do they make more fees? By managing larger sums of money.

Hookay! This belongs in the "never ask the barber whether you need a haircut" section.

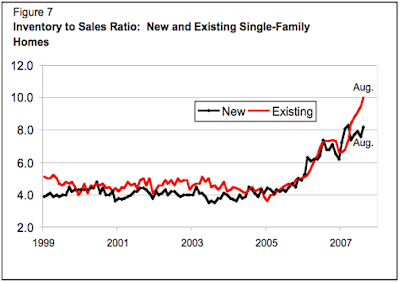

The Rear-view Mirror

Warning: Objects are closer than they seem!

You don't need to be a genius to figure out that the housing collapse really started sometime late-2005/early-2006.

(Data: from the St. Louis Fed.)

Sunday, October 07, 2007

Smoking Cows

From CNN, we have FDIC to mortgage servicers: Freeze ARM rates.

The heat on U.S. mortgage lenders and servicers was turned up a few degrees this week when the country's chief bank regulator publicly proposed that they permanently freeze interest rates on subprime adjustable-rate mortgages (ARMs) for many homeowners.

"Keep it at the starter rate. Convert it into a fixed rate. Make it permanent. And get on with it," Federal Deposit Insurance Corp. Chairman Sheila Bair said in prepared remarks at an investor's conference.

Whoa!!! Talk about clueless.

Lenders borrow short and lend long.

In other words, they borrow money at the short end, and lend long-term. They pocket the difference as a reward for the risk they are taking in lending that money.

This stupid cow is asking lenders to lose money non-stop for the next 30 years.

Ummmm, yeah sure, that's reaaaaally going to happen.

And this is the chairman of the FDIC?

Put the bong down, you stupid bitch!

The heat on U.S. mortgage lenders and servicers was turned up a few degrees this week when the country's chief bank regulator publicly proposed that they permanently freeze interest rates on subprime adjustable-rate mortgages (ARMs) for many homeowners.

"Keep it at the starter rate. Convert it into a fixed rate. Make it permanent. And get on with it," Federal Deposit Insurance Corp. Chairman Sheila Bair said in prepared remarks at an investor's conference.

Whoa!!! Talk about clueless.

Lenders borrow short and lend long.

In other words, they borrow money at the short end, and lend long-term. They pocket the difference as a reward for the risk they are taking in lending that money.

This stupid cow is asking lenders to lose money non-stop for the next 30 years.

Ummmm, yeah sure, that's reaaaaally going to happen.

And this is the chairman of the FDIC?

Put the bong down, you stupid bitch!

Friday, October 05, 2007

Reading tea leaves

We posted the first graph here about 6 months ago.

The second graph is courtesy of Moody's (not that you should trust them) but they might even be truthful. There's lawsuits coming down the poop-chute.

See if you can combine the data to get an accurate reading on the economy.

It's better than tea leaves, I tell ya!

Ferragamo Flip-Flops

From the Chicago Tribune, we have Here's a new one: Being too broke to sell.

Most anybody in the mortgage business will tell you that August was a month that will live in infamy: The market was in turmoil, as doubts about the stability of subprime loans spread to other sectors of the mortgage world.

The cancellation rate undoubtedly was fed by two scenarios playing out: Many buyers couldn't get mortgage approval because lending suddenly tightened; or, financially strained lenders yanked funding from their borrowers at the last minute.

But another factor was at work: Sellers -- not buyers -- were in trouble as their closing dates neared.

"Our office had four sales in one week that failed to close because the seller didn't have the cash," said the real estate agent, who declined to be identified because she feared office repercussions.

The sellers couldn't come up with the money?

It seems that for those homeowners on the margins -- those with some but not much equity -- the costs of a real estate transaction are turning into a kick in the pants.

Oooh! guess those HELOC's are really working out for you, babykins.

How's that oh-so-delightful Gucci purse now? And the fake tits? Keep 'em nice and jiggly 'cause you'll be needing them to make up the difference.

Just make sure you pray to baby-Jebus that they don't spring a "leak".

We'll just call this saving for the downpayment after the fact!

Most anybody in the mortgage business will tell you that August was a month that will live in infamy: The market was in turmoil, as doubts about the stability of subprime loans spread to other sectors of the mortgage world.

The cancellation rate undoubtedly was fed by two scenarios playing out: Many buyers couldn't get mortgage approval because lending suddenly tightened; or, financially strained lenders yanked funding from their borrowers at the last minute.

But another factor was at work: Sellers -- not buyers -- were in trouble as their closing dates neared.

"Our office had four sales in one week that failed to close because the seller didn't have the cash," said the real estate agent, who declined to be identified because she feared office repercussions.

The sellers couldn't come up with the money?

It seems that for those homeowners on the margins -- those with some but not much equity -- the costs of a real estate transaction are turning into a kick in the pants.

Oooh! guess those HELOC's are really working out for you, babykins.

How's that oh-so-delightful Gucci purse now? And the fake tits? Keep 'em nice and jiggly 'cause you'll be needing them to make up the difference.

Just make sure you pray to baby-Jebus that they don't spring a "leak".

We'll just call this saving for the downpayment after the fact!

Thursday, October 04, 2007

Tan Man Issues Green Wristbands

Sometimes you can't make these things up.

From the Wall Street Journal, Countrywide Tells Workers,

'Protect Our House'.

Having suffered a barrage of negative headlines while battling to shore up its finances and shrink its work force of 60,000 by as much as 20%, the nation's largest home-mortgage lender is launching a PR blitz aimed at repairing its reputation. And it starts inside the company.

For the demoralized employees who remain, the new campaign means wristbands with the phrase "Protect Our House" and pep talks promising to keep "amply" rewarding the most successful among them amid a struggle with the sharp drop in mortgage lending as defaults soar and house prices decline.

Rick Simon, a Countrywide spokesman, said the transcript was sent to employees Friday. It says that employees are expected to sign a pledge to "demonstrate their commitment to our efforts," and Mr. Simon says about 11,000 have signed. Each employee who signs up receives the Protect Our House wristband made of green rubber. "We believe there's a great story about the strength of the business," says Mr. Simon.

Hot diggity dang!

Nothing screams professional like a green wristband that says "Protect Our House". Wonder what the poor bitches are signing away on that piece of paper.

If someone asked me to "demonstrate my commitment", not only would I quit, I would borrow all the money I could, and short the stock (or even leverage, and buy all the put options I could.)

However, what I really really want is that green wristband.

C'mon readers, hook me up!

From the Wall Street Journal, Countrywide Tells Workers,

'Protect Our House'.

Having suffered a barrage of negative headlines while battling to shore up its finances and shrink its work force of 60,000 by as much as 20%, the nation's largest home-mortgage lender is launching a PR blitz aimed at repairing its reputation. And it starts inside the company.

For the demoralized employees who remain, the new campaign means wristbands with the phrase "Protect Our House" and pep talks promising to keep "amply" rewarding the most successful among them amid a struggle with the sharp drop in mortgage lending as defaults soar and house prices decline.

Rick Simon, a Countrywide spokesman, said the transcript was sent to employees Friday. It says that employees are expected to sign a pledge to "demonstrate their commitment to our efforts," and Mr. Simon says about 11,000 have signed. Each employee who signs up receives the Protect Our House wristband made of green rubber. "We believe there's a great story about the strength of the business," says Mr. Simon.

Hot diggity dang!

Nothing screams professional like a green wristband that says "Protect Our House". Wonder what the poor bitches are signing away on that piece of paper.

If someone asked me to "demonstrate my commitment", not only would I quit, I would borrow all the money I could, and short the stock (or even leverage, and buy all the put options I could.)

However, what I really really want is that green wristband.

C'mon readers, hook me up!

Wednesday, October 03, 2007

Toro! Toro! Toro!

From Bloomberg, we have Spain Property Delinquencies May Jump, Moody's Says.

The country's banks are ``well positioned'' to withstand a decline in real-estate prices, according to Moody's. The lenders are required to set aside provisions for losses under rules introduced in 2000. The capital of Spanish banks is only at risk if delinquency rates go above 5.5 percent, the report said.

After rising 178 percent between 2000 and 2006, more than any other country in Europe, Spanish home prices are being threatened as the highest European Central Bank interest rates in six years curb consumer spending, Moody's said.

Moody's said a ``hard landing,'' in which loan defaults by developers and builders exceeds 5.5 percent and house prices plunge 20 percent, is a ``remote'' possibility.

Prices rose 178% in 7 years (roughly 12% compounded annually) but a 20% drop is a "remote possibility".

Please note the circularity of the argument. Banks are not at risk because loan defaults can't go above 5.5%. Why not? "Because then they would be at risk."

Sounds like -- it can't happen because if it happens, bad things will happen; hence, it can't happen.

I'll give a dissenting opinion. Home prices in Spain are guaranteed to plunge more than 20%, and there's no chance that those loans will get repaid.

Spain is the Florida of Europe, and has an epic appointment with fate.

``We have no concern at all about the strength of the Spanish financial system,'' Deputy Finance Minister David Vegara said at a press conference today in response to the report.

Really?!?

Let's see.

Spain's gold reserves were 14.717 million troy oz in Aug 2006. Today, they stand at 9.054 million troy oz. That means, they've sold off nearly 40% of their gold reserves, and you have the finance minister giving a conference about their financial strength?

This is the biggest Spanish Bull I've seen!

The country's banks are ``well positioned'' to withstand a decline in real-estate prices, according to Moody's. The lenders are required to set aside provisions for losses under rules introduced in 2000. The capital of Spanish banks is only at risk if delinquency rates go above 5.5 percent, the report said.

After rising 178 percent between 2000 and 2006, more than any other country in Europe, Spanish home prices are being threatened as the highest European Central Bank interest rates in six years curb consumer spending, Moody's said.

Moody's said a ``hard landing,'' in which loan defaults by developers and builders exceeds 5.5 percent and house prices plunge 20 percent, is a ``remote'' possibility.

Prices rose 178% in 7 years (roughly 12% compounded annually) but a 20% drop is a "remote possibility".

Please note the circularity of the argument. Banks are not at risk because loan defaults can't go above 5.5%. Why not? "Because then they would be at risk."

Sounds like -- it can't happen because if it happens, bad things will happen; hence, it can't happen.

I'll give a dissenting opinion. Home prices in Spain are guaranteed to plunge more than 20%, and there's no chance that those loans will get repaid.

Spain is the Florida of Europe, and has an epic appointment with fate.

``We have no concern at all about the strength of the Spanish financial system,'' Deputy Finance Minister David Vegara said at a press conference today in response to the report.

Really?!?

Let's see.

Spain's gold reserves were 14.717 million troy oz in Aug 2006. Today, they stand at 9.054 million troy oz. That means, they've sold off nearly 40% of their gold reserves, and you have the finance minister giving a conference about their financial strength?

This is the biggest Spanish Bull I've seen!

Subscribe to:

Posts (Atom)