... with this ad?

... with this ad?

Sunday, September 30, 2007

Tuesday, September 25, 2007

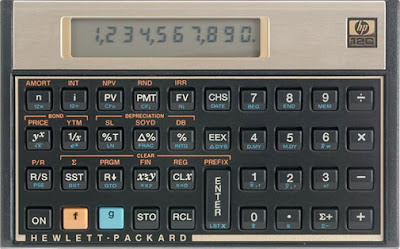

Product Design

Not exactly a "whinefest" but I'm sure the readers of this blog (any left?) will take a welcome respite from the negativity.

What do I think is the best designed electronic equipment in the last 30 years?

My vote goes to the humble HP-12C.

If you've never used it, you simply have never worked in finance.

It does everything right. Calculations, bond math, NPV, amortization, literally everything a financial dude needs quickly.

Hell, it shuts itself off in a strange bow to environmentalism long before it was needed; and fear not, financial wizards, it saves the state to solid-state so you can power it up, and pick up where you left off. General knowledge has it that even heavy users have only replaced the battery once in 10+ years.

Please also note the highly economical "triple-encoding" of functionality via the f and g buttons!

HP has tried to kill the product repeatedly. The hue and cry was so great, it was deafening. I bet at least a couple of Wall St. CEO's said, "You'll never be able to access capital in this town again."

Eat your heart out, Excel!

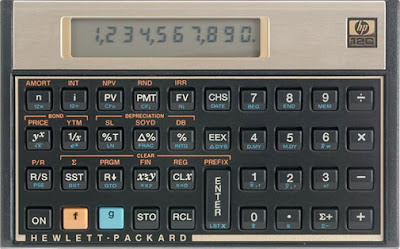

What do I think is the best designed electronic equipment in the last 30 years?

My vote goes to the humble HP-12C.

If you've never used it, you simply have never worked in finance.

It does everything right. Calculations, bond math, NPV, amortization, literally everything a financial dude needs quickly.

Hell, it shuts itself off in a strange bow to environmentalism long before it was needed; and fear not, financial wizards, it saves the state to solid-state so you can power it up, and pick up where you left off. General knowledge has it that even heavy users have only replaced the battery once in 10+ years.

Please also note the highly economical "triple-encoding" of functionality via the f and g buttons!

HP has tried to kill the product repeatedly. The hue and cry was so great, it was deafening. I bet at least a couple of Wall St. CEO's said, "You'll never be able to access capital in this town again."

Eat your heart out, Excel!

Sunday, September 23, 2007

Big Apple Foreclosures for everyone!

Please note that since this is for SFH's (single family homes), a lot of Manhattan data is missing since it is largely co-ops and condos.

Also note that part of 10011 constitutes the "highly desirable" West Village locations.

New York is also the state which takes longest to foreclose (= worst state to lend money in), and hence this data is seriously understated. To get a real sense, we would have to get data on NOD's (notice of defaults.) This is really older data masquerading as recent.

Saturday, September 22, 2007

Nasty, nasty, nasty

Thursday, September 20, 2007

Broken Business Models

From the once-esteemed New York Times, we have Times to Stop Charging for Parts of Its Web Site.

The New York Times will stop charging for access to parts of its Web site, effective at midnight tonight.

The move comes two years to the day after The Times began the subscription program, TimesSelect, which has charged $49.95 a year, or $7.95 a month, for online access to the work of its columnists and to the newspaper’s archives. TimesSelect has been free to print subscribers to The Times and to some students and educators.

In addition to opening the entire site to all readers, The Times will also make available its archives from 1987 to the present without charge, as well as those from 1851 to 1922, which are in the public domain. There will be charges for some material from the period 1923 to 1986, and some will be free.

The Times said the project had met expectations, drawing 227,000 paying subscribers — out of 787,000 over all — and generating about $10 million a year in revenue.

What changed, The Times said, was that many more readers started coming to the site from search engines and links on other sites instead of coming directly to NYTimes.com. These indirect readers, unable to get access to articles behind the pay wall and less likely to pay subscription fees than the more loyal direct users, were seen as opportunities for more page views and increased advertising revenue.

Here we see a classic failure of business -- its inability to see that the business model that it was based on has gone away, and it's not coming back.

Very few businesses take the introspective look. For one, it's hard, and two, you may not like what you see.

Let's first observe what the failure was; then, we may be able to predict what the future holds a little better.

The Net has done three things:

lowered the cost of publication to zero,

severed the channel linking content to distribution, and

created extreme specialization of content.

This blog itself is an example of all three. You are reading a extremely specialized blog, and my cost of publication is non-existent. You are not tied down to reading this every morning or even periodically. If you don't like the content, you are free to go elsewhere, and you may not come back.

"Times Select" didn't understand the rules. For one, it broke the link that traditional readers had. The readers had been programmed (for decades) to read the daily editorial. When you put this behind a "pay wall", you're penalizing the most loyal customers.

The customers went elsewhere for their daily editorial content, and not only found it, found it to be plentiful and, horrors! better. So that's a triple whammy. Your loyal readers went elsewhere, and not only did they not pay, they won't be coming back either.

Bad decision!

Additionally, if you read the article, they talk about "revenue". Yes, but what was the "profit"? My guess is there was none.

A reasonable guess of the future is that the Wall Street Journal is next, and after that The Economist and The Financial Times.

So what does work?

The relationship!

If you understand this, you'll also understand why the "Dining" and "Science" sections of newspapers are doomed. Specialization of content is here to stay, and the only people who hang around are the ones who perceive value in your content. You had better respect this relationship.

This should also explain why the Book-of-the-Month clubs may or may not make a lot of money but Miltary-Books-of-the-Month and Gardening-Books-of-the-Month made monster profits.

This is a brutal lesson for traditional media (newspapers, radio, television, music, film, advertising) to learn. Their failures will be taught in business schools some day.

The New York Times will stop charging for access to parts of its Web site, effective at midnight tonight.

The move comes two years to the day after The Times began the subscription program, TimesSelect, which has charged $49.95 a year, or $7.95 a month, for online access to the work of its columnists and to the newspaper’s archives. TimesSelect has been free to print subscribers to The Times and to some students and educators.

In addition to opening the entire site to all readers, The Times will also make available its archives from 1987 to the present without charge, as well as those from 1851 to 1922, which are in the public domain. There will be charges for some material from the period 1923 to 1986, and some will be free.

The Times said the project had met expectations, drawing 227,000 paying subscribers — out of 787,000 over all — and generating about $10 million a year in revenue.

What changed, The Times said, was that many more readers started coming to the site from search engines and links on other sites instead of coming directly to NYTimes.com. These indirect readers, unable to get access to articles behind the pay wall and less likely to pay subscription fees than the more loyal direct users, were seen as opportunities for more page views and increased advertising revenue.

Here we see a classic failure of business -- its inability to see that the business model that it was based on has gone away, and it's not coming back.

Very few businesses take the introspective look. For one, it's hard, and two, you may not like what you see.

Let's first observe what the failure was; then, we may be able to predict what the future holds a little better.

The Net has done three things:

This blog itself is an example of all three. You are reading a extremely specialized blog, and my cost of publication is non-existent. You are not tied down to reading this every morning or even periodically. If you don't like the content, you are free to go elsewhere, and you may not come back.

"Times Select" didn't understand the rules. For one, it broke the link that traditional readers had. The readers had been programmed (for decades) to read the daily editorial. When you put this behind a "pay wall", you're penalizing the most loyal customers.

The customers went elsewhere for their daily editorial content, and not only found it, found it to be plentiful and, horrors! better. So that's a triple whammy. Your loyal readers went elsewhere, and not only did they not pay, they won't be coming back either.

Bad decision!

Additionally, if you read the article, they talk about "revenue". Yes, but what was the "profit"? My guess is there was none.

A reasonable guess of the future is that the Wall Street Journal is next, and after that The Economist and The Financial Times.

So what does work?

The relationship!

If you understand this, you'll also understand why the "Dining" and "Science" sections of newspapers are doomed. Specialization of content is here to stay, and the only people who hang around are the ones who perceive value in your content. You had better respect this relationship.

This should also explain why the Book-of-the-Month clubs may or may not make a lot of money but Miltary-Books-of-the-Month and Gardening-Books-of-the-Month made monster profits.

This is a brutal lesson for traditional media (newspapers, radio, television, music, film, advertising) to learn. Their failures will be taught in business schools some day.

Tuesday, September 18, 2007

I don't think you know what that word means...

From Bloomberg: Housing Market Slump `Unthinkable' in Spain, Government Says.

A residential real estate slump in Spain, where prices have almost tripled since 1997, is ``unthinkable,'' the top economic adviser of Prime Minister Jose Luis Rodriguez Zapatero said.

The solvency of the banking system and of real estate developers, as well as the unmet demand for new homes, will prevent any meaningful price erosion, David Taguas, head of the prime minister's economic research unit, said in an interview yesterday at his office at the presidential palace in Madrid.

``To talk about severe adjustments or a meltdown in prices is ridiculous,'' Taguas said in response to reports pointing to an end of the Spanish real estate boom. ``That sort of crisis is unthinkable.''

Unthinkable, eh?

Think again!

Now, that Northern Rock can't give sub-primes to Brits, who are you going to sell the excess inventory to?

Zapatero is going to be eating his zapatos before long!

A residential real estate slump in Spain, where prices have almost tripled since 1997, is ``unthinkable,'' the top economic adviser of Prime Minister Jose Luis Rodriguez Zapatero said.

The solvency of the banking system and of real estate developers, as well as the unmet demand for new homes, will prevent any meaningful price erosion, David Taguas, head of the prime minister's economic research unit, said in an interview yesterday at his office at the presidential palace in Madrid.

``To talk about severe adjustments or a meltdown in prices is ridiculous,'' Taguas said in response to reports pointing to an end of the Spanish real estate boom. ``That sort of crisis is unthinkable.''

Unthinkable, eh?

Think again!

Now, that Northern Rock can't give sub-primes to Brits, who are you going to sell the excess inventory to?

Zapatero is going to be eating his zapatos before long!

Thursday, September 13, 2007

Mooning Silicon Valley

From the AP, we have Google Sponsors $30 Million Moon Contest.

Google Inc. is bankrolling a $30 million out-of-this-world prize to the first private company that can safely land a robotic rover on the moon and beam back a gigabyte of images and video to Earth, the Internet search leader said Thursday.

The rules call for a spacecraft to trek at least 1,312 feet across the lunar surface and return a package of data including self-portraits, panoramic views and near-real time videos.

Let's see, they paid $1B for YouTube! and you get $30M to send a robot to the moon, and make it drive.

Hoo-kay! I'm gonna go run out and practice my slingshot tonight. Right after the moon rises.

I think the Google folks have not just drunk the Kool-Aid(TM) but they've started snorting it (Keith Richards style.)

I'm gonna start my own competition: I'll give you $100M if you send the robot to take a drive on the Sun.

Google Inc. is bankrolling a $30 million out-of-this-world prize to the first private company that can safely land a robotic rover on the moon and beam back a gigabyte of images and video to Earth, the Internet search leader said Thursday.

The rules call for a spacecraft to trek at least 1,312 feet across the lunar surface and return a package of data including self-portraits, panoramic views and near-real time videos.

Let's see, they paid $1B for YouTube! and you get $30M to send a robot to the moon, and make it drive.

Hoo-kay! I'm gonna go run out and practice my slingshot tonight. Right after the moon rises.

I think the Google folks have not just drunk the Kool-Aid(TM) but they've started snorting it (Keith Richards style.)

I'm gonna start my own competition: I'll give you $100M if you send the robot to take a drive on the Sun.

Sunday, September 02, 2007

The D word

To doubt the equivocation of the fiend

That lies like truth: ‘Fear not, till Birnam wood

Do come to Dunsinane:’ and now a wood

Comes toward Dunsinane.

Fear not for the Big R; we've already been steeped in it for the last year or so. The experts will confirm it with perfect 20-20 hindsight.

Fear for the Big D.

Saturday, September 01, 2007

Subscribe to:

Posts (Atom)