One of the articles I already posted, had a nefarious tidbit that I missed the first time around. Here's the article from the LA Times again: A loan that'll get ugly fast

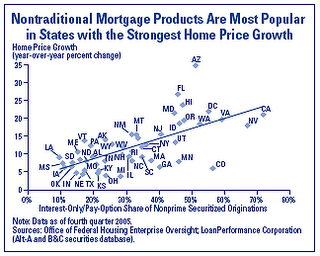

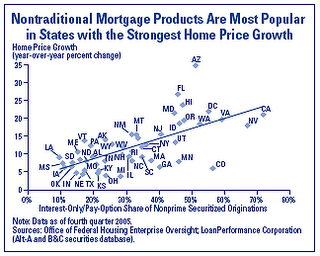

In 2003, only about 8 of every 1,000 people buying a home or refinancing a mortgage in California got a pay option loan, according to San Francisco-based data tracking company First American LoanPerformance.

Last year, 1 in 5 loan applicants got one.

In the first eight months of 2006, even as the real estate market began to weaken amid fears of a downturn, the appeal increased again. Nearly 1 in 3 California loan applicants are now choosing them. The state boasts about 580,000 active pay option mortgages, about half the U.S. total.

First, let us examine what a "pay option" loan is. Effectively, you are allowed to pay much less than the principal+interest on the loan. What happens to the difference? It gets tacked back onto the loan increasing the loan value (and naturally, you have to pay interest on that in the future.) Also, typically the rates reset to fixed ones after 3 years.

Why would you take such a loan?

Effectively, you are betting on the fact that interest rates will be lower in the future, or that you will make a lot more income in the future.

Please note emphatically that you're not betting that inflation will be higher in the future because the market will discount that in the form of higher interest rates in the future as well, and your loan will "reset" to include that!

Firstly, rates are at generational lows. I wouldn't bet on them going much lower.

Secondly, with globalization, there is no way in hell that the incomes of all of these people will be higher. Some will succeed, no doubt, but definitely not all of them.

Now, let's examine the statistics one more time:

2003: 0.8%

2005: 20%

2006: 33%

You should be able to smell the epic disaster looming in 2007, 2008, and 2009.

There is further evidence of the pain that is going to be felt:

California taxes both individuals and businesses at a very high rate. There is considerable evidence that in spite of population growth, California is losing both people and businesses. Evidence is provided below.

What this is telling me is that more and more Californians are taking on high-risk loans, and stretching to make the payments in order to maintain a lifestyle, rather than doing the rational thing, and rapidly downgrading it in the face of diminishing opportunities, and lower wages.

Back to the evidence of out-migration:

Here's a link to the data.

According to the California Department of Finance, the state recorded a net loss of about 29,000 people in 2005.

Please note that that is a loss after population growth!

The only "high tech" state that is doing considerably worse than California is Massachusetts (same high-tax problem) which is losing young workers at some abnormal rate. Currently, 20% of Boston (and surroundings) comprises of students. Yep, 20%.

Which begs the question, as to who's going to pay the piper in the future when businesses refuse to set up shop because of the taxes, and high-income earners leave the state?

California recently passed a law preventing either budgetary caps, or raising taxes, and issued new bonds that just pass the problem on to the next generation.

Spend all you like, don't increase the incoming revenue, and pass the buck along.

What would you expect the end result to be?

Every single one of my friends, anecdotally, who has set up a high-tech startup has done so outside of California or Massachusetts. Even New York is more desirable as a possible location than either of the above two. (That's simply astounding!)

If you think it can't happen, look at Maine. They have had their industry decimated for years, and nobody in their right mind would set up shop there.

Here's a typical example of a company that is planning to leave town. From the San Diego Union Tribune: SAIC is moving some of its brass east.

For some employees at SAIC's corporate headquarters in San Diego, recent weeks have been filled with anxiety over something that begins with a seemingly innocent telephone call.

“I received a phone call that was an invitation to manage my staff from our offices in McLean,” said one mid-level employee, referring to SAIC's facilities near Tyson's Corner, Va. “After some discussion, it was clear that it was more than an invitation. It was an announcement that my position was going there – with or without me.”

SAIC was founded in San Diego in 1969 and currently employs close to 5,000 people here. But the homegrown company, which specializes in complex engineering and technology programs for U.S. military and intelligence agencies, has more than 16,000 employees at its campus in McLean.

SAIC's eastward migration is logical to Wall Street analysts such as Peter Arment of JSA Research in Newport, R.I., who began covering SAIC after the company's initial public stock offering in October.

It only makes sense for a company that derives more than 90 percent of its business from the federal government to locate most of its operations close to Washington, D.C., Arment said in November.

It should be noted that for every defense job that leaves California, one or two "vendor" jobs will also leave for the same destination. Additionally, if the number of employees falls below some critical threshold, they will just move their entire operations to the other location. (It's cheaper to fly people to CA than have them live there.)

This is a non-linearity that very few analysts account for in their models.

Here's another company, Countrywide Financial that fired its employees in CA to move to Chandler, AZ (older news): Countrywide's Arizona Gold Rush: 2,000 New Jobs Phoenix-Bound.

Fast-growing Countrywide Financial Corporation (www.countrywide.com), accelerating its own sort of rewind of the California Gold Rush, has decided to add 2,000-plus new jobs in Chandler, Ariz.

"We are particularly excited about the opportunity to expand our presence in Chandler," said Patrick Benton, the company's executive vice president of administration. "As Countrywide has searched for new office locations in business-friendly areas outside of California, we have placed a good deal of focus on Arizona.

Please note unambiguously what "business friendly" means in these cases. It means "tax friendly".

So what does this have to do with careers, you may ask?

Folks, the rules of the game have changed. You are no longer guaranteed a job for any length of time. Secondly, the job may move, and either you move with it, or you get eliminated.

Anecdotally, I've changed my career once, and my job twice in the last five years, and I'm pretty much typical.

I'll go out on a limb and say that anyone who takes a 30-year mortgage is pretty much screwed. And screwed big time!

There are no guarantees for 30 years, and to argue that you're going to be in the same geographic location for even 10 is folly, in my opinion. Flexibility and nimbleness seem to be the order of the day.

After buying a house, you might as well put a giant tattoo on your forehead that your corporation and your boss can clearly see: "I'm a giant sucker. Please abuse me, and make me your bitch!"

Not having a care in the world automatically translates to higher salaries. You can aggressively negotiate for better projects and better terms, and there's not a thing that they can do about it!

This is clearly something that people carrying a white elephant of a house simply cannot afford to do.

Obviously, for people who have long-term careers (tenured faculty, or even nurses come to mind,) the argument would not apply.

Also, great careers are made by taking great risks. You can't possibly expect to succeed working for a large company. You need to work for startups, or start your own company. If you're going to take great risks career-wise, you might as well minimize any other forms of financial risk in your life.

This should be a rather simple argument to swallow!

Tuesday, December 12, 2006

Monday, December 11, 2006

Use your brains, beyatch!

From CNN Finance, we have Les Christie writing about Help! Home for sale - the Williamses.

Karen and Jerod Williams do not act rashly especially when buying houses. They tried to minimize their financial risks. And they live in one of the most affordable housing markets in the country, which, again, decreases their risk.

They bought a new home early this year, at a time when the housing market in Huntington, Indiana, their home town, was purring along, slow but steady. They then listed their old home for sale, but shortly afterward the market stalled and they haven't found a buyer. It's been nine months.

So now, the family, burdened with the work and expense of two homes, are at the limits of their budget, even though they both make good salaries. He's a machinist and she a manufacturing engineer.

"We didn't think it would ever take this long," says Karen. "If we had, we would not have bought the new house."

They have three young children Darcy, 4, Sloane, 3 and Nolan, 5 months, to support and school debt and motor vehicles to pay for. At the end of the month, there's nothing extra.

"Any emergency may lead to bankruptcy," says Karen.

The family has already suffered through one such crisis; an emergency c-section needed when Nolan was born last July. Karen had scheduled a six-week maternity leave but she needed a full eight weeks to recover.

"I hadn't planned for the extra two weeks and it really set us back," she says.

What kind of idiots are these that two extra weeks can push them into bankruptcy?

And why did they buy a new house without selling the first, or having a contingency clause on the contract?

Most importantly, if they are so hard up, why are they still breeding like rabbits?

And why is CNN wasting time on these losers?

Inquiring minds need to know!

Karen and Jerod Williams do not act rashly especially when buying houses. They tried to minimize their financial risks. And they live in one of the most affordable housing markets in the country, which, again, decreases their risk.

They bought a new home early this year, at a time when the housing market in Huntington, Indiana, their home town, was purring along, slow but steady. They then listed their old home for sale, but shortly afterward the market stalled and they haven't found a buyer. It's been nine months.

So now, the family, burdened with the work and expense of two homes, are at the limits of their budget, even though they both make good salaries. He's a machinist and she a manufacturing engineer.

"We didn't think it would ever take this long," says Karen. "If we had, we would not have bought the new house."

They have three young children Darcy, 4, Sloane, 3 and Nolan, 5 months, to support and school debt and motor vehicles to pay for. At the end of the month, there's nothing extra.

"Any emergency may lead to bankruptcy," says Karen.

The family has already suffered through one such crisis; an emergency c-section needed when Nolan was born last July. Karen had scheduled a six-week maternity leave but she needed a full eight weeks to recover.

"I hadn't planned for the extra two weeks and it really set us back," she says.

What kind of idiots are these that two extra weeks can push them into bankruptcy?

And why did they buy a new house without selling the first, or having a contingency clause on the contract?

Most importantly, if they are so hard up, why are they still breeding like rabbits?

And why is CNN wasting time on these losers?

Inquiring minds need to know!

How not to lead your life!

From the LA Times, we have David Streitfeld writing a typical melodramatic tear-jerker: A loan that'll get ugly fast.

Every day, Will Hertzberg owns a little less of his three-bedroom house in Corona.

Like hundreds of thousands of other homeowners around the state, Hertzberg has a mortgage that lets him choose how much he pays each month.

Like many of them, he always chooses to pay as little as possible.

For the moment, this allows the 56-year-old Hertzberg to continue living in his tract home despite being only marginally employed. But his debt is swelling, and his mortgage company controls his fate.

Hertzberg could sell now, but his lender would charge him an $11,034 prepayment penalty — money he doesn't have. Yet if he stays, the housing market may tank, vaporizing what little equity he has left.

"I made choices, and they happened to be the wrong choices," said Hertzberg, a big guy who lives alone amid the clutter of decades of memorabilia.

One of his options is to pay $2,513 a month. That would cover the principal and interest as if it were a traditional 30-year loan.

A second possibility is to pay $2,279, which would cover only the interest.

But each month he always takes the cheapest option: paying $1,106 and promising to make up the shortfall later.

Hertzberg bought his house 11 years ago for $129,995, immediately after his second divorce. (He has no children.) Since then, Corona and the Inland Empire have boomed.

Comparable homes in his neighborhood fetch more than $400,000. With fresh paint and a few repairs, Hertzberg could probably sell his place for $275,000 more than he paid.

He would see little of that, however, because he's already seen so much. Over the years he has taken out $190,000 in cash through refinancings.

Hertzberg's home equity paid off his credit cards, financed trips around the world that allowed him to indulge his passion for photography, bought a $32,000 Toyota Avalon and enabled some lousy investments. He bought dot-com stocks and lost money. To recoup those losses, he bought commodities — and lost money faster.

"Free money always has the unfortunate effect of making people go overboard," said Hertzberg, whose living room is strewn with financial publications including American Cash Flow Journal and Donald Trump's "How to Get Rich." "You'd be surprised how fast $190,000 can go."

The money wasn't really free, of course. It just seemed that way, the result of a radical shift during the last decade in how people view their homes.

"Homeownership has become like auto leasing, where the price of the car doesn't matter," said Rick Soukoulis, chief executive of LoanCity, a San Jose lender that funded $7 billion in mortgages in 2005. "All that matters is the size of your monthly payment."

Lenders say these new loans are all about payment choice, but Hertzberg is far from the only borrower who invariably chooses the smallest payment option. Washington Mutual Inc., which has one of the nation's largest portfolios of pay option loans, said 47% of its borrowers in this category last December took the minimum option.

Few people intend to become deeper in debt every month. Hertzberg certainly didn't.

"I assumed my future and my retirement would be taken care of by the company I worked for," he said. "I trusted corporate America."

He used to make a six-figure income selling vacation packages to corporations that would use them as customer incentives and employee bonuses. After the 9/11 terrorist attacks, the business soured.

His current sources of income include selling comic books on EBay and freelance photos to golf and travel publications. "Once you're over 55, what employer wants to hire you?" he asked. "I'm a dinosaur."

Last fall, he went to a mortgage broker and refinanced again to make his payments easier to bear. He thought he would have a five-year window before the principal started coming due.

But the day of reckoning is arriving early. By paying the minimum, Hertzberg has increased the size of his loan in a little over a year from $320,000 to $332,616. His lender, Calabasas-based Countrywide Financial Corp., recently sent him a letter warning that when his loan hits 115% of its original size he'll run out of credit with the company.

That will happen in about two years if he continues to take the smallest payment option. Then his minimum payment will automatically go up 150%, to $2,848 a month.

"If I could afford that," he said, "I wouldn't have needed this loan in the first place."

"I am rather screwed," he said.

Yes, you are!

If Hertzberg is living on borrowed time, there's small comfort in the home finance industry's endless inventiveness. It's certainly trying to tempt him. Several times a week, he gets a refinancing offer in the mail.

The latest one suggested a certain unfamiliarity with basic English, proclaiming, "Economic forecast suggests you Interest Rate will increase 1.00% every six months." But its central message was clear: "We can solve your problem in 15 minutes over the phone."

Hertzberg always looks at these fliers, hopeful in spite of himself. "I'm waiting for a 100-year loan," he said. "My heirs can worry about paying it off."

Why would your heirs work hard to bail you out of your bad decisions?

Every day, Will Hertzberg owns a little less of his three-bedroom house in Corona.

Like hundreds of thousands of other homeowners around the state, Hertzberg has a mortgage that lets him choose how much he pays each month.

Like many of them, he always chooses to pay as little as possible.

For the moment, this allows the 56-year-old Hertzberg to continue living in his tract home despite being only marginally employed. But his debt is swelling, and his mortgage company controls his fate.

Hertzberg could sell now, but his lender would charge him an $11,034 prepayment penalty — money he doesn't have. Yet if he stays, the housing market may tank, vaporizing what little equity he has left.

"I made choices, and they happened to be the wrong choices," said Hertzberg, a big guy who lives alone amid the clutter of decades of memorabilia.

One of his options is to pay $2,513 a month. That would cover the principal and interest as if it were a traditional 30-year loan.

A second possibility is to pay $2,279, which would cover only the interest.

But each month he always takes the cheapest option: paying $1,106 and promising to make up the shortfall later.

Hertzberg bought his house 11 years ago for $129,995, immediately after his second divorce. (He has no children.) Since then, Corona and the Inland Empire have boomed.

Comparable homes in his neighborhood fetch more than $400,000. With fresh paint and a few repairs, Hertzberg could probably sell his place for $275,000 more than he paid.

He would see little of that, however, because he's already seen so much. Over the years he has taken out $190,000 in cash through refinancings.

Hertzberg's home equity paid off his credit cards, financed trips around the world that allowed him to indulge his passion for photography, bought a $32,000 Toyota Avalon and enabled some lousy investments. He bought dot-com stocks and lost money. To recoup those losses, he bought commodities — and lost money faster.

"Free money always has the unfortunate effect of making people go overboard," said Hertzberg, whose living room is strewn with financial publications including American Cash Flow Journal and Donald Trump's "How to Get Rich." "You'd be surprised how fast $190,000 can go."

The money wasn't really free, of course. It just seemed that way, the result of a radical shift during the last decade in how people view their homes.

"Homeownership has become like auto leasing, where the price of the car doesn't matter," said Rick Soukoulis, chief executive of LoanCity, a San Jose lender that funded $7 billion in mortgages in 2005. "All that matters is the size of your monthly payment."

Lenders say these new loans are all about payment choice, but Hertzberg is far from the only borrower who invariably chooses the smallest payment option. Washington Mutual Inc., which has one of the nation's largest portfolios of pay option loans, said 47% of its borrowers in this category last December took the minimum option.

Few people intend to become deeper in debt every month. Hertzberg certainly didn't.

"I assumed my future and my retirement would be taken care of by the company I worked for," he said. "I trusted corporate America."

He used to make a six-figure income selling vacation packages to corporations that would use them as customer incentives and employee bonuses. After the 9/11 terrorist attacks, the business soured.

His current sources of income include selling comic books on EBay and freelance photos to golf and travel publications. "Once you're over 55, what employer wants to hire you?" he asked. "I'm a dinosaur."

Last fall, he went to a mortgage broker and refinanced again to make his payments easier to bear. He thought he would have a five-year window before the principal started coming due.

But the day of reckoning is arriving early. By paying the minimum, Hertzberg has increased the size of his loan in a little over a year from $320,000 to $332,616. His lender, Calabasas-based Countrywide Financial Corp., recently sent him a letter warning that when his loan hits 115% of its original size he'll run out of credit with the company.

That will happen in about two years if he continues to take the smallest payment option. Then his minimum payment will automatically go up 150%, to $2,848 a month.

"If I could afford that," he said, "I wouldn't have needed this loan in the first place."

"I am rather screwed," he said.

Yes, you are!

If Hertzberg is living on borrowed time, there's small comfort in the home finance industry's endless inventiveness. It's certainly trying to tempt him. Several times a week, he gets a refinancing offer in the mail.

The latest one suggested a certain unfamiliarity with basic English, proclaiming, "Economic forecast suggests you Interest Rate will increase 1.00% every six months." But its central message was clear: "We can solve your problem in 15 minutes over the phone."

Hertzberg always looks at these fliers, hopeful in spite of himself. "I'm waiting for a 100-year loan," he said. "My heirs can worry about paying it off."

Why would your heirs work hard to bail you out of your bad decisions?

Sunday, December 10, 2006

Controversial Calculations

From the "paper of record", the New York Times, we have Christine Haughney write about Women Unafraid of Condo Commitment.

In the last five months, single women spent more than $30 million out of the $100 million or so in sales in the 299-unit condominium. In fact, single women bought 72 of the first 165 apartments sold. Spending by these women far surpassed that of single men, who accounted for $19 million. Married couples accounted for about $45 million in sales, and investors $5 million.

Brokers say that women are betting that even if they buy in a declining market, the values won’t drop as much as they would have spent on rent. They’re more comfortable buying in the same neighborhoods and buildings as their friends do. By purchasing condominiums that they could eventually rent out if they needed to move, they’re also hoping that they can hold on to these properties until the market improves.

“A woman will say, ‘I’m still saving money in the long term.’ ” said JoAnn Schwimmer, an associate real estate broker at DJK Residential. “They’re able to see the bigger picture, while a guy says, ‘I have to get the best deal.’ ” She said that her female clients who bought four years ago have male friends still waiting for prices to drop.

These women are retards!

They have never run an Excel spreadsheet about buy v/s rent, and are too busy living their "Sex and the City" dream.

They also haven't figured out that the "wasted" rent is implicitly embedded in their purchase price (in the form of interest, taxes, insurance, and maintenance.) Just because it isn't explicit doesn't mean that it has magically disappeared.

Also, the broker is implicitly rebuking them. If there is a "better deal", then there is no "bigger picture" to consider. The "better deal" is the "bigger picture".

This article is full of little gems:

Jen Lee, a 36-year-old director of sales for the Developers Group, bought a one-bedroom in Williamsburg for $440,000 the first day the building at 345 Union Avenue opened for sales in October 2005.

She raved to friends about how her apartment, built by Grand Union Private Development and marketed by her company, had nearly 10-foot-high ceilings, a private roof terrace and lots of closet space. Women have bought four of the building’s 10 units — translating into $2 million in sales, Ms. Lee said. Asked if she was buying at the wrong time, Ms. Lee said she was more excited that she had bought at all. “I wanted to invest in something, and that’s what I’ve done,” she said. “It will always be mine.”

Yep, it will "always" be yours unless you can't pay the debt in which case the big, bad bankers will take it away.

Some women said that they felt their friends were better market indicators than any statistics that point to a downturn.

Yes, why let facts get in the way of your pre-determined conclusions?

From personal anecdote, I'll go out on a limb, and say that I've never ever met a woman who was rational about finance.

NEVER! EVER!!!

I find it completely amazing that all these absurdly intelligent women I know, the ones who speak multiple languages, can argue about art, music and literature at length, and who are successful professionals in everything from engineering to medicine, have a complete meltdown when it comes to money and finance!

Color me surprised!

Here's what I've observed:

Women (at least the ones I've known) first make up their mind, and then go about finding reasons to confirm them.

This is the exact opposite of the "scientific method". Find something, and then go about finding reasons to contradict your conclusion, not the other way around! If you find these contradictions, you were wrong, and should abandon the conclusion; and if you don't find them, then you will end up finding a "deeper" reason to support your argument.

In case you think I'm being sexist, here's what the FDIC has to say on the subject: link.

Scroll down to table 1, and note the percentage of single women needing basic financial knowledge (41%) v/s single men (16%). Such a large difference can hardly be accidental.

Still not convinced?

Here's an article from Realtor Magazine.

While the number of unmarried men and women purchasing their own homes was virtually even 25 years ago, single females have pulled way ahead of their male counterparts in recent years.

In 2005, they bought 20 percent of all U.S. homes sold — about 1.5 million properties, or more than double the 9 percent purchased by single males. Changes in the mortgage lending industry have contributed largely to the shift in home buying demographics.

Once again, 20% v/s 9% at the tail end of a mania can hardly be accidental. The marketeers are very good at getting into the "settle down" part of the female brain.

And only in this country can a company run a television ad like this!

I pity the fools that marry these women.

I pity the fool, I pity the fool!

In the last five months, single women spent more than $30 million out of the $100 million or so in sales in the 299-unit condominium. In fact, single women bought 72 of the first 165 apartments sold. Spending by these women far surpassed that of single men, who accounted for $19 million. Married couples accounted for about $45 million in sales, and investors $5 million.

Brokers say that women are betting that even if they buy in a declining market, the values won’t drop as much as they would have spent on rent. They’re more comfortable buying in the same neighborhoods and buildings as their friends do. By purchasing condominiums that they could eventually rent out if they needed to move, they’re also hoping that they can hold on to these properties until the market improves.

“A woman will say, ‘I’m still saving money in the long term.’ ” said JoAnn Schwimmer, an associate real estate broker at DJK Residential. “They’re able to see the bigger picture, while a guy says, ‘I have to get the best deal.’ ” She said that her female clients who bought four years ago have male friends still waiting for prices to drop.

These women are retards!

They have never run an Excel spreadsheet about buy v/s rent, and are too busy living their "Sex and the City" dream.

They also haven't figured out that the "wasted" rent is implicitly embedded in their purchase price (in the form of interest, taxes, insurance, and maintenance.) Just because it isn't explicit doesn't mean that it has magically disappeared.

Also, the broker is implicitly rebuking them. If there is a "better deal", then there is no "bigger picture" to consider. The "better deal" is the "bigger picture".

This article is full of little gems:

Jen Lee, a 36-year-old director of sales for the Developers Group, bought a one-bedroom in Williamsburg for $440,000 the first day the building at 345 Union Avenue opened for sales in October 2005.

She raved to friends about how her apartment, built by Grand Union Private Development and marketed by her company, had nearly 10-foot-high ceilings, a private roof terrace and lots of closet space. Women have bought four of the building’s 10 units — translating into $2 million in sales, Ms. Lee said. Asked if she was buying at the wrong time, Ms. Lee said she was more excited that she had bought at all. “I wanted to invest in something, and that’s what I’ve done,” she said. “It will always be mine.”

Yep, it will "always" be yours unless you can't pay the debt in which case the big, bad bankers will take it away.

Some women said that they felt their friends were better market indicators than any statistics that point to a downturn.

Yes, why let facts get in the way of your pre-determined conclusions?

From personal anecdote, I'll go out on a limb, and say that I've never ever met a woman who was rational about finance.

NEVER! EVER!!!

I find it completely amazing that all these absurdly intelligent women I know, the ones who speak multiple languages, can argue about art, music and literature at length, and who are successful professionals in everything from engineering to medicine, have a complete meltdown when it comes to money and finance!

Color me surprised!

Here's what I've observed:

Women (at least the ones I've known) first make up their mind, and then go about finding reasons to confirm them.

This is the exact opposite of the "scientific method". Find something, and then go about finding reasons to contradict your conclusion, not the other way around! If you find these contradictions, you were wrong, and should abandon the conclusion; and if you don't find them, then you will end up finding a "deeper" reason to support your argument.

In case you think I'm being sexist, here's what the FDIC has to say on the subject: link.

Scroll down to table 1, and note the percentage of single women needing basic financial knowledge (41%) v/s single men (16%). Such a large difference can hardly be accidental.

Still not convinced?

Here's an article from Realtor Magazine.

While the number of unmarried men and women purchasing their own homes was virtually even 25 years ago, single females have pulled way ahead of their male counterparts in recent years.

In 2005, they bought 20 percent of all U.S. homes sold — about 1.5 million properties, or more than double the 9 percent purchased by single males. Changes in the mortgage lending industry have contributed largely to the shift in home buying demographics.

Once again, 20% v/s 9% at the tail end of a mania can hardly be accidental. The marketeers are very good at getting into the "settle down" part of the female brain.

And only in this country can a company run a television ad like this!

I pity the fools that marry these women.

I pity the fool, I pity the fool!

Friday, December 08, 2006

I want a house, and I want it now!

From the Modesto Bee, we have Ben van der Meer writing about Couple sue over real estate nightmare.

Salida couple is suing a group that offers real estate deals at a Ceres flea market, claiming that the company didn't deliver on promises to sell their home and get them a better one.

Instead, say Manuel and Marbella Salas, they have a new house with construction defects, haven't sold their old home and have learned that the man who arranged the deals doesn't have a real estate license.

I always buy houses at a flea market. Where do you buy?

Marbella Salas said she's afraid that others are getting questionable real estate deals with Singh and the company, adding that he still was set up at the flea market as recently as a few weeks ago.

"He didn't care about us," she said. "He only cared about his commission."

No shit!

Salida couple is suing a group that offers real estate deals at a Ceres flea market, claiming that the company didn't deliver on promises to sell their home and get them a better one.

Instead, say Manuel and Marbella Salas, they have a new house with construction defects, haven't sold their old home and have learned that the man who arranged the deals doesn't have a real estate license.

I always buy houses at a flea market. Where do you buy?

Marbella Salas said she's afraid that others are getting questionable real estate deals with Singh and the company, adding that he still was set up at the flea market as recently as a few weeks ago.

"He didn't care about us," she said. "He only cared about his commission."

No shit!

Bartender, buy these men some clues!

From the Las Vegas Review Journal, we have Tempers flare at USA Capital session.

Investors who bought short-term mortgage loans brokered by USA Capital are shouting mad and divided over the best strategy for recovering some of their assets.

USA Capital controlled $962 million in investor assets in April when it became insolvent and filed for Chapter 11 bankruptcy protection, which would allow it to reorganize. The company solicited money from investors to make short-term loans to developers in return for double-digit interest rates. About 6,000 investors around the country entrusted money to USA Capital.

Since the bankruptcy filing, "we have been brown mushrooms, kept in the dark and fed nothing," said investor Howard Connell, referring to the secrecy that has surrounded negotiations by investor committees. "We are having stuff shoved down our throats at the 11th hour. We should have the right to say something."

Connell said he would be "destitute within the next six months" because of losses at USA Capital.

What kind of retard puts all his money in one venture which may result in him being "destitute in the next six months"?

But, it gets better!

Doris Stevenson said she invested both in USA Capital loans and loans brokered by another failed private lender, Global Express Capital.

Stevenson suggested USA Capital investors may do relatively well compared to those who bought loans through Global Express. Stevenson said she had $170,000 invested with Global Express, has recovered $20,000 and is awaiting one last small payment three years after a federal judge put Global Express into receivership.

This is un-fucking-believable!

Read carefully, and you'll see that she "invested" $170K in a company that failed three years ago, and instead of learning from her mistake, went on to lose money in another company that failed in the same sector.

As I said, un-fucking-believable!

But, it's not over yet...

Bill Bullard, Direct Lender Committee chairman and investment chief for the private investment company of Fertitta Enterprises, recommended investors vote for the reorganization plan. But Morris Mansell, an investor with the Lender Protection Group, opposed the plan for several reasons.

Mansell said investors whose money was stolen should be repaid before lawyers get paid.

Umm, yes, those lawyers are going to work for free (and for a bankrupt company at that!)

Yessir, that's definitely going to fly!

Investors who bought short-term mortgage loans brokered by USA Capital are shouting mad and divided over the best strategy for recovering some of their assets.

USA Capital controlled $962 million in investor assets in April when it became insolvent and filed for Chapter 11 bankruptcy protection, which would allow it to reorganize. The company solicited money from investors to make short-term loans to developers in return for double-digit interest rates. About 6,000 investors around the country entrusted money to USA Capital.

Since the bankruptcy filing, "we have been brown mushrooms, kept in the dark and fed nothing," said investor Howard Connell, referring to the secrecy that has surrounded negotiations by investor committees. "We are having stuff shoved down our throats at the 11th hour. We should have the right to say something."

Connell said he would be "destitute within the next six months" because of losses at USA Capital.

What kind of retard puts all his money in one venture which may result in him being "destitute in the next six months"?

But, it gets better!

Doris Stevenson said she invested both in USA Capital loans and loans brokered by another failed private lender, Global Express Capital.

Stevenson suggested USA Capital investors may do relatively well compared to those who bought loans through Global Express. Stevenson said she had $170,000 invested with Global Express, has recovered $20,000 and is awaiting one last small payment three years after a federal judge put Global Express into receivership.

This is un-fucking-believable!

Read carefully, and you'll see that she "invested" $170K in a company that failed three years ago, and instead of learning from her mistake, went on to lose money in another company that failed in the same sector.

As I said, un-fucking-believable!

But, it's not over yet...

Bill Bullard, Direct Lender Committee chairman and investment chief for the private investment company of Fertitta Enterprises, recommended investors vote for the reorganization plan. But Morris Mansell, an investor with the Lender Protection Group, opposed the plan for several reasons.

Mansell said investors whose money was stolen should be repaid before lawyers get paid.

Umm, yes, those lawyers are going to work for free (and for a bankrupt company at that!)

Yessir, that's definitely going to fly!

Thursday, December 07, 2006

Holy smokes, Batman!

From the Arkansas Times, we have Warwick Sabin writing about Suddenly, the NW Ark. real estate market isn't so hot.

Northwest Arkansas has grown faster than anyone could have anticipated. Sleepy pastureland overnight became subdivisions, office parks and strip malls. Traffic backs up amid road construction and snarls at rush hour on a freeway not yet 10 years old. Internet map sites like Mapquest can’t update Benton County quick enough to keep up with all of the new local streets.

The lure of easy money proved irresistible to would-be developers.

The dizzying pace of expansion was as evident in the pages of new society magazines as in the economic statistics. Ambitious developers joined with start-up bank executives to unveil high-profile projects at glitzy functions.

Now, the hangover from the big party has set in. Despite a steady population increase of about 1,100 people a month, there’s a serious oversupply of residential and commercial property. One economist estimates 112.9 months of housing inventory — more than nine years’ worth — at the current rates of absorption.

Nine years of inventory?!? In Benton County, home of Walmart?!?

Sweet suffering surfeit!

Northwest Arkansas has grown faster than anyone could have anticipated. Sleepy pastureland overnight became subdivisions, office parks and strip malls. Traffic backs up amid road construction and snarls at rush hour on a freeway not yet 10 years old. Internet map sites like Mapquest can’t update Benton County quick enough to keep up with all of the new local streets.

The lure of easy money proved irresistible to would-be developers.

The dizzying pace of expansion was as evident in the pages of new society magazines as in the economic statistics. Ambitious developers joined with start-up bank executives to unveil high-profile projects at glitzy functions.

Now, the hangover from the big party has set in. Despite a steady population increase of about 1,100 people a month, there’s a serious oversupply of residential and commercial property. One economist estimates 112.9 months of housing inventory — more than nine years’ worth — at the current rates of absorption.

Nine years of inventory?!? In Benton County, home of Walmart?!?

Sweet suffering surfeit!

Wednesday, December 06, 2006

Editors of the World, Unite!

From the Star Bulletin in sunny Hawaii, we have Allison Schaefers writing about: Home price climb finally over.

Scott Higashi, vice president of sales for Prudential Locations LLC on Oahu, agreed: "We're still nowhere near a monumental fall in value. During this cycle, we don't expect to see any double-digit rises or falls."

Further on, in the same article:

The median price paid for a single-family home on Kauai fell 14.43 percent to $590,000, a decline of $99,500 from November 2005.

It's one thing to do no research; it's a completely different thing to have an article that contradicts itself!

This is just fucking embarassing!

Scott Higashi, vice president of sales for Prudential Locations LLC on Oahu, agreed: "We're still nowhere near a monumental fall in value. During this cycle, we don't expect to see any double-digit rises or falls."

Further on, in the same article:

The median price paid for a single-family home on Kauai fell 14.43 percent to $590,000, a decline of $99,500 from November 2005.

It's one thing to do no research; it's a completely different thing to have an article that contradicts itself!

This is just fucking embarassing!

Sunday, December 03, 2006

One of those Homer Simpson Moments

From the self-congratulatory New York Times, we have Andrew Ross Serkin talking about: Beat the Clock (and Get a Double Bonus).

EVER wonder why there is a torrent of multibillion takeovers and mergers at the end of every year?

Nah. Here’s a dirty little secret: The urge to merge may be influenced by bonuses for all involved in the deal, especially the bankers. Corporate America’s biggest cheerleaders and boosters need to get paid.

Well, duh!

In case you didn't get it, I'll say it again: DUH!!!

DUHHHHHHHHHHHHH!

Honeypie, we live in a capitalist society, so it's every person for themselves.

The bankers only care about their bonus because that's the way things are set up. If you want them to actually care about the companies involved, there should be some incentive involved. No incentive, no reason to play nice.

In a bad merger, everyone makes out like bandits. The CEO, the board, the bankers. Naturally, someone must get screwed. Typically, it's the shareholders (although on occasion, it can be the bondholders too.)

Actually, the beauty of modern finance is that you can decide what percentage you want to screw the shareholders vis a vis the bondholders.

Ain't that just peachy?!?

Wow! these journalists are both naive and clueless!

EVER wonder why there is a torrent of multibillion takeovers and mergers at the end of every year?

Nah. Here’s a dirty little secret: The urge to merge may be influenced by bonuses for all involved in the deal, especially the bankers. Corporate America’s biggest cheerleaders and boosters need to get paid.

Well, duh!

In case you didn't get it, I'll say it again: DUH!!!

DUHHHHHHHHHHHHH!

Honeypie, we live in a capitalist society, so it's every person for themselves.

The bankers only care about their bonus because that's the way things are set up. If you want them to actually care about the companies involved, there should be some incentive involved. No incentive, no reason to play nice.

In a bad merger, everyone makes out like bandits. The CEO, the board, the bankers. Naturally, someone must get screwed. Typically, it's the shareholders (although on occasion, it can be the bondholders too.)

Actually, the beauty of modern finance is that you can decide what percentage you want to screw the shareholders vis a vis the bondholders.

Ain't that just peachy?!?

Wow! these journalists are both naive and clueless!

Friday, December 01, 2006

$hitloads of trouble

From Floriday Today, we have Scott Blake writing about Sluggish housing market showing mixed results.

On the Space Coast, reduced prices since last year have enabled some buyers to enter the market -- people such as Kanishka Perera, who was renting in Palm Bay before he bought a two-bedroom townhouse in Melbourne last month for about $176,000. Perera said the builder -- Mercedes Homes -- gave him incentives to buy, requiring only a 5 percent down payment and paying $5,000 of the closing costs.

"I always wanted to own a home. I just couldn't afford it earlier," Perera said.

Hint, babe: You still can't afford it; you've just lost your 5%; you still don't know it, and won't for a few more years.

To stimulate the local housing market, builders and others are hoping to persuade county commissioners to delay a scheduled increase in a county transportation impact fee on each new single-family home. The fee -- which applies to unincorporated areas of Brevard and most local municipalities -- is to increase from $1,414 to $4,353 on Dec. 31.

The delay could help the market, which already is burdened by higher property taxes and insurance rates, said Dave Armstrong, treasurer of the Florida Homebuilders Association and a local home builder.

"Right now, the animal is wounded and we don't want to kill it," Armstrong said about the housing market.

The animal is not only wounded but also dead with its guts spilling out, and the diseased carcass has started to rot in the rain. The smell is giving you the clue that anyone with half a brain would've figured out a long time ago.

I really doubt that $3000 is going to change anything in an area which has seen inventory that accounts for population growth for 10+ years.

However, we all need to be periodically reminded about the wisdom of Motoko Rich of the New York Times about all of this: "South Florida is working off of a totally new economic model than any of us have ever experienced in the past.".

On the Space Coast, reduced prices since last year have enabled some buyers to enter the market -- people such as Kanishka Perera, who was renting in Palm Bay before he bought a two-bedroom townhouse in Melbourne last month for about $176,000. Perera said the builder -- Mercedes Homes -- gave him incentives to buy, requiring only a 5 percent down payment and paying $5,000 of the closing costs.

"I always wanted to own a home. I just couldn't afford it earlier," Perera said.

Hint, babe: You still can't afford it; you've just lost your 5%; you still don't know it, and won't for a few more years.

To stimulate the local housing market, builders and others are hoping to persuade county commissioners to delay a scheduled increase in a county transportation impact fee on each new single-family home. The fee -- which applies to unincorporated areas of Brevard and most local municipalities -- is to increase from $1,414 to $4,353 on Dec. 31.

The delay could help the market, which already is burdened by higher property taxes and insurance rates, said Dave Armstrong, treasurer of the Florida Homebuilders Association and a local home builder.

"Right now, the animal is wounded and we don't want to kill it," Armstrong said about the housing market.

The animal is not only wounded but also dead with its guts spilling out, and the diseased carcass has started to rot in the rain. The smell is giving you the clue that anyone with half a brain would've figured out a long time ago.

I really doubt that $3000 is going to change anything in an area which has seen inventory that accounts for population growth for 10+ years.

However, we all need to be periodically reminded about the wisdom of Motoko Rich of the New York Times about all of this: "South Florida is working off of a totally new economic model than any of us have ever experienced in the past.".

Thursday, November 30, 2006

Pimp my life!

From CNN Finance, we have an unusual kind of article: College kid tries to sell his future on eBay.

In August, Steen put himself on eBay (Charts) to pay for his college education, offering 2 percent of all future earnings to the highest bidder, with a minimum $100,000 bid.

"I am the real deal" and "a very intelligent guy," he wrote on eBay.

He says that he expects to earn "way more" than $125,000 a year until he turns 65, at which point his investor would break even on a $100,000 investment. (Steen would have to average more than $1.5 million a year to match an investment that yielded a 6 percent return, compounded annually over the same period.)

Here's a link to the PDF of the actual auction. (EBay cancelled the auction, and he got no bids.)

Firstly, I should say flat out that this is, in principle, an excellent idea. After all, exchanging future income for a lump-sum up front is precisely what a bond really is.

Secondly, if enough people did this, you could statistically estimate their future earnings, and price them competitively. (Think of it as an insurance policy on education. The future "investment bankers" are subsidizing the future "secretaries", etc.)

So why is it really stupid?

Several reasons.

Firstly, let's examine the reasons as to what can go wrong. Perhaps, he will renege on the contract, die or get dismembered before 40 years, or simply not make as much money as he thinks he's going to make.

Now let's work through these assumptions. We'll do all the calculations in "future dollars" so we have to include the effects of inflation. If he's really good at what he does, his wages will be above inflation each year by let's say 1-2%. Let's also assume he makes $100K (highly unlikely, but still.) Let's assume inflation runs at a fixed 3%.

You'd get paid between $190K (4% assumption) to $240K (6%).

Take the same $100K and buy 30 year US treasuries, and you'll get roughly $138K of coupons at current yields, plus your original $100K back, plus any interest that you pick up by reinvesting these coupons! Add in interest for an extra 10 years (at the same rate) you get an extra $46K. (That's $284K.)

So this kid is shit out of luck even under the most optimistic assumptions. You don't have to be a genius to figure out if you assume more realistic assumptions, you'd be really stupid to invest in this kid.

I mean, if the kid can't even do these calculations, there's no chance of him making "way more" than $125K.

So what did he really do wrong, theoretically speaking? Obviously, 2% of your income is too little. Up it to 10%, and the numbers would change.

The other alternative would've been not to demand a minimum of $100K, but let the market determine what they're willing to risk on you.

(Incidentally, Robert Shiller has written extensively about this in his book: The New Financial Order.)

In August, Steen put himself on eBay (Charts) to pay for his college education, offering 2 percent of all future earnings to the highest bidder, with a minimum $100,000 bid.

"I am the real deal" and "a very intelligent guy," he wrote on eBay.

He says that he expects to earn "way more" than $125,000 a year until he turns 65, at which point his investor would break even on a $100,000 investment. (Steen would have to average more than $1.5 million a year to match an investment that yielded a 6 percent return, compounded annually over the same period.)

Here's a link to the PDF of the actual auction. (EBay cancelled the auction, and he got no bids.)

Firstly, I should say flat out that this is, in principle, an excellent idea. After all, exchanging future income for a lump-sum up front is precisely what a bond really is.

Secondly, if enough people did this, you could statistically estimate their future earnings, and price them competitively. (Think of it as an insurance policy on education. The future "investment bankers" are subsidizing the future "secretaries", etc.)

So why is it really stupid?

Several reasons.

Firstly, let's examine the reasons as to what can go wrong. Perhaps, he will renege on the contract, die or get dismembered before 40 years, or simply not make as much money as he thinks he's going to make.

Now let's work through these assumptions. We'll do all the calculations in "future dollars" so we have to include the effects of inflation. If he's really good at what he does, his wages will be above inflation each year by let's say 1-2%. Let's also assume he makes $100K (highly unlikely, but still.) Let's assume inflation runs at a fixed 3%.

You'd get paid between $190K (4% assumption) to $240K (6%).

Take the same $100K and buy 30 year US treasuries, and you'll get roughly $138K of coupons at current yields, plus your original $100K back, plus any interest that you pick up by reinvesting these coupons! Add in interest for an extra 10 years (at the same rate) you get an extra $46K. (That's $284K.)

So this kid is shit out of luck even under the most optimistic assumptions. You don't have to be a genius to figure out if you assume more realistic assumptions, you'd be really stupid to invest in this kid.

I mean, if the kid can't even do these calculations, there's no chance of him making "way more" than $125K.

So what did he really do wrong, theoretically speaking? Obviously, 2% of your income is too little. Up it to 10%, and the numbers would change.

The other alternative would've been not to demand a minimum of $100K, but let the market determine what they're willing to risk on you.

(Incidentally, Robert Shiller has written extensively about this in his book: The New Financial Order.)

Tuesday, November 28, 2006

Sucka-paloozah

From the San Diego Union Tribune, we have Plan for second tower irks El Cortez owners.

El Cortez condo owners feel cheated. They bought homes in the historic hotel with luxury in mind, but their sinks back up, their homeowners association is broke and there's no doorman to welcome them at the end of the day.

The fact that developer Peter Janopaul – who along with business partner Anthony Block renovated the 1927 hotel – is now planning to build a new condominium tower where their pool and parking is, well, that's just one more slap in the face.

Janopaul declined to be interviewed for this article, but Michael Zucchet, the vice president of Janopaul's development company, said a handful of homeowners at the El Cortez are making Janopaul a scapegoat for problems he had nothing to do with.

“Didn't read your disclosure documents? Blame the developer,” Zucchet said. “Developer's right to build getting vindicated at every turn? . . . Argue that the developer is actually a mean guy. Condo market heading south two years after you bought your unit? Sue the developer.

Residents concede they signed documents acknowledging that another building could be constructed just 40 feet away, but many say they were told it wouldn't happen for a long time. They say construction could damage their home values, their building's foundation and the historic character of the El Cortez.

Janopaul's company also is suing contractors for plumbing defects that include leaking pipes and backups, and lawsuits have been combined. But residents should not be surprised, said Janopaul attorney Tomas Morales. He noted that buyers signed detailed disclosures.

“Before they gave their money to the developer, they had to sign some very direct documents that said a building is coming (next door) and they were buying a unit built in 1927 and it would be unreasonable to expect it would operate like a building built in 2004,” Morales said.

Oooh, this is like front-row tickets to the "shear the sheep" finals!

Developers are smart cookies, particularly the crooked ones. If you signed a contract, there's absolutely nothing you can do about it!

So long, suckahs!

El Cortez condo owners feel cheated. They bought homes in the historic hotel with luxury in mind, but their sinks back up, their homeowners association is broke and there's no doorman to welcome them at the end of the day.

The fact that developer Peter Janopaul – who along with business partner Anthony Block renovated the 1927 hotel – is now planning to build a new condominium tower where their pool and parking is, well, that's just one more slap in the face.

Janopaul declined to be interviewed for this article, but Michael Zucchet, the vice president of Janopaul's development company, said a handful of homeowners at the El Cortez are making Janopaul a scapegoat for problems he had nothing to do with.

“Didn't read your disclosure documents? Blame the developer,” Zucchet said. “Developer's right to build getting vindicated at every turn? . . . Argue that the developer is actually a mean guy. Condo market heading south two years after you bought your unit? Sue the developer.

Residents concede they signed documents acknowledging that another building could be constructed just 40 feet away, but many say they were told it wouldn't happen for a long time. They say construction could damage their home values, their building's foundation and the historic character of the El Cortez.

Janopaul's company also is suing contractors for plumbing defects that include leaking pipes and backups, and lawsuits have been combined. But residents should not be surprised, said Janopaul attorney Tomas Morales. He noted that buyers signed detailed disclosures.

“Before they gave their money to the developer, they had to sign some very direct documents that said a building is coming (next door) and they were buying a unit built in 1927 and it would be unreasonable to expect it would operate like a building built in 2004,” Morales said.

Oooh, this is like front-row tickets to the "shear the sheep" finals!

Developers are smart cookies, particularly the crooked ones. If you signed a contract, there's absolutely nothing you can do about it!

So long, suckahs!

Monday, November 27, 2006

Economics, Ethics and Morality

To give a break from the stunningly single-minded (according to some of you) economic stupidity in the housing market, we'll get back to the Editorial from the New York Times: When Don’t Smoke Means Do.

Philip Morris has adopted the role of good citizen these days. Its Web site brims with information on the dangers of smoking, and it has mounted a campaign of television spots that urge parents, oh so earnestly, to warn their children against smoking. That follows an earlier $100 million campaign warning young people to “Think. Don’t Smoke,” analogous to the “just say no” admonitions against drugs.

Just why the costly advertising campaigns produce no health benefits is a rich subject for exploration. The ads are fuzzy-warm, which could actually generate favorable feelings for the tobacco industry and, by extension, its products. And their theme — that adults should tell young people not to smoke mostly because they are young people — is exactly the sort of message that would make many teenagers feel like lighting up.

Philip Morris says it has spent more than $1 billion on its youth smoking prevention programs since 1998 and that it devised its current advertising campaign on the advice of experts who deem parental influence extremely important. But the company has done only the skimpiest research on how the campaign is working. It cites June 2006 data indicating that 37 percent of parents with children age 10 to 17 were both aware of its ads and spoke to their children about not smoking. How the children reacted has not been explored. And somehow the company forgot to tell the parents, as role models, to stop smoking themselves.

Philip Morris, the industry’s biggest and most influential company, is renowned for its marketing savvy. If it really wanted to prevent youth smoking — and cut off new recruits to its death-dealing products — it could surely mount a more effective campaign to do so.

Let me bluntly say that I abhor smoking. I'm terribly allergic to it, and have hated it since I was a child. My parents can tell you that I have, flat out, at age 7 told my grandfather that I'm going to leave the room while he was smoking, and will come back when he was finished (and followed up on that for the next 8+ years or so.)

I have also worked in the theater for 15+ years through graduate school, and those of you have some experience in the theater will know what I mean when I say "everyone" in the theater smokes, and I have put up with it, and pretty damned patiently at that.

However, all of these are personal opinions not "economic" or "rational" ones.

Let's go to the economic stupidity which is, after all, the point of this blog.

Firstly, there is quite literally, no incentive for a company to do something against its own interests.

The real question is not "would you?" but if you were the steward of a company with a given mandate, "would you?"

Please note that we're talking about the subtle distinction between ethics and morals here!

Secondly, the blunt economic truth is that governments can never ban anything that people genuinely want to do. At best, they can act as traffic policemen.

Ask yourself, how well has the "war on drugs" really performed? Which major American city can you not buy marijuana at any hour of the day or night? Hell! There's home delivery for the product!

Please note the argument for precisely what it is. I neither care for drugs nor cigarettes. Nor do I care for a nanny state. But then, nor do I care for free healthcare (if "you" can't pay, and the state is paying for "your" healthcare, then the state can and should ban cigarettes for "you", not for the people willing to pay.)

And, negative incentives do actually work. The trifecta of higher taxes, banning cigarettes in bars and restaurants, and free nicotine patches in New York has transformed the "Paris of the US" into a non-smoking paradise.

So if you want to disincentivize something, ask the Federal Government to behave like New York City, not the company to act against in its own self-interest.

Which brings us to the stupidity part, which is what the Editorial is being accused of!

Fair Disclosure: I used to own stock in Altria, and was forced to dispose it for professional reasons. (If not, I would've hung on to it!)

Philip Morris has adopted the role of good citizen these days. Its Web site brims with information on the dangers of smoking, and it has mounted a campaign of television spots that urge parents, oh so earnestly, to warn their children against smoking. That follows an earlier $100 million campaign warning young people to “Think. Don’t Smoke,” analogous to the “just say no” admonitions against drugs.

Just why the costly advertising campaigns produce no health benefits is a rich subject for exploration. The ads are fuzzy-warm, which could actually generate favorable feelings for the tobacco industry and, by extension, its products. And their theme — that adults should tell young people not to smoke mostly because they are young people — is exactly the sort of message that would make many teenagers feel like lighting up.

Philip Morris says it has spent more than $1 billion on its youth smoking prevention programs since 1998 and that it devised its current advertising campaign on the advice of experts who deem parental influence extremely important. But the company has done only the skimpiest research on how the campaign is working. It cites June 2006 data indicating that 37 percent of parents with children age 10 to 17 were both aware of its ads and spoke to their children about not smoking. How the children reacted has not been explored. And somehow the company forgot to tell the parents, as role models, to stop smoking themselves.

Philip Morris, the industry’s biggest and most influential company, is renowned for its marketing savvy. If it really wanted to prevent youth smoking — and cut off new recruits to its death-dealing products — it could surely mount a more effective campaign to do so.

Let me bluntly say that I abhor smoking. I'm terribly allergic to it, and have hated it since I was a child. My parents can tell you that I have, flat out, at age 7 told my grandfather that I'm going to leave the room while he was smoking, and will come back when he was finished (and followed up on that for the next 8+ years or so.)

I have also worked in the theater for 15+ years through graduate school, and those of you have some experience in the theater will know what I mean when I say "everyone" in the theater smokes, and I have put up with it, and pretty damned patiently at that.

However, all of these are personal opinions not "economic" or "rational" ones.

Let's go to the economic stupidity which is, after all, the point of this blog.

Firstly, there is quite literally, no incentive for a company to do something against its own interests.

The real question is not "would you?" but if you were the steward of a company with a given mandate, "would you?"

Please note that we're talking about the subtle distinction between ethics and morals here!

Secondly, the blunt economic truth is that governments can never ban anything that people genuinely want to do. At best, they can act as traffic policemen.

Ask yourself, how well has the "war on drugs" really performed? Which major American city can you not buy marijuana at any hour of the day or night? Hell! There's home delivery for the product!

Please note the argument for precisely what it is. I neither care for drugs nor cigarettes. Nor do I care for a nanny state. But then, nor do I care for free healthcare (if "you" can't pay, and the state is paying for "your" healthcare, then the state can and should ban cigarettes for "you", not for the people willing to pay.)

And, negative incentives do actually work. The trifecta of higher taxes, banning cigarettes in bars and restaurants, and free nicotine patches in New York has transformed the "Paris of the US" into a non-smoking paradise.

So if you want to disincentivize something, ask the Federal Government to behave like New York City, not the company to act against in its own self-interest.

Which brings us to the stupidity part, which is what the Editorial is being accused of!

Fair Disclosure: I used to own stock in Altria, and was forced to dispose it for professional reasons. (If not, I would've hung on to it!)

Sunday, November 26, 2006

Eyes Wide Shut

Just to make sure that stupidity is a trait shared by all humans, we have Tony Levene writing for the UK Guardian: Landbanking flop ends field of dreams.

One of Britain's biggest landbankers has gone bust, leaving investors who paid a total of £7m for tiny slices of farmland, wondering where their money went. Land Heritage (UK) Ltd told 700 land purchasers this week it was going into liquidation on the "advice" of accountants PricewaterhouseCoopers (PWC).

It told them to direct future correspondence towards PWC. But when Guardian Money contacted the accountancy firm, it said it had never heard of Land Heritage (UK) Ltd.

"Whatever LHUK says, we have not been instructed by this company and will not be. We have not provided any formal advice and we have not billed the company for anything. We shall not be handling any liquidation - we have no relationship whatsoever with it," PWC says.

Whoever acts as liquidator, the end of LHUK destroys what slim hopes investors had of the firm turning their minuscule plots into potentially valuable housebuilding sites - or of getting any refund.

"I fully expected 20% annual returns over the next decade - multiplying my money up to eight times. I know that's a lot but I did not go into this investment with my eyes closed," says one Kent investor who asked for anonymity.

Now all he has is title to a plot of land in the middle of a field which is unlikely ever to gain planning permission.

Wow, this is stunning in its sheer panoramic scope.

A worthless piece of land in the middle of nowhere, no planning permission ergo no way to access your own piece of land. The land is literally worthless! You could probably plant vegetables on it, if you got air-dropped or something.

A company that PWC has never even heard of, and an investor who was multiplying his "mental money" by "up to eight times".

Stupendous, just absolutely stupendous!

One of Britain's biggest landbankers has gone bust, leaving investors who paid a total of £7m for tiny slices of farmland, wondering where their money went. Land Heritage (UK) Ltd told 700 land purchasers this week it was going into liquidation on the "advice" of accountants PricewaterhouseCoopers (PWC).

It told them to direct future correspondence towards PWC. But when Guardian Money contacted the accountancy firm, it said it had never heard of Land Heritage (UK) Ltd.

"Whatever LHUK says, we have not been instructed by this company and will not be. We have not provided any formal advice and we have not billed the company for anything. We shall not be handling any liquidation - we have no relationship whatsoever with it," PWC says.

Whoever acts as liquidator, the end of LHUK destroys what slim hopes investors had of the firm turning their minuscule plots into potentially valuable housebuilding sites - or of getting any refund.

"I fully expected 20% annual returns over the next decade - multiplying my money up to eight times. I know that's a lot but I did not go into this investment with my eyes closed," says one Kent investor who asked for anonymity.

Now all he has is title to a plot of land in the middle of a field which is unlikely ever to gain planning permission.

Wow, this is stunning in its sheer panoramic scope.

A worthless piece of land in the middle of nowhere, no planning permission ergo no way to access your own piece of land. The land is literally worthless! You could probably plant vegetables on it, if you got air-dropped or something.

A company that PWC has never even heard of, and an investor who was multiplying his "mental money" by "up to eight times".

Stupendous, just absolutely stupendous!

Tuesday, November 21, 2006

Starlight, starbright...

From the Detroit Free Press, we have a "Free Press Staff" write about Detroit-area home prices plunge 10.5% compared with year ago.

"And for sellers, it's almost a nightmare," he says. "A property can be marketed with every kind of tool you can think of, and unless there are really, really great incentives that make the property 20% below what the market price should be, they're just sitting there."

I have news for you, sunshine!

There is no "should be" in the market. What the market says is precisely what the market is.

If a piece of property sells for 20% less than what you think it "should be" then that's what the market thinks the property is worth. Everything else is what we call "wishing prices".

In the words of Yoda, "Is or is not. There is no should."

"And for sellers, it's almost a nightmare," he says. "A property can be marketed with every kind of tool you can think of, and unless there are really, really great incentives that make the property 20% below what the market price should be, they're just sitting there."

I have news for you, sunshine!

There is no "should be" in the market. What the market says is precisely what the market is.

If a piece of property sells for 20% less than what you think it "should be" then that's what the market thinks the property is worth. Everything else is what we call "wishing prices".

In the words of Yoda, "Is or is not. There is no should."

Monday, November 20, 2006

That sickening feeling...

From the St. Petersburg Times in sunny Tampa Bay, FL, we have the holy trinity of James Thorner, Scott Barancik, and Matthew Waite writing about Bay's home boom suddenly belly-up.

The fun time has ended for Leonard and Joyce Sondheimer. In October 2005, the Bradenton couple bought a $338,900 MiraBay townhome on Aberdeen Pond Drive. The bayside investment home with stone counters, hardwood floors and stainless steel appliances was sure to appreciate to half a million dollars. Or so the Sondheimers thought.

After a year on the market, no one has nibbled. Their Realtor chopped the price to break even. The tax bill alone on that single investment -— $8,900 a year — is draining the Sondheimer’s nest egg.

“I was retired and now I’ve had to go back to work. I’ve got to pay all these bills,” Leonard Sondheimer, 68, said of his new job as a mattress salesman. “It’s getting sickening.”

It was sure to appreciate to half a million, eh?

Well, it didn't, so I guess you're working off a different meaning of "sure" than the rest of the world.

You've made your mattress, now I suppose you're going to have to lie in it!

The fun time has ended for Leonard and Joyce Sondheimer. In October 2005, the Bradenton couple bought a $338,900 MiraBay townhome on Aberdeen Pond Drive. The bayside investment home with stone counters, hardwood floors and stainless steel appliances was sure to appreciate to half a million dollars. Or so the Sondheimers thought.

After a year on the market, no one has nibbled. Their Realtor chopped the price to break even. The tax bill alone on that single investment -— $8,900 a year — is draining the Sondheimer’s nest egg.

“I was retired and now I’ve had to go back to work. I’ve got to pay all these bills,” Leonard Sondheimer, 68, said of his new job as a mattress salesman. “It’s getting sickening.”

It was sure to appreciate to half a million, eh?

Well, it didn't, so I guess you're working off a different meaning of "sure" than the rest of the world.

You've made your mattress, now I suppose you're going to have to lie in it!

Sunday, November 19, 2006

"Daddy, buy me a condo!"

From the Minneapolis Star Tribune, we have Jackie Crosby writing about Option ARMS right for you?

In April, Marie Senn found the home of her dreams, a condo that hadn't even gone on the market yet. Then she fell into a nightmare of a mortgage -- a type of adjustable-rate mortgage known as an option ARM.

"I was a young buyer," said Senn, 24, who said she wasn't told that she could qualify for low-interest loans targeted at first-time homeowners.

"I'd never heard of this loan," she said. "There are so many things that I wish I knew then."

That's where Senn was headed. Her payments eventually would have tripled from a low payment that came with her option ARM if she hadn't just refinanced into a fixed-rate mortgage, which still leaves her strapped with higher monthly payments than she had planned.

"I want to put this behind me," she said.

It is behind you, honey, it is totally behind you.

Open up wide, baby, daddy's coming home!

In April, Marie Senn found the home of her dreams, a condo that hadn't even gone on the market yet. Then she fell into a nightmare of a mortgage -- a type of adjustable-rate mortgage known as an option ARM.

"I was a young buyer," said Senn, 24, who said she wasn't told that she could qualify for low-interest loans targeted at first-time homeowners.

"I'd never heard of this loan," she said. "There are so many things that I wish I knew then."

That's where Senn was headed. Her payments eventually would have tripled from a low payment that came with her option ARM if she hadn't just refinanced into a fixed-rate mortgage, which still leaves her strapped with higher monthly payments than she had planned.

"I want to put this behind me," she said.

It is behind you, honey, it is totally behind you.

Open up wide, baby, daddy's coming home!

Tuesday, November 14, 2006

Orwell Lives!

From CBS Marketwatch, we have John Spence reporting on D.R. Horton's quarterly net slips 51%.

"This decline was due primarily to core margin deterioration resulting from a lack of pricing power and increased use of sales incentives relative to last year," said Chief Financial Officer Bill Wheat. The company is focusing on further scaling back its inventory, the CFO added.

Say what?

Let's work through the gobbledy-gook:

"core margin deterioration" = "our sales margin is shrinking"

"lack of pricing power" = "no buyers are showing up"

"increased use of sales incentive" = "we're cutting prices"

"scaling back inventory" = "having trouble selling, cutting prices to sell stuff"

I think he means, "Our ass is toast!"

"This decline was due primarily to core margin deterioration resulting from a lack of pricing power and increased use of sales incentives relative to last year," said Chief Financial Officer Bill Wheat. The company is focusing on further scaling back its inventory, the CFO added.

Say what?

Let's work through the gobbledy-gook:

"core margin deterioration" = "our sales margin is shrinking"

"lack of pricing power" = "no buyers are showing up"

"increased use of sales incentive" = "we're cutting prices"

"scaling back inventory" = "having trouble selling, cutting prices to sell stuff"

I think he means, "Our ass is toast!"

Monday, November 13, 2006

Living the American Dream

From the New Jersey Herald News we have A bitter ending.

The Maldonados, like many other homeowners, faced financial difficulties and refinanced with a nontraditional mortgage -- the kind of adjustable-rate loan that has inundated the market over the past few years, promising quick cash or low interest rates.