I miss Goldilocks. I really really do. I miss the fact that they no longer talk about her on CNBC.

Where's my Goldilocks Economy?

Did Goldie get sodomized by the three bears? Is she now flashing "six-inch hooker heels, and a `tramp stamp'"? Is there some deep dark shameful secret that nobody wants to talk about?

Where is she?

Bring her back, says I!

Friday, November 30, 2007

Tuesday, November 27, 2007

Brain Meltdown

From Bloomberg: U.S. Stocks Rebound, Led by Banks; Citigroup, Intel Shares Rise.

Altria Group Inc., the world's largest tobacco maker, increased after Goldman Sachs Group Inc. advised buying shares whose profits aren't tied to the economy.

Huh?!? (insert head-scratching)

Altria Group Inc., the world's largest tobacco maker, increased after Goldman Sachs Group Inc. advised buying shares whose profits aren't tied to the economy.

Huh?!? (insert head-scratching)

Monday, November 26, 2007

The Smell Test

CBS Marketwatch reports: HSBC to provide $35 billion in funding to SIVs.

HSBC Holdings on Monday said it would move two of its structured investment vehicles onto its balance sheet and provide up to $35 billion in funding, saying it doesn't expect a near-term resolution of the funding problems faced by the vehicles that it and other banks operate.

The bank said it is providing up to $35 billion in funding, and its balance sheet will expand by $45 billion.

But the banking giant insists earnings won't be materially impacted, because existing investors will continue to bear all economic risk from actual losses. It added that the move won't impact capital requirements much, either.

"We believe that HSBC's actions will set a benchmark and restore a degree of confidence to the SIV sector, while providing a specific solution to address the challenges faced by investors in Cullinan and Asscher, the two SIVs managed by HSBC," the bank said in a statement.

Here's my interpretation:

HSBC blinked first. Citibank, Bank of America, and J.P.Morgan are currentily in the process of beshitting themselves.

From Bloomberg: Bank of America Takes Lead in Backing `SuperSIV' Fund.

Loomis Sayles & Co. declined to invest after receiving one of 16 invitations for a personal meeting last week with current Fed Chairman Ben Bernanke, said Daniel Fuss, who oversees $22 billion as chief investment officer at the Boston-based firm.

``It's so nice to get a personal invitation to go to Washington and have a one-hour visit with Ben Bernanke,'' said Fuss, who decided participating wasn't worth the risk to his firm. ``Oh, boy, did I feel important for about 27 seconds, and then you smell a rat.''

Bravo!!!

HSBC Holdings on Monday said it would move two of its structured investment vehicles onto its balance sheet and provide up to $35 billion in funding, saying it doesn't expect a near-term resolution of the funding problems faced by the vehicles that it and other banks operate.

The bank said it is providing up to $35 billion in funding, and its balance sheet will expand by $45 billion.

But the banking giant insists earnings won't be materially impacted, because existing investors will continue to bear all economic risk from actual losses. It added that the move won't impact capital requirements much, either.

"We believe that HSBC's actions will set a benchmark and restore a degree of confidence to the SIV sector, while providing a specific solution to address the challenges faced by investors in Cullinan and Asscher, the two SIVs managed by HSBC," the bank said in a statement.

Here's my interpretation:

HSBC blinked first. Citibank, Bank of America, and J.P.Morgan are currentily in the process of beshitting themselves.

From Bloomberg: Bank of America Takes Lead in Backing `SuperSIV' Fund.

Loomis Sayles & Co. declined to invest after receiving one of 16 invitations for a personal meeting last week with current Fed Chairman Ben Bernanke, said Daniel Fuss, who oversees $22 billion as chief investment officer at the Boston-based firm.

``It's so nice to get a personal invitation to go to Washington and have a one-hour visit with Ben Bernanke,'' said Fuss, who decided participating wasn't worth the risk to his firm. ``Oh, boy, did I feel important for about 27 seconds, and then you smell a rat.''

Bravo!!!

Saturday, November 24, 2007

You really stuck it to the Man, man!

From the Richmond Times, we have: Dream in distress.

Scott and Dawn Loving were able to stop the foreclosure on their house -- at least temporarily.

The Lovings got into trouble when the subprime adjustable-rate mortgage on their Chesterfield County home reset after two years.

Their monthly payment jumped from $1,250 to $1,400, resetting six months later at $1,600, then again at $1,650. Their new payment consumed more than half their net income.

They got the subprime loan because their credit was damaged years ago when they went on a debt-management plan to pay off $30,000 in credit-card debt.

They were locked into their original mortgage because it carried a hefty prepayment penalty.

As soon as the penalty phase passed, they looked into refinancing. "At least a dozen lenders turned us down," Scott said.

They found one taker. The payoff on the old loan -- a combo ARM and fixed-rate mortgage -- was $137,000.

They walked away with another ARM. This one was for $161,000, which increased their debt. It included $4,000 in cash. Fees and closing costs totaled $20,000.

"We didn't feel we had any choice," Scott said.

The new payment is $1,623, not much better than the $1,650 payment on the old loan. "But we had a fresh start," he said.

The initial interest rate on the new loan is 9.8 percent, 0.1 percent better than the old loan. It, too, has a prepayment penalty -- 5 percent of the loan amount. It resets next June.

Let's see:

You were bothered because you were paying half your salary on $137K.

Now, you owe $161K.

Some jack-off ran away with $20K that you now have to repay.

You also got $4K "back". You do realize that the $4K was a loan that you have to pay back, dontcha?

The loan resets in 6 months. Guess what's it gonna reset to, and guess what happens to a payment on a larger loan. You should sit down and check whether it will take up more than half your salary or not.

You're a regular Cheese-Whiz, d00d! You should run for Congress.

Scott and Dawn Loving were able to stop the foreclosure on their house -- at least temporarily.

The Lovings got into trouble when the subprime adjustable-rate mortgage on their Chesterfield County home reset after two years.

Their monthly payment jumped from $1,250 to $1,400, resetting six months later at $1,600, then again at $1,650. Their new payment consumed more than half their net income.

They got the subprime loan because their credit was damaged years ago when they went on a debt-management plan to pay off $30,000 in credit-card debt.

They were locked into their original mortgage because it carried a hefty prepayment penalty.

As soon as the penalty phase passed, they looked into refinancing. "At least a dozen lenders turned us down," Scott said.

They found one taker. The payoff on the old loan -- a combo ARM and fixed-rate mortgage -- was $137,000.

They walked away with another ARM. This one was for $161,000, which increased their debt. It included $4,000 in cash. Fees and closing costs totaled $20,000.

"We didn't feel we had any choice," Scott said.

The new payment is $1,623, not much better than the $1,650 payment on the old loan. "But we had a fresh start," he said.

The initial interest rate on the new loan is 9.8 percent, 0.1 percent better than the old loan. It, too, has a prepayment penalty -- 5 percent of the loan amount. It resets next June.

Let's see:

You were bothered because you were paying half your salary on $137K.

Now, you owe $161K.

Some jack-off ran away with $20K that you now have to repay.

You also got $4K "back". You do realize that the $4K was a loan that you have to pay back, dontcha?

The loan resets in 6 months. Guess what's it gonna reset to, and guess what happens to a payment on a larger loan. You should sit down and check whether it will take up more than half your salary or not.

You're a regular Cheese-Whiz, d00d! You should run for Congress.

Wednesday, November 21, 2007

Knock, knock, knocking on Norwegian Wood?

All the way from icy Norway, we have Townships caught up in international credit crisis.

Several small townships in northern Norway went along with a securities firm's advice and invested as much as NOK 4 billion in complicated American commercial paper sold by Citibank. They now risk losing it all.

The township politicians are both embarrassed and angry at the financial advisers who they now claim led them astray. "They think we're a bunch of small-town fools," one local mayor told newspaper Dagens Næringsliv.

Excuse me, you are a bunch of small-town fools.

Like yokels everywhere, you were probably wined and dined by Citibank, and you fell for the bait.

Terra officials say they're sorry about the losses, but claim the townships are viewed as "professional players" in the financial markets and must also take responsibility "for the investments they choose to make."

The politicians claim they "asked all the questions we could" about risk levels, not least those tied to currency valuation. The US dollar is also extremely weak at present against the Norwegian kroner, reducing relative values of US holdings.

While the finger-pointing continues, the townships are obligated to put what some fear is good money after bad. Norwegian townships that are suddenly relatively wealthy on energy revenues are also learning to be more cautious, as they face constant, complicated investment offers from foreign institutions.

Experience keeps a dear school but fools will learn in no other.

Several small townships in northern Norway went along with a securities firm's advice and invested as much as NOK 4 billion in complicated American commercial paper sold by Citibank. They now risk losing it all.

The township politicians are both embarrassed and angry at the financial advisers who they now claim led them astray. "They think we're a bunch of small-town fools," one local mayor told newspaper Dagens Næringsliv.

Excuse me, you are a bunch of small-town fools.

Like yokels everywhere, you were probably wined and dined by Citibank, and you fell for the bait.

Terra officials say they're sorry about the losses, but claim the townships are viewed as "professional players" in the financial markets and must also take responsibility "for the investments they choose to make."

The politicians claim they "asked all the questions we could" about risk levels, not least those tied to currency valuation. The US dollar is also extremely weak at present against the Norwegian kroner, reducing relative values of US holdings.

While the finger-pointing continues, the townships are obligated to put what some fear is good money after bad. Norwegian townships that are suddenly relatively wealthy on energy revenues are also learning to be more cautious, as they face constant, complicated investment offers from foreign institutions.

Experience keeps a dear school but fools will learn in no other.

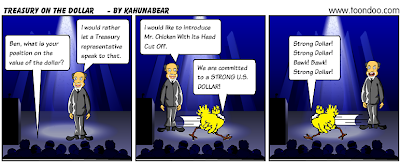

Jawboning

From the esteemed Wall Street Journal, we have: Paulson Shifts on Mortgages.

U.S. Treasury Secretary Henry Paulson, concerned that millions of homeowners aren't being helped quickly enough, is pressing the mortgage-service industry to help broad swaths of borrowers qualify for better loans instead of dealing with mortgage problems on a case-by-case basis.

In an interview, Mr. Paulson said the number of potential home-loan defaults "will be significantly bigger" in 2008 than in 2007. He said he is "aggressively encouraging" the mortgage-service industry -- which collects loan payments from borrowers -- to develop criteria that would enable large groups of borrowers who might default on their payments to qualify for loans with better terms.

Let us first take a detour:

We first had this from CNN on April 20th.

"All the signs I look at" show "the housing market is at or near the bottom," Paulson said. The U.S. economy is "very healthy" and "robust," he said.

Then, we had this on July 2nd.

"In terms of looking at housing, most of us believe that it's at or near the bottom," he told Reuters in an interview.

Mr. Paulson, you seem to be coming around to Planet Reality(TM). You know the one that Warren Buffett lives on?

Also, "aggressively encouraging" is not a plan. Agreed?

Flapping your gums doesn't seem to be having much of an effect as you may have noticed. Of course, you and I both know that that was never the plan but perception matters particularly at the level at which you are operating. Agreed?

You may want to consult this graph again. Time's kinda running out.

There's just one teensy-weensy niggling little problem with the "broad swaths" solution. The vast majority people wouldn't be able to pay back the principal even if you gave them loans at 0% interest. So I would advise a Plan B.

And if they hand back the house, then their paying neighbors might also refuse to pay inordinate sums, and may also hand back the house. In that case, I would advise a Plan C as well.

Incidentally, how's that Super-SIV plan of yours working out?

U.S. Treasury Secretary Henry Paulson, concerned that millions of homeowners aren't being helped quickly enough, is pressing the mortgage-service industry to help broad swaths of borrowers qualify for better loans instead of dealing with mortgage problems on a case-by-case basis.

In an interview, Mr. Paulson said the number of potential home-loan defaults "will be significantly bigger" in 2008 than in 2007. He said he is "aggressively encouraging" the mortgage-service industry -- which collects loan payments from borrowers -- to develop criteria that would enable large groups of borrowers who might default on their payments to qualify for loans with better terms.

Let us first take a detour:

We first had this from CNN on April 20th.

"All the signs I look at" show "the housing market is at or near the bottom," Paulson said. The U.S. economy is "very healthy" and "robust," he said.

Then, we had this on July 2nd.

"In terms of looking at housing, most of us believe that it's at or near the bottom," he told Reuters in an interview.

Mr. Paulson, you seem to be coming around to Planet Reality(TM). You know the one that Warren Buffett lives on?

Also, "aggressively encouraging" is not a plan. Agreed?

Flapping your gums doesn't seem to be having much of an effect as you may have noticed. Of course, you and I both know that that was never the plan but perception matters particularly at the level at which you are operating. Agreed?

You may want to consult this graph again. Time's kinda running out.

There's just one teensy-weensy niggling little problem with the "broad swaths" solution. The vast majority people wouldn't be able to pay back the principal even if you gave them loans at 0% interest. So I would advise a Plan B.

And if they hand back the house, then their paying neighbors might also refuse to pay inordinate sums, and may also hand back the house. In that case, I would advise a Plan C as well.

Incidentally, how's that Super-SIV plan of yours working out?

Tuesday, November 20, 2007

2 Good 2 B 4got10

From Newsday, we have: Loan was too good to be true.

Robin and William Fitzgerald always wanted to buy a home, but with no savings, mediocre credit and jobs as a legal secretary and truck driver, they thought it was beyond their reach.

Then, in 2005, the Fitzgeralds believed their luck had turned.

Through a friend, they met Aaron Wider, a Garden City mortgage banker who also owned several homes in the Massapequa area. They settled on a two-family high ranch in North Massapequa at a sales price of $805,000.

Because Wider also was a mortgage banker, he said he could approve a loan that other banks wouldn't, the Fitzgeralds recalled. "It was like he was giving us an opportunity for us to fulfill our dream," Robin Fitzgerald said.

After a year of struggling with mortgage payments that -- minus rent from tenants -- were $3,400 a month, the Fitzgeralds fell behind. Last March, Pennsylvania-based GMAC Bank, which had bought their loans from Wider's bank, began foreclosure proceedings.

Only then, after hiring their own appraiser, did the Fitzgeralds learn that their home was valued at $545,000 when they bought it.

No savings, mediocre credit, barely job-worthy, didn't do any homework, borrowed $800K to buy a house which may or may not have been "worth" $545K.

What a bunch of fuckin' ding-dongs!

George Cornielle was living in Elmhurst with his wife and grown daughter in 2005, when a friend who did construction work for Wider asked Cornielle if he was interested in buying a home.

"I wasn't even thinking about a house," Cornielle said. "I said 'I don't think I qualify.' " But the friend assured Cornielle that Wider could arrange a loan and soon Cornielle was in contract to buy a high ranch in East Massapequa for $812,500.

Cornielle, who is a $52,000-a-year catering supervisor at Kennedy Airport, said he paid a down payment of $17,000 and didn't ask questions when lawyers placed dozens of documents before him to sign. Cornielle said he used a lawyer Wider provided him; Wider did not comment on Cornielle's case.

Cornielle said he did not notice that personal information in his loan application was incorrect. The papers say he has two children, ages 13 and 14, and that he earns $14,500 a month -- more than triple what he said he actually makes.

Although Cornielle is not in foreclosure, he said he is one month behind on his mortgage payments and has borrowed up to $60,000 from family and friends in order to avoid defaulting.

Cornielle eventually obtained copies of the appraisals, which showed the house was worth $830,000 and $825,000 in 2005. Cornielle paid for a new appraisal in July, which showed the house was valued last summer at $484,000.

Wider said he considers the Fitzgeralds personal friends. Robin Fitzgerald tells a different story.

"I said Aaron, 'You're like a walking angel.' That's how I felt about him," Fitzgerald said. "We felt like he was the answer to our prayers."

Now, she said, she often cries herself to sleep.

Didn't notice the phantom income; didn't notice two fake young children; didn't notice the fake appraisal of $825K from $484K; borrowed more than 15X his income to buy a house which was "worth" slightly more than half that; currently continuing to borrow $60K from family which will obviously never get paid back.

Now his wife cries herself to sleep.

Lady, you're gonna learn a lesson as old as time : debt never sleeps!

Is this a great fuckin' country or what?

Robin and William Fitzgerald always wanted to buy a home, but with no savings, mediocre credit and jobs as a legal secretary and truck driver, they thought it was beyond their reach.

Then, in 2005, the Fitzgeralds believed their luck had turned.

Through a friend, they met Aaron Wider, a Garden City mortgage banker who also owned several homes in the Massapequa area. They settled on a two-family high ranch in North Massapequa at a sales price of $805,000.

Because Wider also was a mortgage banker, he said he could approve a loan that other banks wouldn't, the Fitzgeralds recalled. "It was like he was giving us an opportunity for us to fulfill our dream," Robin Fitzgerald said.

After a year of struggling with mortgage payments that -- minus rent from tenants -- were $3,400 a month, the Fitzgeralds fell behind. Last March, Pennsylvania-based GMAC Bank, which had bought their loans from Wider's bank, began foreclosure proceedings.

Only then, after hiring their own appraiser, did the Fitzgeralds learn that their home was valued at $545,000 when they bought it.

No savings, mediocre credit, barely job-worthy, didn't do any homework, borrowed $800K to buy a house which may or may not have been "worth" $545K.

What a bunch of fuckin' ding-dongs!

George Cornielle was living in Elmhurst with his wife and grown daughter in 2005, when a friend who did construction work for Wider asked Cornielle if he was interested in buying a home.

"I wasn't even thinking about a house," Cornielle said. "I said 'I don't think I qualify.' " But the friend assured Cornielle that Wider could arrange a loan and soon Cornielle was in contract to buy a high ranch in East Massapequa for $812,500.

Cornielle, who is a $52,000-a-year catering supervisor at Kennedy Airport, said he paid a down payment of $17,000 and didn't ask questions when lawyers placed dozens of documents before him to sign. Cornielle said he used a lawyer Wider provided him; Wider did not comment on Cornielle's case.

Cornielle said he did not notice that personal information in his loan application was incorrect. The papers say he has two children, ages 13 and 14, and that he earns $14,500 a month -- more than triple what he said he actually makes.

Although Cornielle is not in foreclosure, he said he is one month behind on his mortgage payments and has borrowed up to $60,000 from family and friends in order to avoid defaulting.

Cornielle eventually obtained copies of the appraisals, which showed the house was worth $830,000 and $825,000 in 2005. Cornielle paid for a new appraisal in July, which showed the house was valued last summer at $484,000.

Wider said he considers the Fitzgeralds personal friends. Robin Fitzgerald tells a different story.

"I said Aaron, 'You're like a walking angel.' That's how I felt about him," Fitzgerald said. "We felt like he was the answer to our prayers."

Now, she said, she often cries herself to sleep.

Didn't notice the phantom income; didn't notice two fake young children; didn't notice the fake appraisal of $825K from $484K; borrowed more than 15X his income to buy a house which was "worth" slightly more than half that; currently continuing to borrow $60K from family which will obviously never get paid back.

Now his wife cries herself to sleep.

Lady, you're gonna learn a lesson as old as time : debt never sleeps!

Is this a great fuckin' country or what?

Thursday, November 15, 2007

The Gentleman's Index

The Herengracht (Gentleman's Canal) is one of the most desirable places in Amsterdam, and thanks to the finicky particular capitalists that the Dutch traditionally were, we have an uninterrupted view of house prices for more than 350 years.

Here's what it looks like (the graph is adjusted for inflation.) Even if you don't speak Dutch you should be able to guess easily.

Here's what it looks like (the graph is adjusted for inflation.) Even if you don't speak Dutch you should be able to guess easily.

How to cope if you're a senior?

Wednesday, November 14, 2007

Cleaving Cleveland

From the BBC: Foreclosure wave sweeps America.

Of course, the BBC is spinning the story as, "Look at those stupid people across the Pond" while ignoring the fact that Britain's situation is an order of magnitude worse.

Now, CNN seems to have picked up that story: Where Cleveland went wrong.

What made Cleveland the nation's foreclosure epicenter?

Like most rust-belt cities, it's suffered serious economic setbacks. The city lost jobs at more than three times the national rate during 2001 through 2003 and has not had a meaningful recovery since, according to Richard DeKaser, chief economist at Cleveland-based mortgage lender National City Corp. The state of Ohio recorded a quarter of all U.S. manufacturing job losses since 2001.

Add considerable population shrinkage: With 450,000 people, Cleveland has fewer than half the residents it boasted in 1950, when only six cities in the nation were larger.

As the Treasurer of Cuyahoga County in Ohio, Jim Rokakis spends a lot of his time trying to deal with Cleveland's foreclosure crisis.

According to Rokakis, Cleveland got hammered because lax governmental oversight from the state allowed Wild-West lending. "No one was watching," he said. "There was no sheriff in town. The state legislature was dominated by banking interests."

Cleveland tried to enact local anti-predatory lending ordinances in 2002, but national lenders then abandoned the market, according to Mark Wiseman, who heads the Cuyahoga County Foreclosure Prevention Program, which is part of the county treasurer's office.

One bank representative, speaking under condition of anonymity, said the ordinances would have put local lending criteria well above and beyond the national standards. The lenders wanted no part of that.

For Rokakis, this long-term lack of accountability enabled lenders to continue to make bad loans virtually unchecked. These included many subprime, hybrid ARMs, also called "toxic ARMs," products he considers predatory.

But even the staunchly pro-consumer Rokakis admitted that predatory lending victims are not entirely blameless for their own problems.

With times hard, "People were looking for a way to make a living," he said. "There were all these 'Buy real estate with no credit and no down payment deals.' The way to wealth was real estate."

Rokakis told of a 78-year-old Cleveland woman recently saddled with an unaffordable, 30-year ARM arranged by her minister, a mortgage broker. "I asked him why," said Rokakis, "you would give an elderly woman an ARM. He said, 'She wanted the house.'"

Roakakis shook his head. "I want a date with Uma Thurman," he said, "but you have to be realistic."

Of course, the BBC is spinning the story as, "Look at those stupid people across the Pond" while ignoring the fact that Britain's situation is an order of magnitude worse.

Now, CNN seems to have picked up that story: Where Cleveland went wrong.

What made Cleveland the nation's foreclosure epicenter?

Like most rust-belt cities, it's suffered serious economic setbacks. The city lost jobs at more than three times the national rate during 2001 through 2003 and has not had a meaningful recovery since, according to Richard DeKaser, chief economist at Cleveland-based mortgage lender National City Corp. The state of Ohio recorded a quarter of all U.S. manufacturing job losses since 2001.

Add considerable population shrinkage: With 450,000 people, Cleveland has fewer than half the residents it boasted in 1950, when only six cities in the nation were larger.

As the Treasurer of Cuyahoga County in Ohio, Jim Rokakis spends a lot of his time trying to deal with Cleveland's foreclosure crisis.

According to Rokakis, Cleveland got hammered because lax governmental oversight from the state allowed Wild-West lending. "No one was watching," he said. "There was no sheriff in town. The state legislature was dominated by banking interests."

Cleveland tried to enact local anti-predatory lending ordinances in 2002, but national lenders then abandoned the market, according to Mark Wiseman, who heads the Cuyahoga County Foreclosure Prevention Program, which is part of the county treasurer's office.

One bank representative, speaking under condition of anonymity, said the ordinances would have put local lending criteria well above and beyond the national standards. The lenders wanted no part of that.

For Rokakis, this long-term lack of accountability enabled lenders to continue to make bad loans virtually unchecked. These included many subprime, hybrid ARMs, also called "toxic ARMs," products he considers predatory.

But even the staunchly pro-consumer Rokakis admitted that predatory lending victims are not entirely blameless for their own problems.

With times hard, "People were looking for a way to make a living," he said. "There were all these 'Buy real estate with no credit and no down payment deals.' The way to wealth was real estate."

Rokakis told of a 78-year-old Cleveland woman recently saddled with an unaffordable, 30-year ARM arranged by her minister, a mortgage broker. "I asked him why," said Rokakis, "you would give an elderly woman an ARM. He said, 'She wanted the house.'"

Roakakis shook his head. "I want a date with Uma Thurman," he said, "but you have to be realistic."

Giambattista Vico and the Cyclicity of History

From a Florida ad.

From within your architecturally distinctive residence or upon its gracious terrace, you feel the caress of a bay breeze as you gaze across the urban landscape and emerald waters. And yet, you remain one cool remove from the sea and city sites at your feet. Privacy and luxury envelop you. Rooftop gardens and terraces create an enchanting oasis in the heart of the city.

Here's a similar ad.

Where you sit and watch at twilight the fronds of the graceful palm, latticed against the fading gold of the sun-kissed sky–

Where sun, moon and stars, at eventide, stage a welcome constituting the glorious galaxy of the firmament–Where the whispering breeze springs fresh from the lap of Caribbean and woos with elusive cadence like unto a mother’s lullaby–Where the silver cycle is heaven’s lavalier, and the full orbit its glorious pendant.

Except the second ad is from 1925 right before the Great Florida Bust of 1926. Prices didn't recover in nominal terms until 1986.

Plus ça change, plus ...

From within your architecturally distinctive residence or upon its gracious terrace, you feel the caress of a bay breeze as you gaze across the urban landscape and emerald waters. And yet, you remain one cool remove from the sea and city sites at your feet. Privacy and luxury envelop you. Rooftop gardens and terraces create an enchanting oasis in the heart of the city.

Here's a similar ad.

Where you sit and watch at twilight the fronds of the graceful palm, latticed against the fading gold of the sun-kissed sky–

Where sun, moon and stars, at eventide, stage a welcome constituting the glorious galaxy of the firmament–Where the whispering breeze springs fresh from the lap of Caribbean and woos with elusive cadence like unto a mother’s lullaby–Where the silver cycle is heaven’s lavalier, and the full orbit its glorious pendant.

Except the second ad is from 1925 right before the Great Florida Bust of 1926. Prices didn't recover in nominal terms until 1986.

Plus ça change, plus ...

Banker-ese

From Bloomberg: JPMorgan Says SIVs Will `Go the Way of the Dinosaur'.

JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon said structured investment vehicles, whose assets have dwindled by at least $75 billion since July, will ``go the way of the dinosaur.''

``SIVs don't have a business purpose,'' Dimon told a conference hosted by Merrill Lynch & Co. in New York today.

Sure they do.

They're a mechanism for evading capital requirements hence allowing much larger leverage than is legal.

And what's so radical about SIV's anyway? All they do is borrow short, and lend long taken to an absurd extreme. That's like Banking 101 -- the stuff they teach undergraduates on the first day of class.

What are you, retarded?

JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon said structured investment vehicles, whose assets have dwindled by at least $75 billion since July, will ``go the way of the dinosaur.''

``SIVs don't have a business purpose,'' Dimon told a conference hosted by Merrill Lynch & Co. in New York today.

Sure they do.

They're a mechanism for evading capital requirements hence allowing much larger leverage than is legal.

And what's so radical about SIV's anyway? All they do is borrow short, and lend long taken to an absurd extreme. That's like Banking 101 -- the stuff they teach undergraduates on the first day of class.

What are you, retarded?

Monday, November 12, 2007

Is Switzerland really Turkmenistan?

From the LA Times: S & P slashes State Street CDO rating.

The ratings on the most senior class of Carina CDO Ltd. were lowered to BB, two levels below investment grade, from AAA, while another AAA class was slashed 18 steps to CCC-minus. The chance of material losses to note holders is high, New York-based S&P said.

Eighteen notches, count 'em, eighteen.

It's as if you thought you were loaning money to the Swiss, and instead found that you'd bought bonds from Uruguay or Turkmenistan!

Hurray for the lawyers!

The ratings on the most senior class of Carina CDO Ltd. were lowered to BB, two levels below investment grade, from AAA, while another AAA class was slashed 18 steps to CCC-minus. The chance of material losses to note holders is high, New York-based S&P said.

Eighteen notches, count 'em, eighteen.

It's as if you thought you were loaning money to the Swiss, and instead found that you'd bought bonds from Uruguay or Turkmenistan!

Hurray for the lawyers!

Saturday, November 10, 2007

New York is "Special"

From the New York Sun: Condo Fee Defaults Surge in Manhattan.

A precipitous rise in the number of condominium owners who are defaulting on their common payments, an important indicator of future foreclosures, is being reported.

Much has been said about Manhattan's perceived real estate invincibility in the aftermath of the subprime meltdown, but lawyers representing dozens of condominium boards in some of the city's wealthiest neighborhoods say they are seeing these default cases increase as much as 25% this year.

Let's review the situation one more time.

While the desire to live in Manhattan/San Francisco/Paris/Rome is infinite, the means to do so are decidedly not.

Are we clear on this concept?

And just for those who think everyone in Manhattan is "rich", the median income is $50K. Just Manhattan, not the five boroughs; just the frakkin' island; and that's familial income, not individual income.

There seems to be one more argument made. The Europeans/Arabs/Chinese will buy the property now that the dollar is sinking.

It doesn't matter.

What matters is whether or not the local incomes support the rent. If they don't, it doesn't matter what you paid for the condo. You won't be able to rent it out for anywhere near the carrying costs, and if you can't rent it out for the carrying costs, you overpaid. The END.

This actually brings us to an old joke of how "economists know the price of everything but the value of nothing".

This is an argument about valuation not price, and the valuation depends on rent, and rents depend on local incomes. The price may appear cheap denominated in euros/dinar/remnimbi but the value, alas, is quite decidedly not.

Then there's the "they'll just raise the rent" or the "rents just go up" argument.

The landlords can "demand" any rent they like but the question is how are they going to get it if the local economy doesn't support it? It's like the scene in Austin Powers where she states her name as "Ivana Hump-a-lot", and he replies, "and I wanna toilet made out of solid gold, babeee, but it's just not in the cards, now is it?"

Are we really clear about this concept as well?

At this point in time, usually, there is a final fallback argument. It's a hedge against inflation. Fine, but why would you buy a depreciating asset as a hedge? Just buy gold/oil/non-agricultural commodities if you're so worried.

Why is this absurdly simple argument so hard for people to understand?

A precipitous rise in the number of condominium owners who are defaulting on their common payments, an important indicator of future foreclosures, is being reported.

Much has been said about Manhattan's perceived real estate invincibility in the aftermath of the subprime meltdown, but lawyers representing dozens of condominium boards in some of the city's wealthiest neighborhoods say they are seeing these default cases increase as much as 25% this year.

Let's review the situation one more time.

While the desire to live in Manhattan/San Francisco/Paris/Rome is infinite, the means to do so are decidedly not.

Are we clear on this concept?

And just for those who think everyone in Manhattan is "rich", the median income is $50K. Just Manhattan, not the five boroughs; just the frakkin' island; and that's familial income, not individual income.

There seems to be one more argument made. The Europeans/Arabs/Chinese will buy the property now that the dollar is sinking.

It doesn't matter.

What matters is whether or not the local incomes support the rent. If they don't, it doesn't matter what you paid for the condo. You won't be able to rent it out for anywhere near the carrying costs, and if you can't rent it out for the carrying costs, you overpaid. The END.

This actually brings us to an old joke of how "economists know the price of everything but the value of nothing".

This is an argument about valuation not price, and the valuation depends on rent, and rents depend on local incomes. The price may appear cheap denominated in euros/dinar/remnimbi but the value, alas, is quite decidedly not.

Then there's the "they'll just raise the rent" or the "rents just go up" argument.

The landlords can "demand" any rent they like but the question is how are they going to get it if the local economy doesn't support it? It's like the scene in Austin Powers where she states her name as "Ivana Hump-a-lot", and he replies, "and I wanna toilet made out of solid gold, babeee, but it's just not in the cards, now is it?"

Are we really clear about this concept as well?

At this point in time, usually, there is a final fallback argument. It's a hedge against inflation. Fine, but why would you buy a depreciating asset as a hedge? Just buy gold/oil/non-agricultural commodities if you're so worried.

Why is this absurdly simple argument so hard for people to understand?

Thursday, November 01, 2007

Rolling a Fatty!

From the Wall Street Journal: Bear CEO's Handling

Of Crisis Raises Issues.

A crisis at Bear Stearns Cos. this summer came to a head in July. Two Bear hedge funds were hemorrhaging value. Investors were clamoring to get their money back. Lenders to the funds were demanding more collateral. Eventually, both funds collapsed.

During 10 critical days of this crisis -- one of the worst in the securities firm's 84-year history -- Bear's chief executive wasn't near his Wall Street office. James Cayne was playing in a bridge tournament in Nashville, Tenn., without a cellphone or an email device.

Eh? This is not really a problem. That's what deputies are for. Would they have made the same fuss if he was having his appendix out?

After a day of bridge at a Doubletree hotel in Memphis, in 2004, Mr. Cayne invited a fellow player and a woman to smoke pot with him, according to someone who was there, and led the two to a lobby men's room where he intended to light up. The other player declined, says the person who was there, but the woman followed Mr. Cayne inside and shared a joint, to the amusement of a passerby.

Oooh! When times are troubling, you gotta "unwind" somehow.

Most of Wall St. does alcohol. Jimmy Cayne prefers Humboldt County's finest!

"Asked more generally whether he smoked pot during bridge tournaments or on other occasions, Mr. Cayne said he would respond only "to a specific allegation," not to general questions.

Now that's being "blunt" about it!

Of Crisis Raises Issues.

A crisis at Bear Stearns Cos. this summer came to a head in July. Two Bear hedge funds were hemorrhaging value. Investors were clamoring to get their money back. Lenders to the funds were demanding more collateral. Eventually, both funds collapsed.

During 10 critical days of this crisis -- one of the worst in the securities firm's 84-year history -- Bear's chief executive wasn't near his Wall Street office. James Cayne was playing in a bridge tournament in Nashville, Tenn., without a cellphone or an email device.

Eh? This is not really a problem. That's what deputies are for. Would they have made the same fuss if he was having his appendix out?

After a day of bridge at a Doubletree hotel in Memphis, in 2004, Mr. Cayne invited a fellow player and a woman to smoke pot with him, according to someone who was there, and led the two to a lobby men's room where he intended to light up. The other player declined, says the person who was there, but the woman followed Mr. Cayne inside and shared a joint, to the amusement of a passerby.

Oooh! When times are troubling, you gotta "unwind" somehow.

Most of Wall St. does alcohol. Jimmy Cayne prefers Humboldt County's finest!

"Asked more generally whether he smoked pot during bridge tournaments or on other occasions, Mr. Cayne said he would respond only "to a specific allegation," not to general questions.

Now that's being "blunt" about it!

Subscribe to:

Posts (Atom)