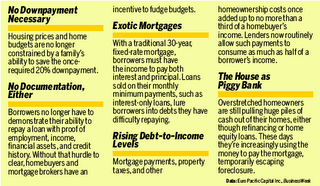

Let's focus on the last part. They're pulling out money from their home equity to pay the mortgage.

For the unenlightened, let me explain in detail.

The important part is the "theoretical" part because you don't know what your home is worth until you actually sell it. Unlike fungible assets in liquid markets (stocks, bonds, commodities, liquid derivatives on the former) there is no mechanism to "mark to market".

Equity is based on what someone thinks your home is worth, and what these "someones" (read: banks) are willing to loan you against this highly theoretical number.

These loans have to be at a higher interest rate than your mortgage because they are secondary loans, and they are "theoretical", as we have noted above (and hence, more "risky".)

So these folks are using money obtained at a higher interest rate to pay off loans at a lower interest rate!

Do you see the problem?

No comments:

Post a Comment